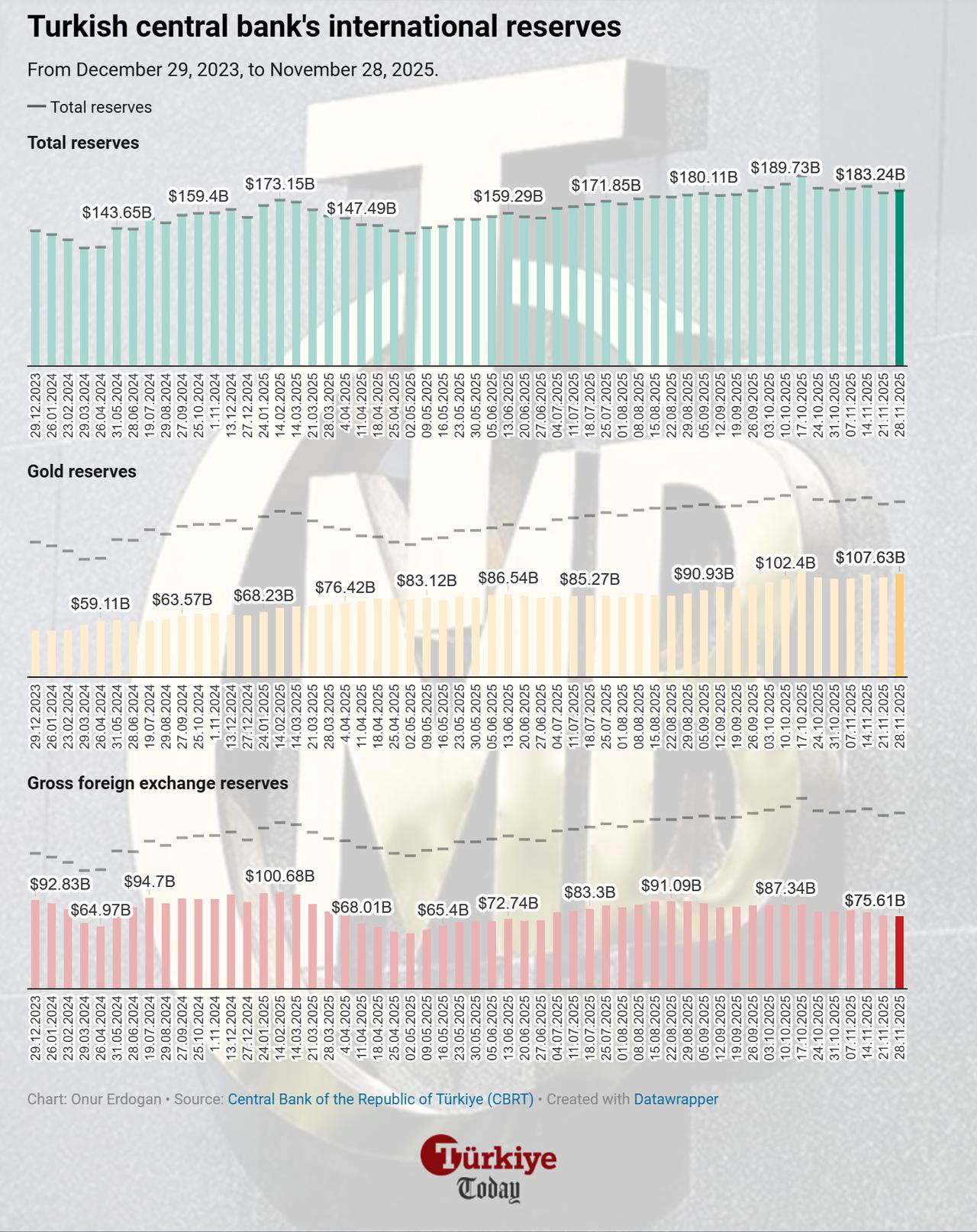

Central Bank of the Republic of Türkiye's (CBRT) total international reserves increased by $2.61 billion to reach $183.24 billion in the week ending November 28, driven primarily by a sharp rise in spot gold prices.

The CBRT’s gross foreign exchange reserves fell by $626 million during the week, decreasing from $76.24 billion on November 21 to $75.61 billion on November 28. However, this decline was more than offset by a $3.24 billion increase in gold reserves, which rose from $104.39 billion to $107.63 billion.

Net international reserves rose from $69.4 billion to $72.1 billion, while swap-adjusted reserves increased from $55 billion to $57.7 billion.

The week also saw notable movements in foreign portfolio flows, led by inflows into Turkish government bonds. Foreign investors increased their holdings of government domestic debt securities (GDDs) by $594.5 million, along with $200,000 in other public-sector assets.

However, non-resident investors also slightly reduced their Turkish equity holdings by $9.2 million. As a result, the stock of Turkish equities held by non-residents declined from $31.59 billion to $31.47 billion, while government bond holdings rose from $16.46 billion to $17.23 billion—the highest level since the week of March 21. The stock of other securities held by non-residents stood at $546.2 million.

The Turkish banking sector's total deposits rose by ₺490.15 billion during the week, reaching ₺27.25 trillion ($642.14 billion), up from ₺26.76 trillion in the previous week.

Lira-denominated deposits increased by 1.3% to ₺14.82 trillion, while foreign currency deposits grew by 1.2% to ₺9.01 trillion. Total foreign currency deposits across all accounts stood at $250.25 billion, of which $213.11 billion belonged to domestic residents, reflecting a $320 million weekly increase.

Consumer loans extended to domestic residents rose by 1.7% to ₺5.41 trillion, while the total credit volume of the banking sector, including the central bank, increased by ₺225.4 billion to ₺21.46 trillion in the week ending November 28.