Carry trade inflows into Turkish lira assets exceeded $45.5 billion by the end of September, driven by the highest real return among emerging-market currencies when adjusted for expected inflation over the next 12 months, U.S.-based investment bank Morgan Stanley said in its latest report.

According to the U.S. investment bank, strong carry trade inflows—investments where traders borrow in low-yielding currencies to buy higher-yielding assets—continue to rise and have now surpassed the March peak of $36.5 billion.

The bank highlighted that Türkiye leads all major emerging markets in real rates at around 18%, according to its 12-month ahead inflation-adjusted calculation, followed by Brazil and Egypt.

"The Turkish lira offers the highest real return based on expected inflation over the next 12 months, sustaining continued foreign carry trade inflows," the bank analysts said.

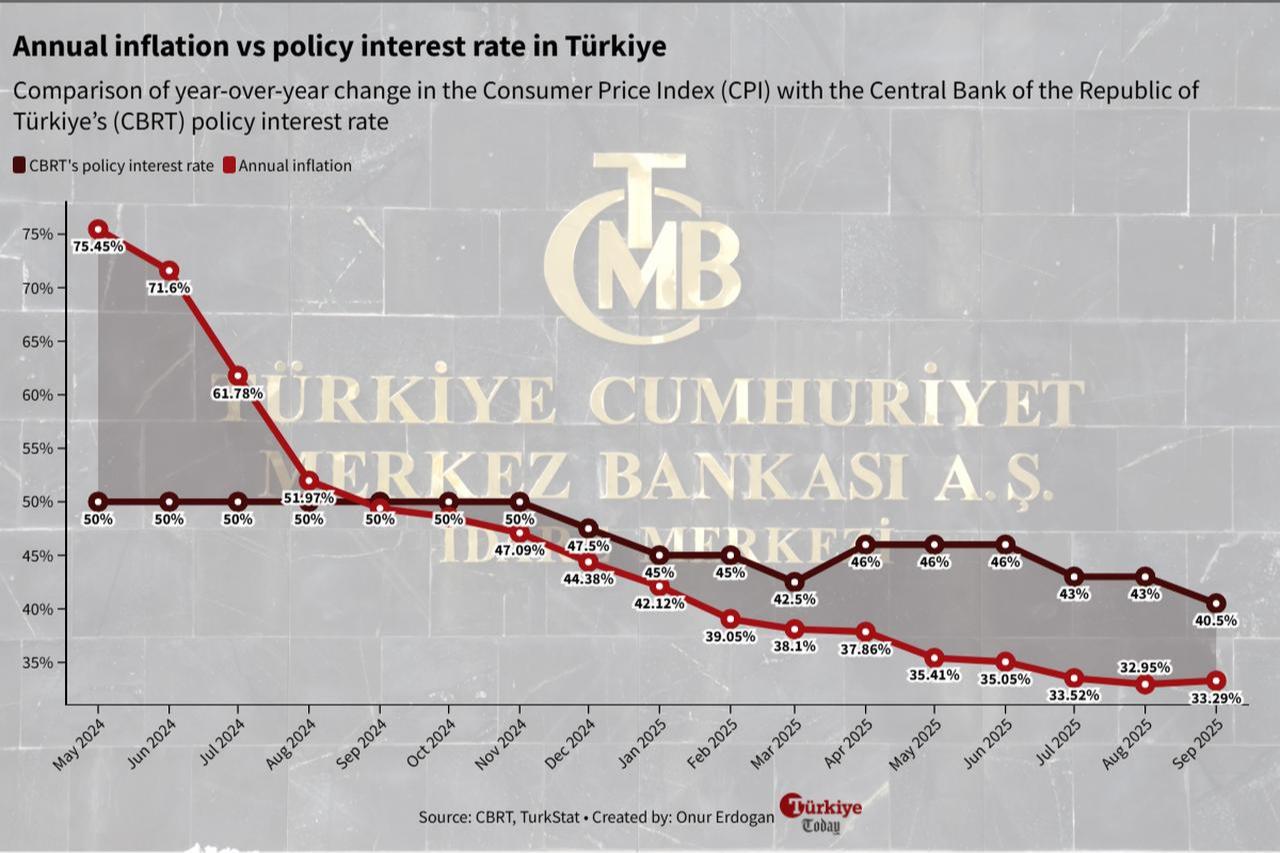

Morgan Stanley raised its year-end inflation forecast for Türkiye from 30% to 31.5% following September’s higher-than-expected inflation data, which signaled a slower pace of disinflation.

Analysts noted that the latest data indicated "a more gradual slowdown in disinflation momentum," prompting the revision.

They maintained their 2026 year-end inflation projection at 26%, far above the Turkish central bank’s interim target of 16%, citing expectations that food supply conditions will normalize next year, helping to ease price pressures in the fourth quarter of 2026.

Food inflation was the largest contributor to consumer price increases in September, rising 4.6% month-on-month and 36% year-on-year, driven by tighter supply conditions following large-scale weather disasters that caused extensive crop losses.

The report also suggested that the Turkish central bank may adopt a more cautious approach to monetary easing.

Morgan Stanley revised its earlier projection of a 200-basis-point rate cut in October to 150 basis points, reflecting a likely moderation in the pace of easing.

It expects the policy rate—currently at 40.5%—to fall to 37.5% by the end of 2025 and 26.5% by the end of 2026.

The Turkish central bank resumed rate cuts in July and September, lowering its policy rate by 300 and 250 basis points, respectively.

Policymakers are scheduled to decide on whether to continue the easing cycle on Oct. 23.