Global flock to safe-haven assets gained further momentum on Tuesday as gold prices continued their record-breaking run toward $4,500 per ounce, while other precious metals mirrored the move amid rising expectations of further Fed rate cuts ahead of 2026 and increasing geopolitical uncertainties.

Spot gold was trading at $4,473.04 per ounce at 6:20 a.m. GMT, up 0.6% on the day, after reaching an intraday record of $4,497.55. Silver also rose, gaining 0.2% to $69.17 per ounce after hitting a record of $69.98 earlier.

Other precious metals also strengthened, with palladium gaining 1.2% to $1,848.93 per ounce, its highest level since 2022, while platinum rose 2.4% to an all-time high of $2,187.27.

Gold is on track for its strongest annual performance since 1979, with year-to-date gains surpassing 70%. The surge has been fueled by expectations of further monetary easing in the United States following the Federal Reserve’s first rate cut in September. Investors have been weighing expectations of a more accommodative stance from the Federal Reserve, leading traders to price in two additional rate cuts for 2026.

The Fed has already lowered its policy rate by a total of 75 basis points this year, bringing the benchmark range down to 3.5%–3.75% from 4.25%–4.5%.

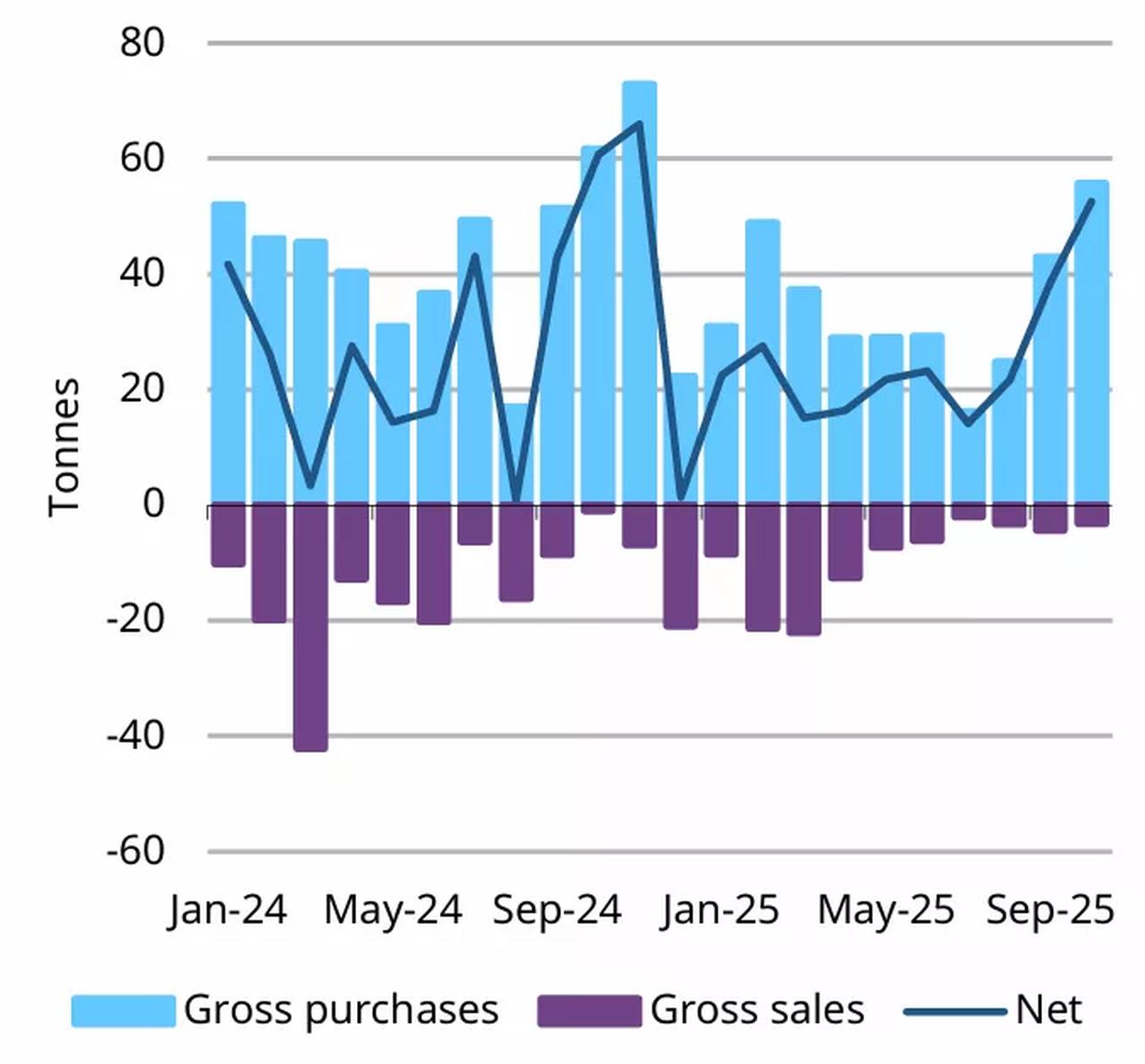

Central banks have played a substantial role in the rally, with World Gold Council data showing net purchases of 254 tonnes between January and October. Broader geopolitical risks, including the ongoing Russia–Ukraine war and, more recently, U.S.–Venezuela tensions, have also helped push gold and silver higher by amplifying concerns over global security.

Silver’s gains have outpaced gold, rising 135% this year. The increase stems from tight supply conditions following a decline in global mining output, combined with heightened industrial demand in sectors such as solar energy, electronics, and electric vehicles.

The U.S. Geological Survey’s decision to add silver to its list of critical minerals has reinforced expectations of continued demand growth.

In the case of palladium and platinum, China’s Securities Regulatory Commission recently approved new futures and options contracts for both metals, which are widely used in the automotive and industrial sectors. These approvals, together with ongoing supply constraints and uncertainty over potential U.S. tariffs, have helped lift prices across both markets.

Palladium’s rise has also been shaped by geopolitical tensions involving Russia, one of the world’s key suppliers. Platinum prices, meanwhile, have gained support from expectations that weakening demand for electric vehicles could allow sales of combustion-engine cars to outpace them.

Oil prices also moved up as tensions between Washington and Caracas intensified. Both WTI Crude and Brent Crude rose 2.2% since Monday, trading at $57.8 and $61.86 per barrel, respectively, though each slipped slightly by 0.2% on Tuesday.

Last week, U.S. President Donald Trump declared what he described as a "total and complete blockade" on sanctioned oil tankers entering or leaving Venezuela, and U.S. forces intercepted a third vessel over the weekend in the region since Dec. 10.

Venezuela holds some of the world’s largest proven oil reserves and was once a leading global producer. Output, however, has dropped sharply over the past two decades due to mismanagement, corruption, insufficient investment, and infrastructure deterioration. Additional pressure has come from U.S. sanctions targeting PDVSA, the state-owned oil company. Production, which once approached 3 million barrels per day, has in recent years fallen below 1 million barrels per day.