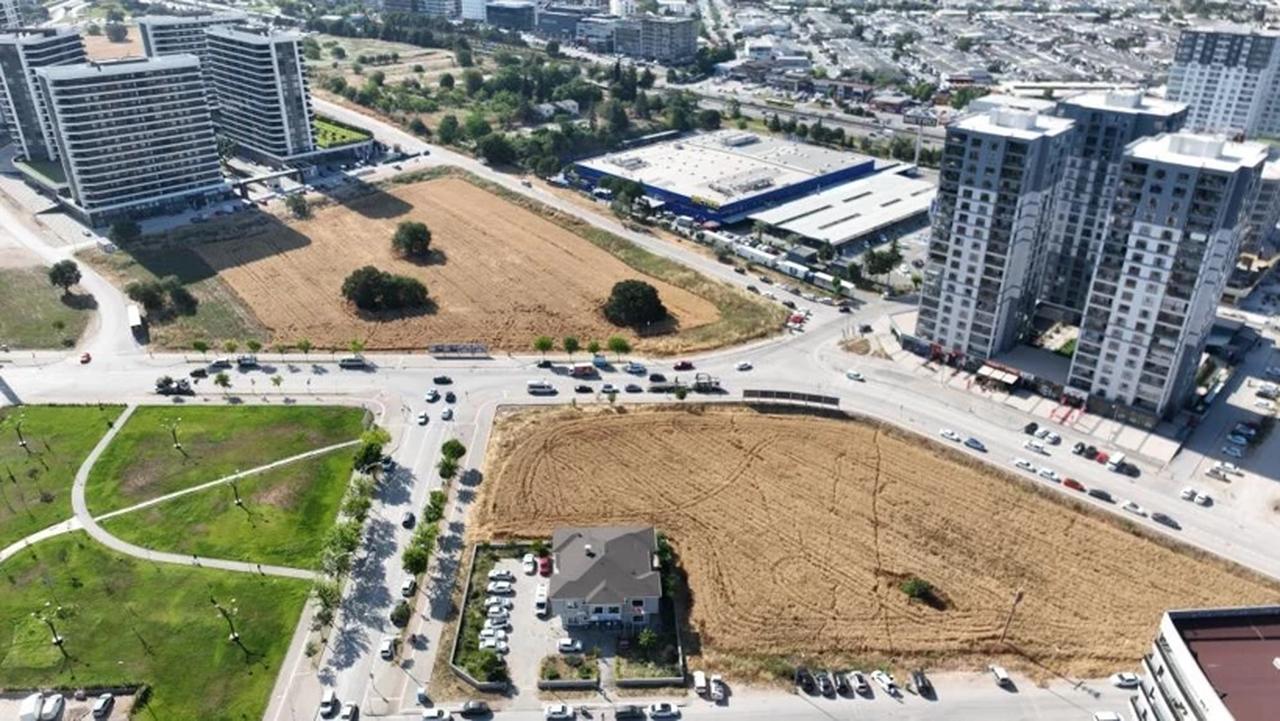

A wheat farmer in Türkiye’s northwestern province of Bursa has drawn widespread attention after reportedly rejecting a ₺30 million ($737,000) offer for his land—only to earn ₺39,000 ($970) from cultivating it.

Despite soaring land values—reaching ₺25–30 million ($614,000–$737,000) per decare in some areas—farmers in central Bursa continue cultivating wheat, earning around ₺39,000 ($959) from five decares by harvesting three tons and selling it at ₺13 per kilogram.

The stark contrast between urban real estate prices and agricultural returns has fueled a broader debate over land use priorities.

According to Dr. Fevzi Cakmak, head of the Bursa branch of the Union of Chambers of Turkish Engineers and Architects (TMMOB) Chamber of Agricultural Engineers, the city has experienced rapid industrial growth and high inward migration, placing pressure on farmland.

He noted that during the COVID-19 pandemic, the country was reminded of agriculture’s strategic value, yet that awareness quickly faded. “We waited for sunflower oil and grain ships from Ukraine, but after the pandemic, we began to disregard our farmland and farmers,” he told Ihlas News Agency, pointing to widespread zoning and unlicensed construction as key drivers of farmland loss.

In Bursa, 12% of agricultural land—amounting to 51,000 hectares—has been lost over the past 17 years, with much of the decline concentrated in the Nilufer district. This loss is equivalent to approximately 72,000 football fields.

The incident comes as Türkiye’s agriculture sector faces serious headwinds. In the first quarter of 2025, agriculture’s share of gross domestic product (GDP) dropped to 2.2%, with the sector contracting by 2% year-on-year to $65.66 billion—driven by adverse weather conditions, rising input costs, and declining profitability.

This contrasts sharply with the national economy, which grew 2% during the same period.

Adding to the pressures, a severe frost in April—described by Agriculture and Forestry Minister Ibrahim Yumakli as the most damaging in a decade—caused extensive damage to crop fields across the country, compounding the challenges for farmers already grappling with rising costs and shrinking margins.

According to estimates by the Turkish Statistical Institute (TurkStat), wheat production in 2025 is forecast to decline by 5.8%, while overall grain output is expected to fall by 4.1% to 37.4 million tons.

The financial burden on farmers is also growing. Agricultural loans climbed 51% over the past year to reach ₺1.04 trillion ($25.6 billion), according to the data from the Banking Regulation and Supervision Agency (BRSA). Meanwhile, non-performing loans in the sector rose 188% to ₺7.3 billion ($296.7 million), underlining deteriorating financial health.

Producer price inflation in agriculture surged to an annual 50.31% in June, reflecting a widening gap between production costs and market prices. Even unprocessed food prices—traditionally more stable—remained elevated, dipping only slightly to 25.8% in July, and continuing to reflect pressure on household budgets.

In response to mounting sectoral pressures, the Turkish government has expanded agricultural support, increasing disbursements to ₺24 billion ($589 million) for 2025.

President Recep Tayyip Erdogan announced in July that ₺18.5 billion of this will be allocated for rural development through a combination of budgetary and international funding. The program is expected to generate approximately ₺25 billion in total investment and create employment for 10,000 people in rural areas.

In terms of financing, state-run Ziraat Bank’s agricultural loan portfolio now exceeds ₺700 billion ($17.20 billion), meeting nearly 71% of the sector’s credit needs. Of this, over ₺650 billion has been extended under subsidized lending schemes to ease farmers’ financial burden.