The European Commission projected that Türkiye’s economy will grow by 3.4% in both 2025 and 2026, accelerating to 4% in 2027, with household consumption expected to remain the main growth driver, supported by rising employment and wealth effects from elevated gold prices.

According to the Commission’s Autumn 2025 European Economic Forecast report released on Monday, domestic demand in Türkiye remained robust during the first half of 2025 despite ongoing tight monetary policy.

Türkiye’s economy grew by 4.8% in the second quarter of 2025, driven by a 5.1% rise in household consumption and an 8.8% increase in investment, which were the main contributors to the better-than-expected performance, the report highlighted.

The official targets indicated in the Medium-Term Program for 2026–2028 were 3.3%, 3.8%, and 4.3% for 2025, 2026, and 2027, respectively.

Alongside strong consumption, investment is expected to grow steadily as financial conditions improve and business sentiment strengthens.

The commission anticipates that Türkiye’s trade and current account balances will remain broadly stable through the forecast period.

Employment is forecasted to expand gradually, with the unemployment rate holding at around 8.6% between 2025 and 2027.

"Cost pressures are expected to be limited due to the significant slack in the labor market in view of elevated underemployment and a large potential labor force," the report said.

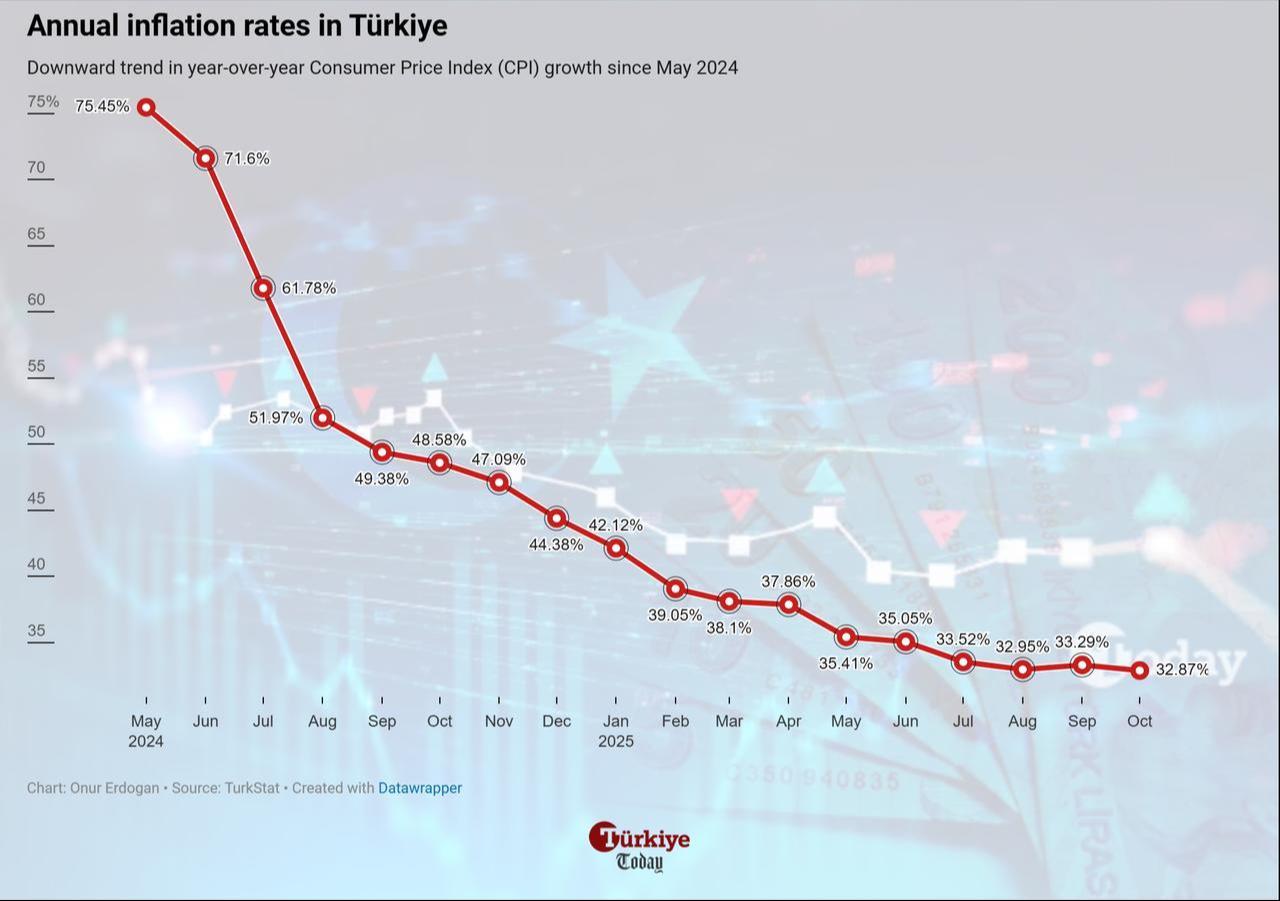

It also stressed that lowering inflation remains the government’s top priority, adding that despite persistent upward pressures from elevated food and service prices—exacerbated by weather-related disruptions to agriculture—and rising gold prices, inflation is projected to decline gradually.

Headline consumer inflation is forecast to reach 35.4% by the end of 2025, falling to 24.8% in 2026 and 17.7% in 2027. The continued implementation of tight monetary policy is seen as key to achieving these reductions.

Türkiye’s inflation resumed its downward trend in October, falling to 32.87%, with official projections expecting it to decline to 28.5% by the end of 2025. The inflation targets have been set at 16% for 2026 and 9% for 2027.

