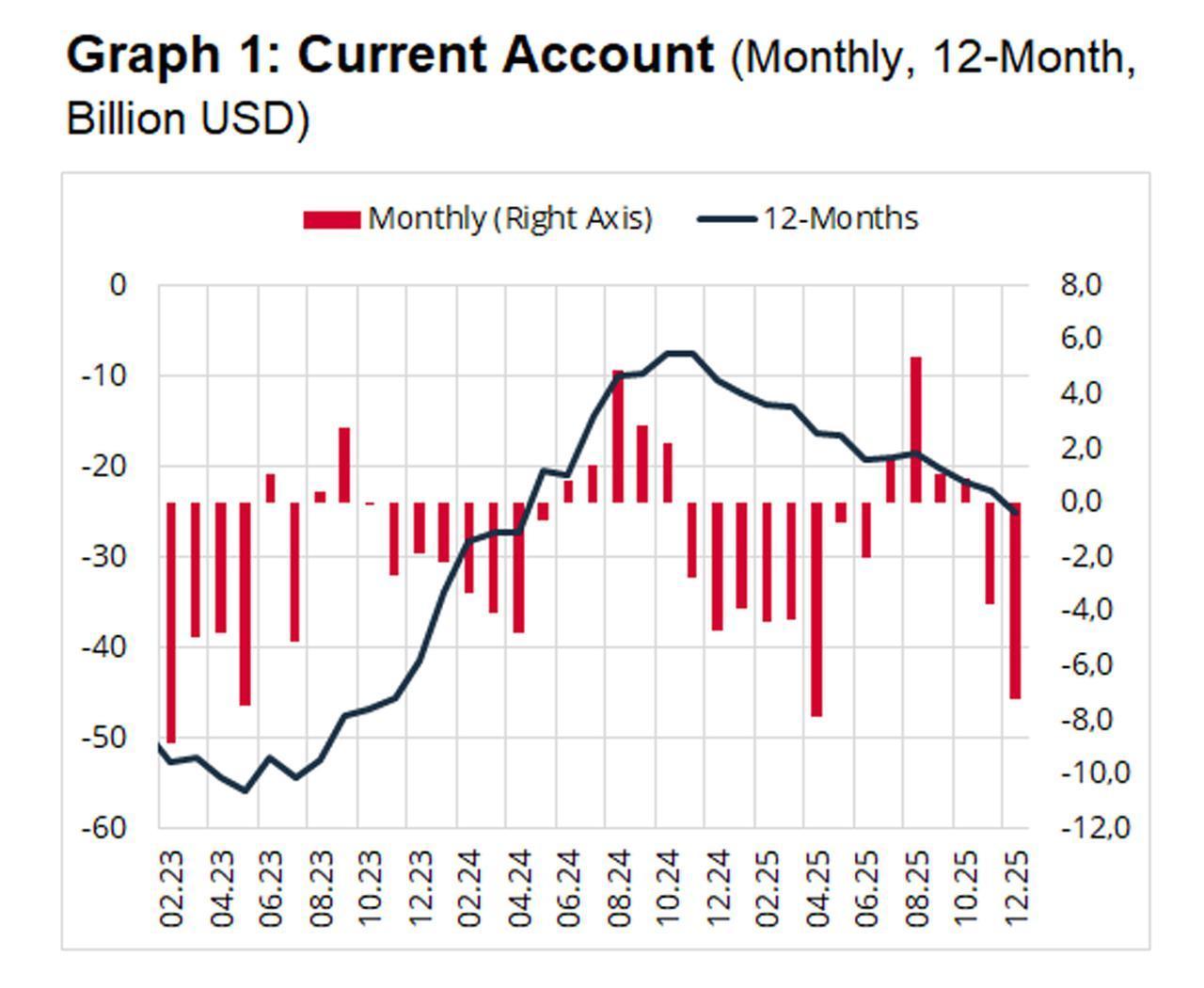

Türkiye’s current account posted a $7.25 billion deficit in December, bringing the year-end current account gap to about $25.20 billion, according to official balance of payments data.

The yearly deficit marked an increase of over 141% compared with the prior year’s deficit of $10.45 billion, mainly due to a wider foreign trade gap as a limited easing cycle lifted economic activity and household consumption stayed firm alongside the Turkish lira’s continued real appreciation.

The balance of payments–defined foreign trade deficit came in at $7.44 billion in December, while the full-year trade gap reached $69.70 billion.

Stripping out gold and energy, the current account ran a $0.69 billion monthly deficit, but on a yearly basis the adjusted balance still showed a $42.08 billion surplus.

Services generated a $63.50 billion surplus over the year, mainly from $51.02 billion in travel income and $22.87 billion from transport services. In December, services posted $2.65 billion in net inflows, with $1.67 billion coming from transport and $2.53 billion from travel.

Total foreign direct investment into Türkiye reached $13.08 billion, while outbound direct investment by Turkish residents stood at $9.83 billion in 2025. Property purchases by Turkish residents abroad climbed to a record $2.68 billion in 2025, while nonresidents’ real estate investments in Türkiye plunged by 17.02% to $2.34 billion.

The government’s medium-term program projects the current account deficit at 1.40% of GDP for 2025, while the ratio stood at around 1.32% in the third quarter.