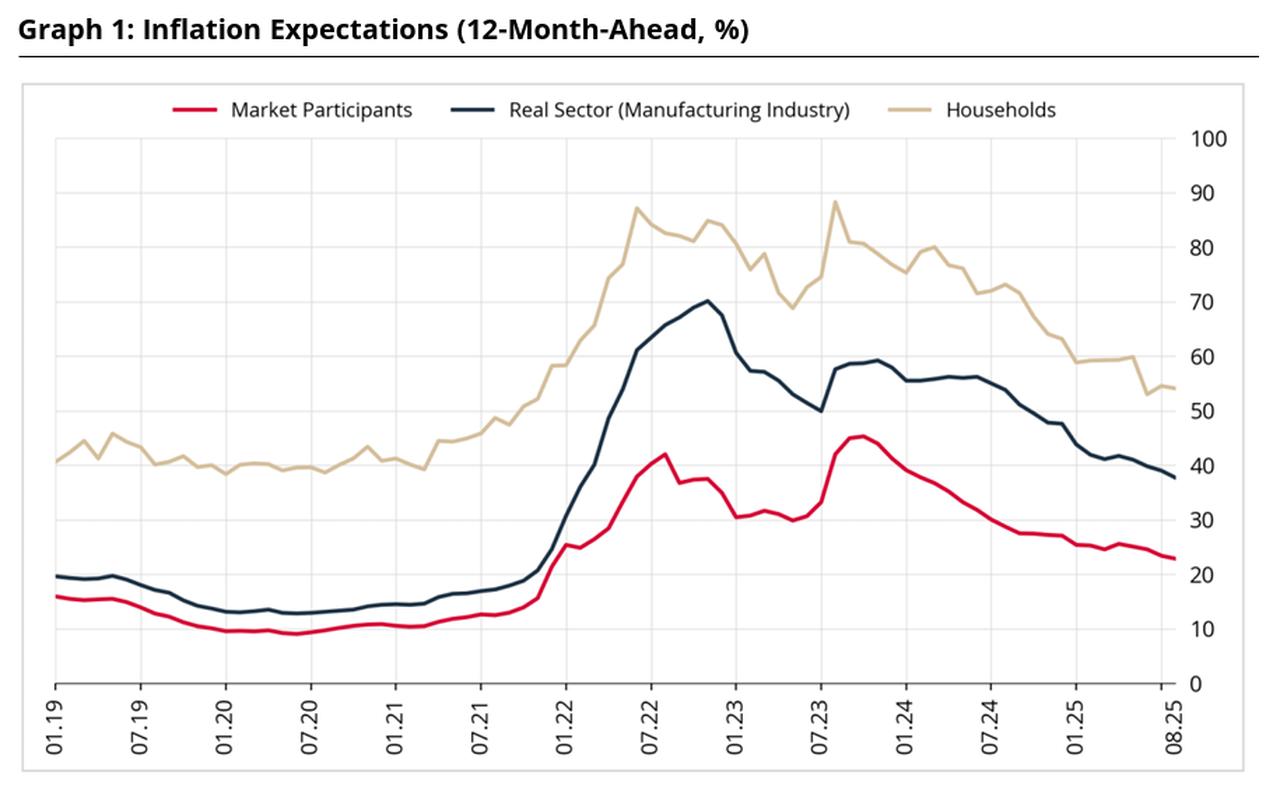

Annual inflation expectations in Türkiye declined across markets, the real sector, and households in August, according to figures released by the central bank on Tuesday.

The data comes as the first sectoral inflation expectations release following the Turkish central bank’s presentation of its third Inflation Report in mid-August, where it reaffirmed its year-end inflation target of 24% for 2025 and narrowed the forecast range to between 25% and 29%.

A sectoral inflation expectations report is a survey published by the Turkish central bank that measures how different groups in the economy anticipate inflation will evolve over the next 12 months, asking respondents to provide their expectations for future inflation rates.

The survey showed that 12-month ahead inflation expectations dropped to 22.8% among financial market participants, marking a decrease of 0.6 percentage points from the previous month.

Expectations within the real sector, which includes manufacturing and non-financial businesses, fell by 1.3 points to 37.7%.

Household expectations also edged lower by 0.4 points to 54.1%, while the share of households expecting inflation to decline over the next 12 months rose to 27.6% in August, an increase of one percentage point from the previous month.

Treasury and Finance Minister Mehmet Simsek said the improvement in inflation expectations supports the country’s disinflation program. In his post on X, Simsek also pointed out that both business and household expectations had fallen sharply compared with last year.

"Real sector and household expectations for 12 months ahead have declined by 16 and 19 percentage points, respectively, from the same period a year ago," he noted.

"We will decisively implement our program to ensure the permanent establishment of price stability," Simsek added.

A consistent decline in expectations often supports the central bank’s disinflation policies, while rising expectations may signal reduced confidence in monetary policy or concern about future price pressures.

As the figures declined across all sectors, the Turkish central bank is seen as more likely to continue cutting interest rates at its September meeting, after it resumed cautious easing in July with a 300 basis point reduction that brought the policy rate down to 43%.

The Survey of Market Participants, conducted among representatives of the real and financial sectors, had anticipated another 300 basis point cut at the September meeting in its August release.