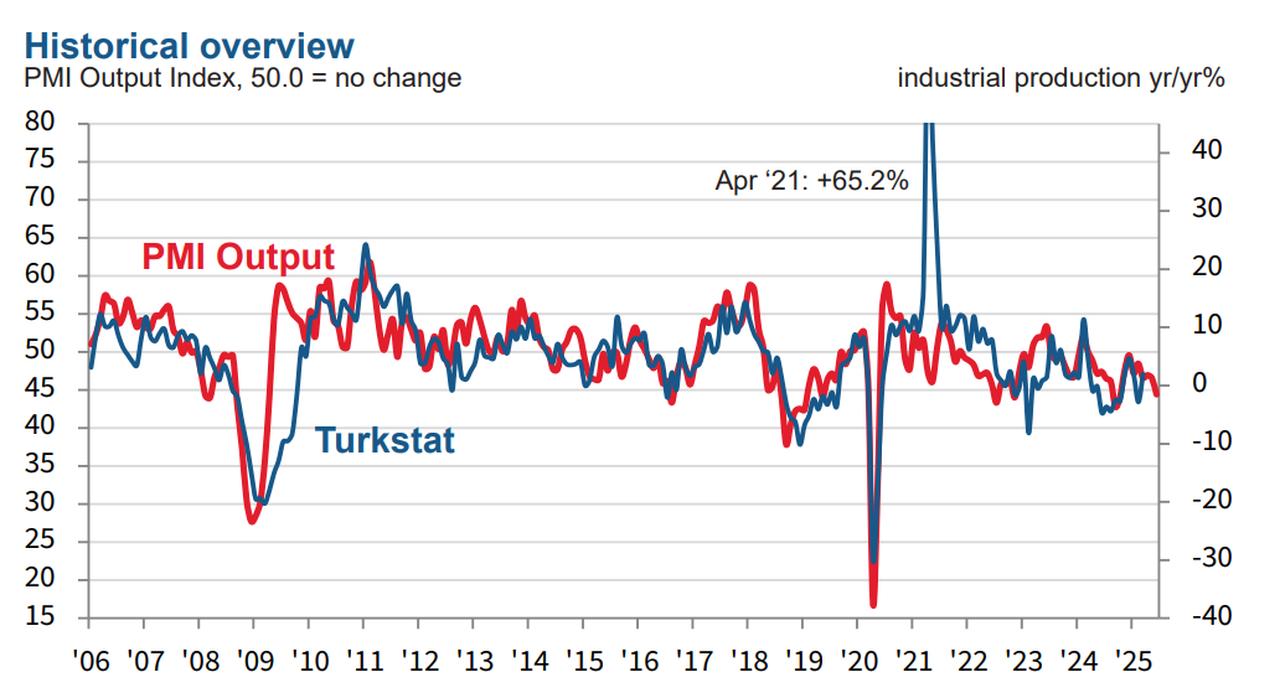

Türkiye’s manufacturing activity came under renewed pressure in June, with the headline Purchasing Managers’ Index (PMI) dropping sharply to 46.7 — marking the steepest monthly decline since October 2024, according to the Istanbul Chamber of Industry (ISO).

The report shows that the downturn, which began in April 2024, continued as weakening demand led to sharper declines in both total and export orders.

The drop was the steepest in three months, extending a negative trend that has lasted for two consecutive years.

As new orders remained subdued, manufacturers scaled back output significantly—at the steepest rate since October last year. This slowdown also affected staffing and procurement. Employment dropped at the fastest pace in nine months, while purchasing activity saw its sharpest decline since September 2024.

While input inventories fell, finished goods stocks increased for the first time in three months, reflecting weak sales. This shift indicates a build-up in unsold inventory across factories.

Input cost inflation edged up in June, driven by the weakening Turkish lira and inflationary pressures linked to the recent Iran-Israel conflict. While some firms raised their selling prices to offset rising input costs, weak demand conditions limited pricing power. As a result, the rate of output price inflation slowed to its lowest level since the beginning of the year.

Suppliers’ delivery times lengthened for the first time in four months, with firms largely attributing delays to raw material shortages.

Commenting on the results, Andrew Harker, Economics Director at S&P Global Market Intelligence, noted that Turkish manufacturers remained under pressure due to increasingly challenging demand conditions. “As a result, firms looked to scale back activity, with output falling at the sharpest rate since last October,” he said.

Harker added that despite weak sales, finished goods inventories rose for the first time in three months. He expressed cautious optimism, saying that “as the first half of the year draws to a close in a difficult environment, hopes are pinned on an improvement in conditions during the second half of 2025.”