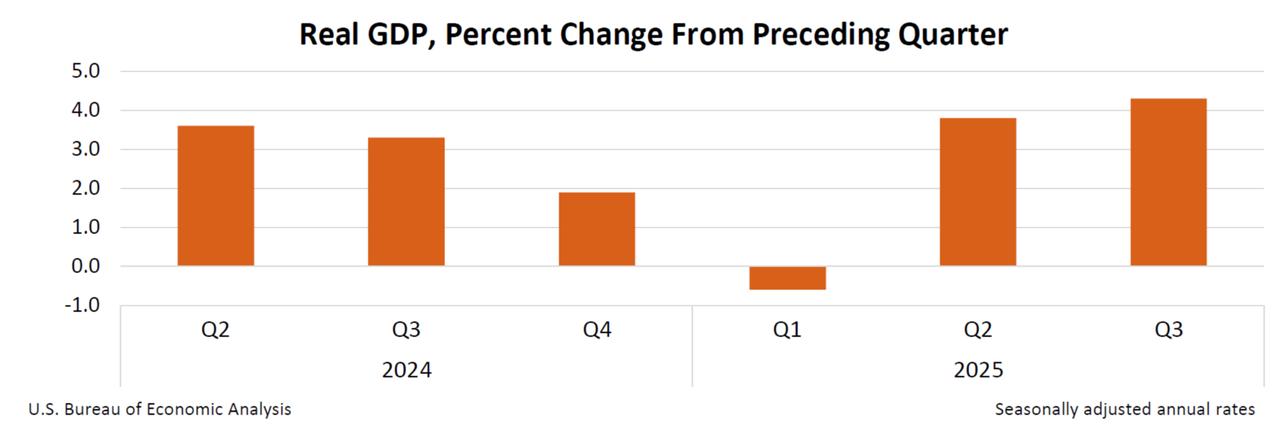

Wall Street stocks jumped on Tuesday after the U.S. economy’s third-quarter growth came in stronger than expected at 4.3%, lifting confidence about the outlook for conditions heading into 2026.

All three major U.S. indices ended the day higher, extending a month of gains driven by hopes of a year-end "Santa Claus Rally."

The S&P 500 rose 0.5% to close at 6,909.79, narrowly surpassing its previous record set earlier in December.

The Dow Jones Industrial Average increased 0.16% to 48,442.41 points, while the Nasdaq Composite rose 0.57% to 23,561.844 points, with markets initially wavering before settling into gains as the latest economic figures pointed to slower but still resilient expansion heading into the final quarter.

Preliminary data from the Bureau of Economic Analysis showed that the increase in gross domestic product (GDP) reflected a smaller decline in investment, faster consumer spending, and an upturn in exports and government spending.

The bureau said consumer spending rose across both services and goods, with health care, international travel, and professional services contributing on the services side, and information-processing equipment and prescription drugs lifting goods demand.

Exports increased in both goods and services, driven by capital goods, nondurable consumer goods, and business services, while imports fell as lower nondurable consumer goods outweighed an increase in imported business services.

Government spending increased at both the federal and state and local levels, supported by higher defense consumption and broader consumption-related expenditures.

Investment, however, declined, mainly because businesses added fewer goods to their inventories, particularly in wholesale trade and manufacturing, according to the report.

The data have softened expectations for additional Federal Reserve rate cuts, suggesting that economic conditions may remain firmer than previously projected and could pause the central bank’s easing cycle for a while.

The Fed, which has delivered three consecutive rate cuts since September and brought the benchmark range to 3.5%–3.75%, has also helped lift demand for safe-haven assets, as a softer U.S. dollar and lower borrowing costs tend to make them more attractive.

On Wednesday, the U.S. Dollar Index extended its retreat to 97.81, its lowest level since October, while gold climbed above the $4,500 threshold for the first time and silver rose past $70 per ounce. Although investors currently expect the Fed to delay another rate cut in January, the broader easing outlook still points to two more reductions in 2026.

Meanwhile, heightened geopolitical tensions, particularly the U.S. blockade against Venezuela and the ongoing conflict in Ukraine, have added further support to the move, reinforcing demand for safe-haven assets.

Other precious metals widely used in electric vehicle batteries and solar panels, including palladium and platinum, also extended their gains to $2,341.19 and $1,954.27, while copper reached a record high of $12,159.50 per ton.

Oil prices also edged higher, with WTI crude up 0.4% at $58.6 per barrel and Brent rising 0.3% to $62.57, supported by tensions surrounding Venezuela.