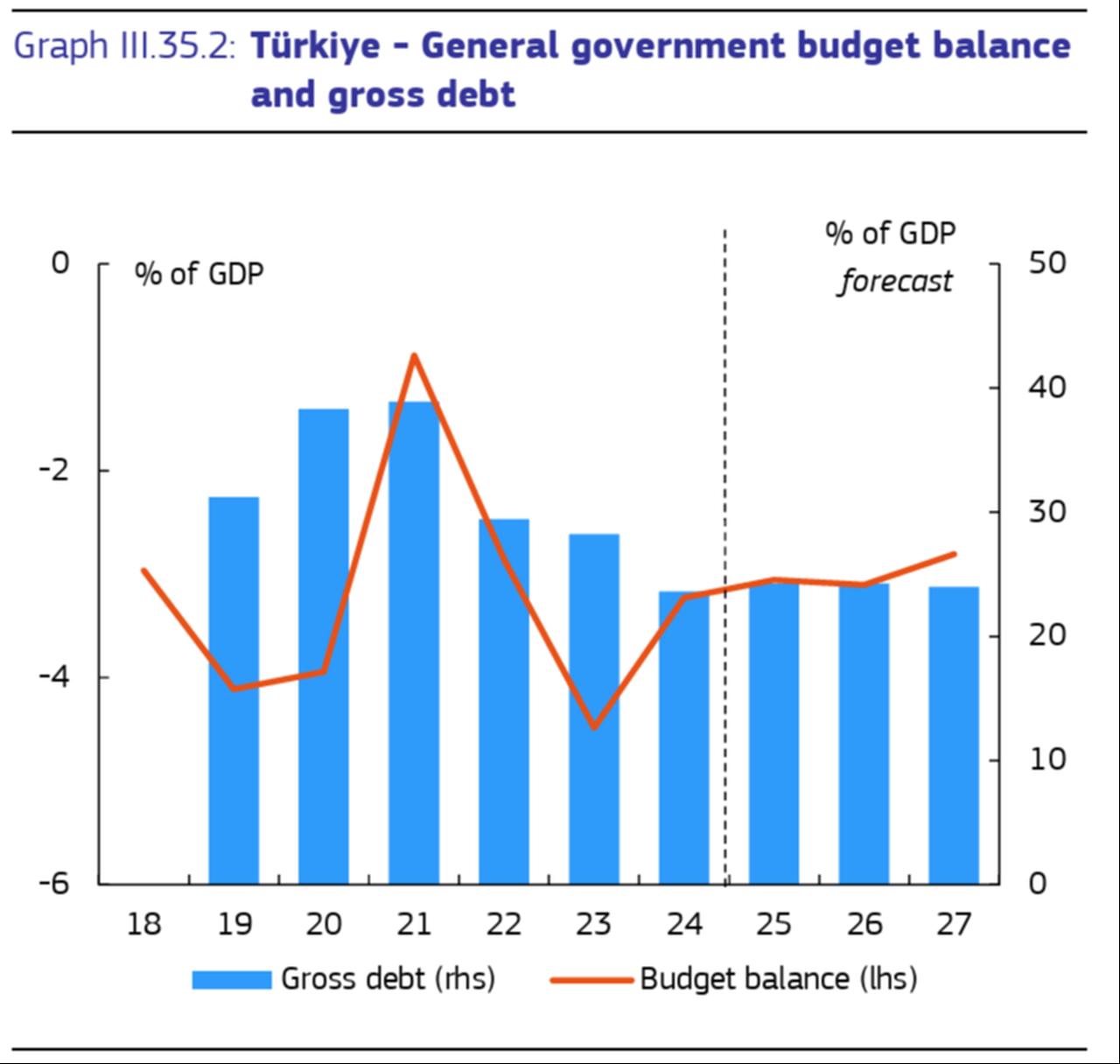

The Commission estimates that Türkiye’s central government budget deficit will remain close to 3% of gross domestic product (GDP), excluding earthquake-related expenditures.

A moderately tighter fiscal stance is expected to provide some support for disinflation efforts over the next two years.

Public debt is projected to stay near 25% of GDP, reflecting a stable outlook with limited short-term risks.

According to the Commission, Türkiye has managed recent domestic and geopolitical uncertainties relatively well. Although political tensions earlier in the year triggered financial market volatility, the report observes that stability returned quickly.

It also highlights that recent "solid policy actions," declining macroeconomic imbalances, and increased precautionary measures could support Türkiye’s resilience if orthodox economic policies continue.

For the EU, the Commission projects modest but positive growth across both the European Union and the euro area through 2027, with inflation expected to ease gradually and unemployment to remain stable.

Growth has outperformed earlier expectations, driven by stronger-than-anticipated performance in the first nine months of 2025—particularly in export activity and investment in equipment and intangible assets.

The EU’s GDP growth is now forecast at 1.4% for both 2025 and 2026, with a slight increase to 1.5% in 2027. For the euro area, growth is expected to reach 1.3% in 2025, 1.2% in 2026, and 1.4% in 2027.

Inflation in the EU is projected to decline from 2.5% in 2025 to 2.1% in 2026, before rising slightly to 2.2% in 2027.

The unemployment rate is expected to hold steady at 5.9% in 2025 and 2026, then ease to 5.8% in 2027. On the fiscal front, the general government deficit is forecast to rise slightly to 3.3% of GDP in 2025 and to 3.4% in both 2026 and 2027.

The Commission also highlighted several external risks facing the EU economy, including trade policy uncertainty, elevated global tariffs—particularly from the United States—and slower growth in export markets.

Productivity improvements, tighter labor markets, and effective deployment of EU funds—especially those under the Recovery and Resilience Facility—are considered key to supporting continued economic momentum.