The Central Bank of the Republic of Türkiye (CBRT) has officially withdrawn two key regulations supporting foreign exchange-protected deposit accounts, following the maturity of the last remaining accounts.

According to two notices published in the Official Gazette, the move repeals regulations that governed the conversion of both Turkish lira and gold deposit accounts into foreign exchange-protected savings products, commonly known as "KKM" accounts.

The move formalizes the CBRT’s earlier announcement to phase out the scheme, excluding the separate YUVAM accounts for non-residents, by August 2025. The central bank had previously stated that once these accounts reached maturity, the supporting legislation would be repealed.

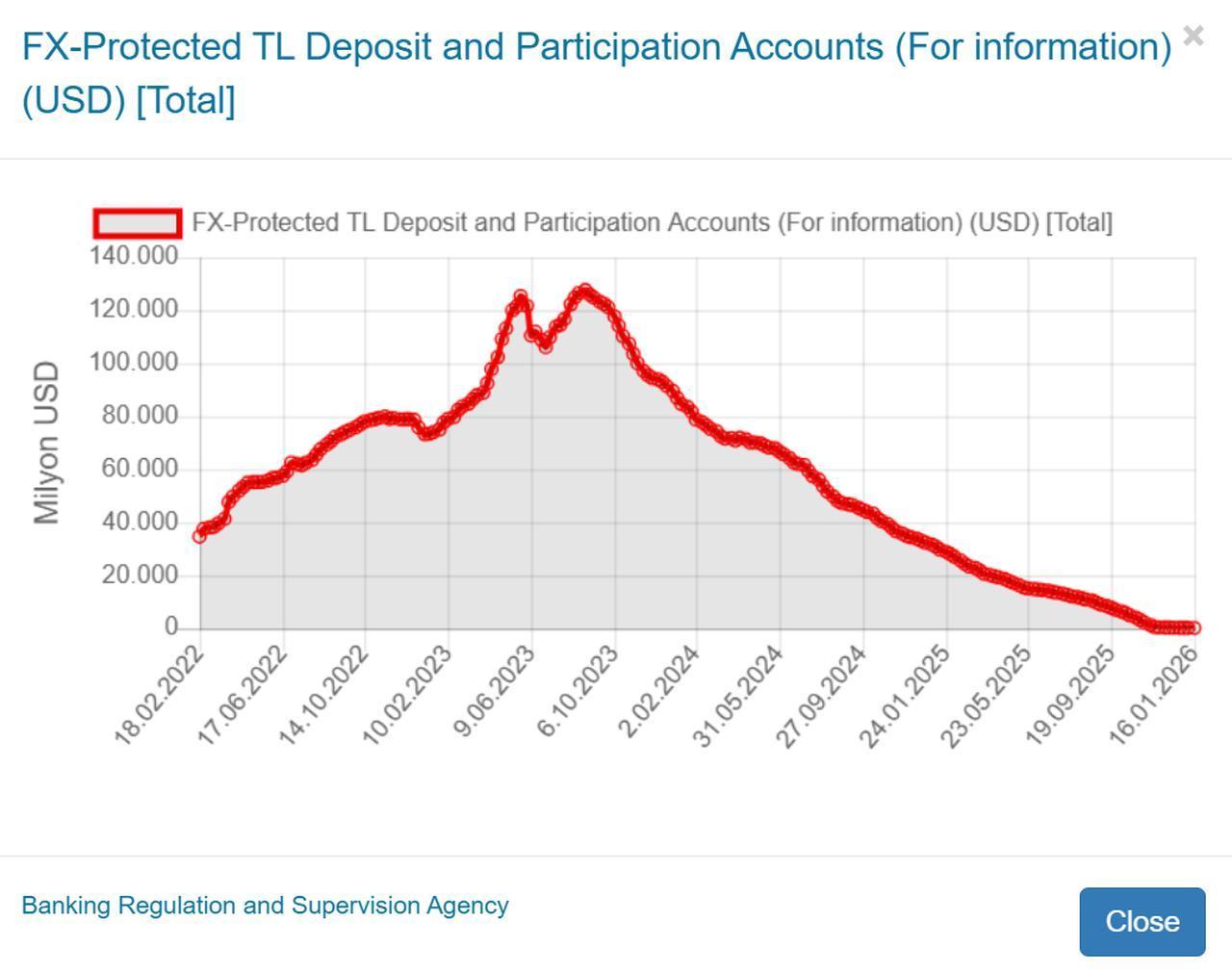

Introduced in late 2021 to counter dollarization amid a sharp depreciation in the Turkish lira, the FX-protected scheme guaranteed savers compensation for currency losses relative to lira deposit interest. While it helped temporarily stabilize the exchange rate, the program also heightened the country’s sensitivity to external shocks and was widely criticized for its fiscal burden.

After reaching a record level of ₺3.4 trillion ($127.57 billion) at its peak in August 2023, the scheme is estimated by economists to have cost the Treasury over $60 billion since its inception.

Despite the KKM rollback, the CBRT confirmed that gold-linked savings instruments, particularly the scheme aimed at integrating physical gold into the financial system, will remain in place as part of efforts to deepen domestic savings and reduce informal holdings.

In a separate move aimed at reinforcing financial stability and enhancing the effectiveness of monetary transmission, the CBRT also raised reserve requirement ratios on Turkish lira loans and deposits sourced from abroad.

The new measures apply to lira-denominated external borrowings with maturities of up to one year, which have been increased by 2 percentage points. As a result, the reserve ratio now stands at 20% for borrowings with maturities of up to one month, 16% for those up to three months, and 14% for those up to one year.

The same 14% rate will also apply to short-term deposits and participation funds held by foreign banks, as well as liabilities owed to foreign headquarters by branches of international banks operating in Türkiye, a step aimed at discouraging volatile short-term inflows and reinforcing monetary tightening.

Required reserves in Türkiye’s banking sector reached ₺3.81 trillion ($87.92 billion) as of Jan. 16, according to official figures.