The Biden administration is considering new measures to restrict Russia's oil trade, aiming to undercut the Kremlin's finances before President-elect Donald Trump takes office.

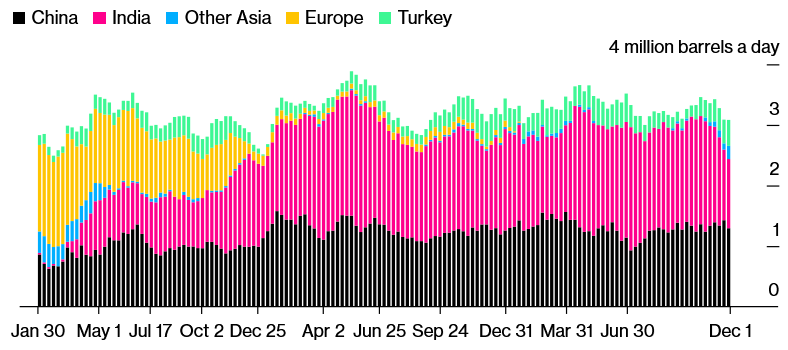

Sources familiar with the deliberations revealed to Bloomberg that potential sanctions could include restrictions on Russian crude exports and penalties for foreign buyers, marking a significant escalation in U.S. efforts to pressure Moscow.

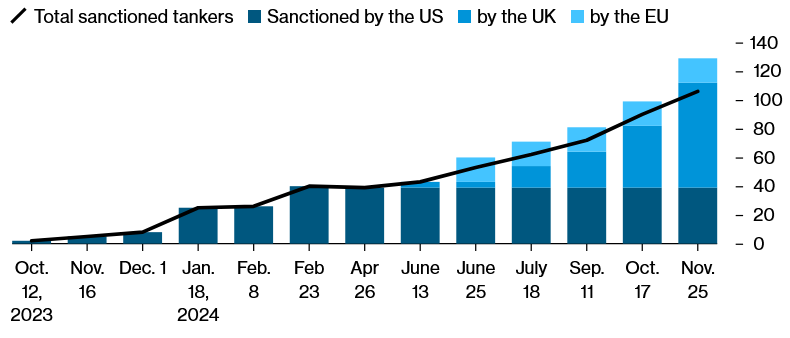

Previous U.S. sanctions, including a price cap on Russian oil, had limited impact on curbing Moscow's revenues. The new measures under consideration would build on these efforts by targeting foreign buyers and the so-called shadow fleet of tankers that transport Russian oil.

Key considerations include:

Officials suggest these steps could leverage current low oil prices, minimizing the global economic fallout.

The Biden administration’s move comes as oil prices remain stable, with Brent crude trading below $75 per barrel. This strategic window allows for tighter sanctions without causing significant market disruptions.

The timing also reflects concerns about Trump's potential policy shifts. As president-elect, Trump has expressed interest in pushing for negotiations to end the nearly three-year conflict in Ukraine, which some fear could lead to concessions to Moscow.

While the proposed sanctions aim to reduce Russia's war finances, they come with risks: