The Capital Markets Board of Türkiye (SPK) reportedly does not seek to extend the short-selling ban on Borsa Istanbul that was imposed in March amid a market downturn, following ensured stability and record-breaking performance in recent weeks, Bloomberg reported Monday.

According to sources cited by Bloomberg, the country’s market regulator is considering not extending the ban, which is set to expire on Aug. 29, allowing investors to bet on falling prices.

A short-selling ban refers to a temporary or permanent restriction imposed by regulators that prevents investors from selling borrowed shares with the aim of buying them back at a lower price. Such bans are usually introduced during periods of high market volatility or financial stress, when authorities want to curb speculative trading that could accelerate stock price declines.

The sources said the move is anticipated particularly by foreign investors, who hold $33.7 billion in Turkish stocks, accounting for 43% of the total portfolio value, according to official figures.

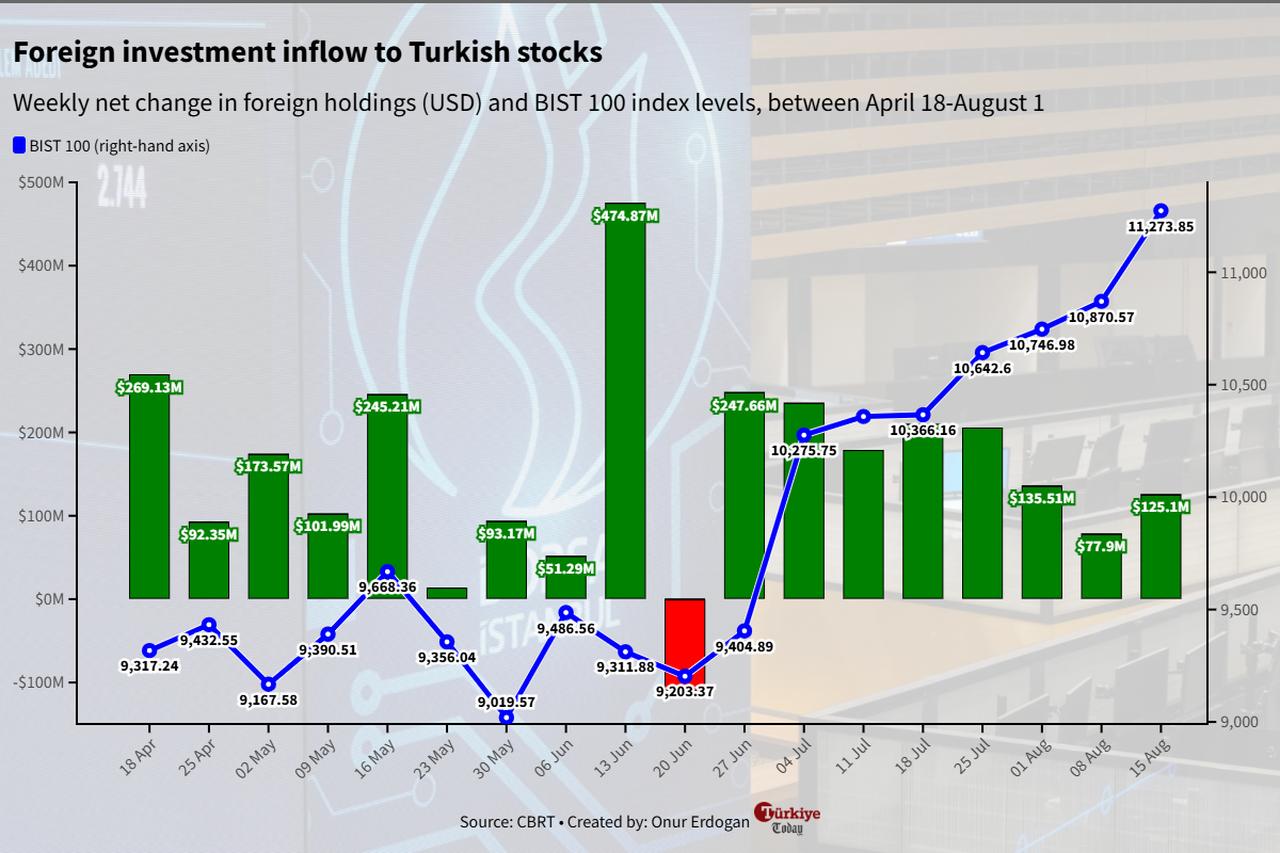

Since early June, the Turkish central bank has signaled plans to ease liquidity conditions for the markets after the effects of the turbulence in March began to fade. This has prompted a prolonged rally in Turkish stocks, with the benchmark BIST 100 index surging by over 26% during the period.

Closing last week at an all-time high, the index started this week in a fresh record zone above 11,500.

The period also marked the return of foreign inflows into the Turkish market, as the central bank data showed that since April 18, the net change in foreign holdings of Turkish stocks has surpassed $2 billion year-to-date, with inflows continuing for eight consecutive weeks as of Aug. 15.

The short-selling ban was first introduced in February 2023 following the February 6 earthquakes. SPK later lifted the ban for companies in the BIST 50 index starting in 2025.

However, on March 23, 2025, SPK announced that the short-selling restriction in Borsa Istanbul’s equity markets would be extended until the end of trading on April 25, 2025.

The ban was later extended again on June 27 until the close of trading on Aug. 29.