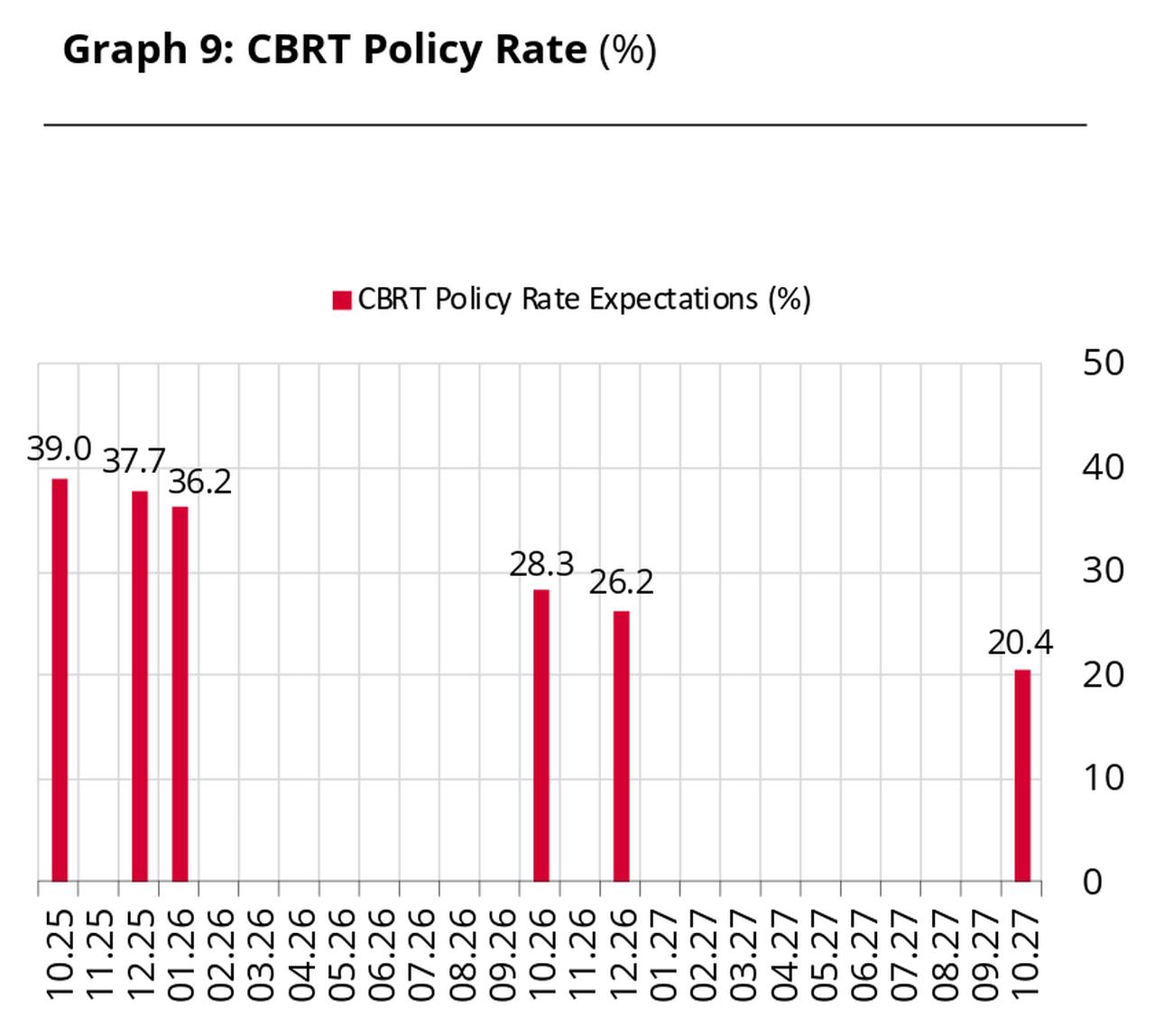

The Central Bank of the Republic of Türkiye (CBRT) is expected to continue its easing cycle with at least a 150 basis point rate cut in October, bringing the policy rate down to 39% for the first time since October 2023, an official survey of market participants showed.

According to the CBRT’s latest Survey of Market Participants, which compiles expectations from 68 representatives across the real and financial sectors, the following two meetings are projected to bring further reductions, with policy rate expectations at 37.66% and 36.17% in December and January, respectively.

The one-year-ahead policy rate expectation rose slightly to 28.26%, suggesting that participants anticipate the CBRT to cut rates gradually over the next year as disinflation gains traction.

The Turkish central bank’s Monetary Policy Committee (MPC) is scheduled to convene on Oct. 23 to set its next interest rate decision.

The Turkish central bank has implemented two consecutive rate cuts since July, lowering the policy rate to 40.5% from 46% through reductions of 300 and 250 basis points. However, as September inflation figures broke a 15-month cooling trend, rising to 33.3%, market participants now anticipate a more cautious stance from the policymakers.

Survey participants now project consumer prices to increase by 2.34% in October, up from 2.05% in the previous survey. The year-end inflation expectation also rose from 29.86% to 31.77%, exceeding the government’s official projection.

One-year-ahead inflation expectations rose from 22.25% to 23.26%, and two-year forecasts climbed to 17.36%, reflecting a continued belief that price pressures will ease only gradually despite monetary tightening earlier in the year.

The survey shows participants expect the Turkish lira to trade at 43.56 per U.S. dollar by year-end, slightly stronger than the previous forecast of 43.85. However, they foresee a modest depreciation in the medium term, with the 12-month expectation rising from 48.96 to 49.75 per dollar.

As of Friday’s close, the U.S. dollar/Turkish lira exchange rate stood at 41.90.

The projected current account deficit narrowed marginally to $20.8 billion for end-2025, compared with $20.9 billion in the previous survey, while the estimate for the following year stood at $25.4 billion, suggesting reduced import demand and stable export trends.