Market participants in Türkiye raised their year-end inflation expectations to 32.2% and projected at least a 100 basis points cut at the December Monetary Policy Committee (MPC) meeting, according to a report released by the Turkish central bank on Friday.

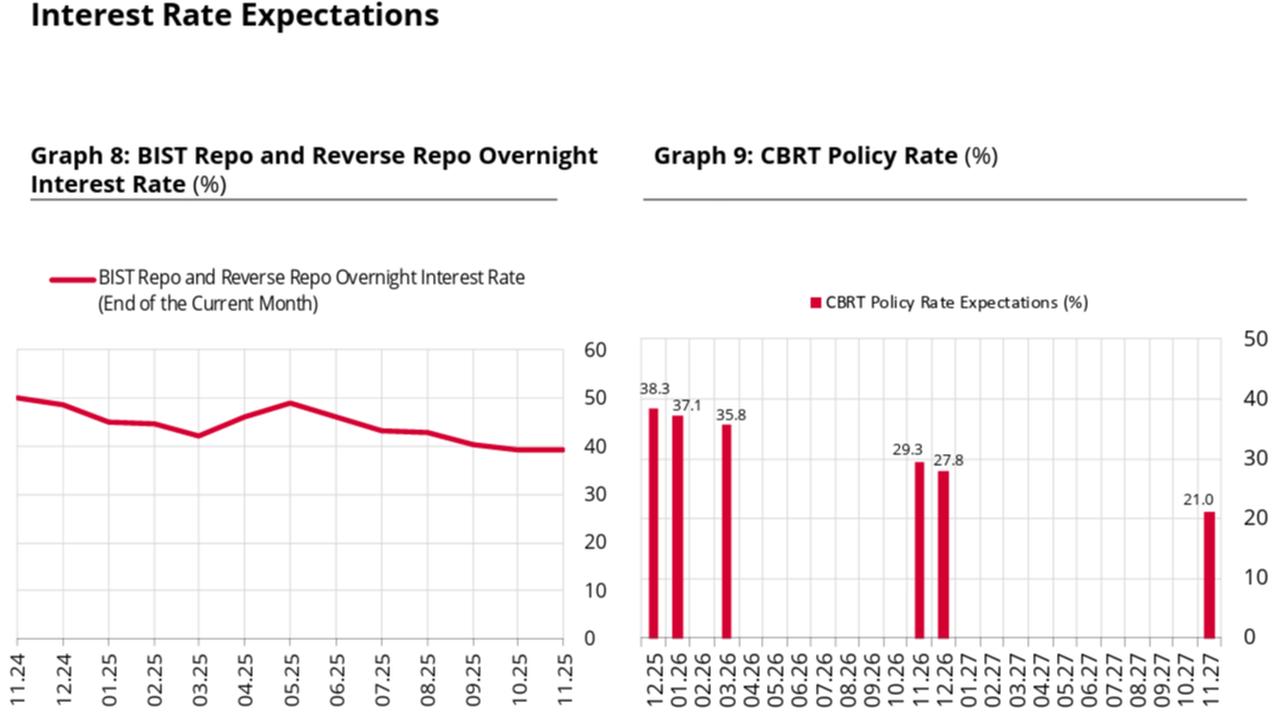

Since July, the Central Bank of the Republic of Türkiye (CBRT) has initiated a cycle of monetary easing, beginning with a 300-basis-point reduction. In its most recent decision in October, policymakers scaled back the pace of cuts to 100 basis points, citing a slower-than-expected disinflation trend. The current policy rate stands at 39.5%.

In October, Türkiye's inflation slowed again after an uptick in September that disrupted a 15-month downward trend, declining to 32.87%.

The monthly consumer inflation expectation for November rose to 1.59% from 1.55% in the previous survey period, which could bring the annual rate to 32.02%. Participants also revised their 12-month ahead inflation forecast to 23.49%, up from 23.26%, while the 24-month outlook increased to 17.69%, up from 17.36%.

Meanwhile, expectations for the CBRT's policy rate indicate a downward trajectory in the coming period, with smaller cuts expected. The average expected policy rate for the December meeting is 38.28%, with projections falling to 37.11% for the second meeting and 35.81% for the third. The 12-month forward expectation for the policy rate stands at 29.32%.

Survey participants adjusted their year-end exchange rate forecast for the U.S. dollar against the Turkish lira (USD/TRY) to 43.42, slightly lower than the previous 43.56. However, the 12-month outlook for the currency pair rose to 50.62 from 49.75.

On the external balance front, the expected current account deficit for 2026 was revised downward to $24.3 billion, from $25.4 billion. For the current year, the deficit is expected to be around $20.9 billion, marginally higher than the previous $20.8 billion estimate.

Türkiye recorded a current account surplus of $1.11 billion in September, marking its third consecutive monthly surplus and bringing the annualized deficit to $20.1 billion.

Expectations for Türkiye’s gross domestic product (GDP) growth remain stable, with participants projecting a 3.4% expansion in 2025, up slightly from previous forecasts. The outlook for 2025 suggests a further acceleration to 3.8%.

Commenting on the figures, Treasury and Finance Minister Mehmet Simsek reiterated that the government remains committed to its disinflation agenda and anticipates that inflation expectations will gradually realign with official targets. He acknowledged, however, that near-term inflation forecasts remain sensitive to recent developments.

Türkiye’s Medium-Term Program (MTP) covering 2026–2028, published in September, forecasts inflation at 28.5% for the end of 2025. The central bank, meanwhile, has maintained an interim target of 24%, though it revised its year-end projection range to 31%–33% in its latest Inflation Report.