Türkiye’s economic team will continue its efforts to bring inflation down despite the recent slowdown in disinflation, the head of the European Bank for Reconstruction and Development (EBRD) Odile Renaud-Basso said following talks with Finance Minister Mehmet Simsek in Washington, D.C.

Renaud-Basso, who had just returned from the International Monetary Fund (IMF) and World Bank annual meetings, told Reuters that Simsek attributed the September uptick to temporary factors, particularly pressures on food prices caused by drought-related effects and other short-term influences.

"But I think the objective to decrease inflation will remain on track — these objectives are not going to change; they are going to keep the policy course," she said.

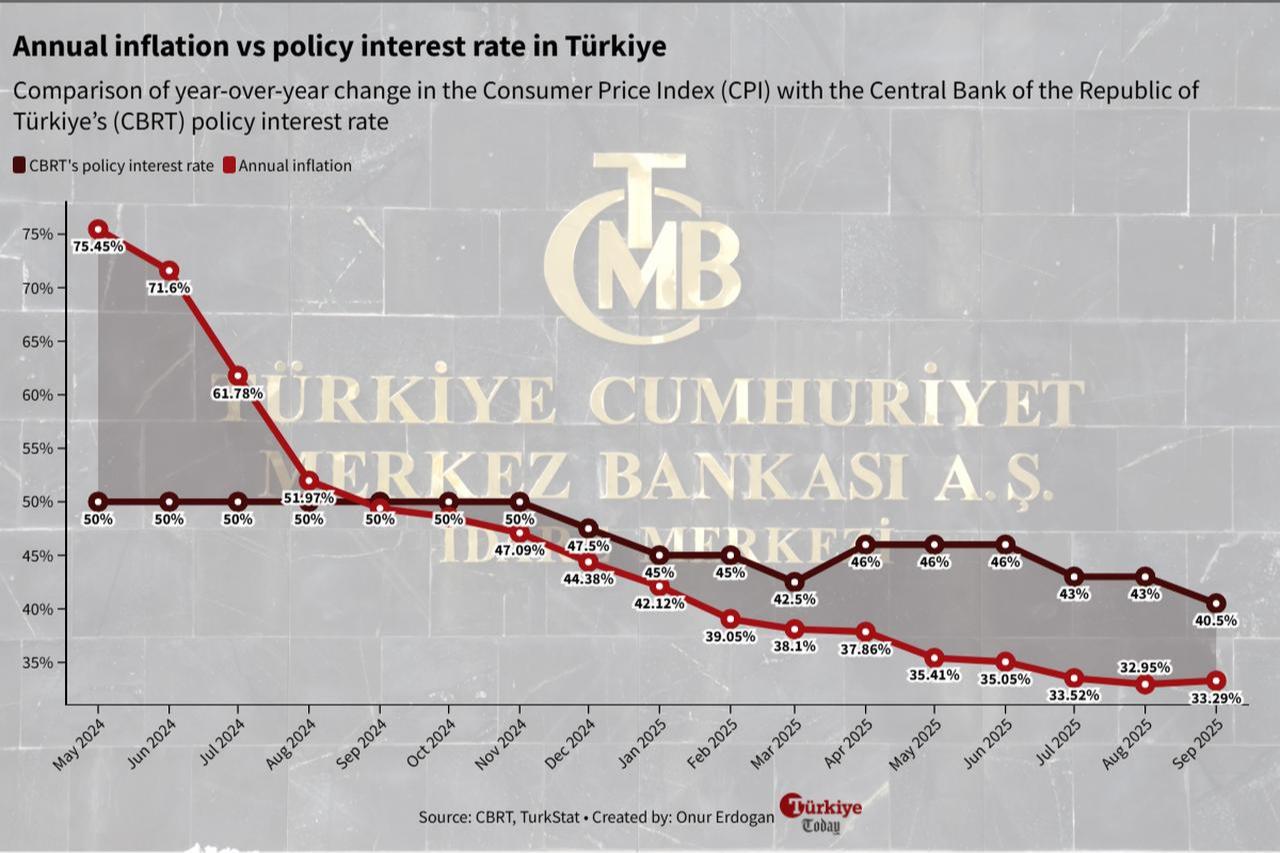

Türkiye’s annual inflation rate rose to 33.3% in September, exceeding expectations and marking the first year-on-year increase since May 2024, when inflation peaked at 75.4%. The August data had also surprised to the upside, prompting concerns that price pressures could linger longer than anticipated.

The recent figures have strengthened expectations that the Central Bank of the Republic of Türkiye (CBRT) will move more cautiously in the coming months, moderating the pace of rate cuts to preserve policy credibility while supporting disinflation efforts.

Similarly, another Reuters report said that foreign investors who attended a meeting in Washington, D.C., last week were told that CBRT Governor Fatih Karahan had expressed a more cautious tone, trimming the size of the expected cut.

Participants in the meeting said that CBRT Governor Fatih Karahan’s remarks reflected a more measured policy stance, signaling that the central bank may deliver smaller rate reductions than previously forecast.

Ahead of this week’s monetary policy meeting, U.S. investment bank JPMorgan adjusted its forecast for the CBRT’s rate decision, lowering its expectation for the October cut from 150 basis points to 100 basis points.

In a client note, the U.S. lender cited stronger-than-expected inflation in recent months as justification for a slower approach. The bank also increased its 2025 year-end inflation projection from 31.5% to 32%, while raising its policy rate forecast to 38.5% from 38%.

The bank analyst Fatih Akcelik expected the easing cycle to continue into 2026, projecting 100 basis point cuts at each meeting, with the policy rate reaching 30.5% by the end of that year. However, it warned that both inflation and interest rate outlooks carry upward risks through 2025–2026.

Turkish central bank policymakers will convene on Thursday, Oct. 23 to decide on the trajectory of the rate cut cycle, with October’s Survey of Market Particpants showing that Turkish traders wait a 150 basis points cut.