Türkiye is preparing to relaunch and expand its Credit Guarantee Fund (CGF) in a bid to revive lending to small and medium-sized enterprises (SMEs), which continue to struggle under the burden of elevated financing costs due to the country's tight monetary policy.

The announcement came on Thursday, as President Recep Tayyip Erdogan underscored the importance of the Credit Guarantee Fund (CGF) during a press briefing on his return flight from Hungary. He described the CGF as a vital tool to "prime the pump" of the real economy and stated that the government is in the final stages of preparing a new initiative under the program. “The drop in inflation is clearly visible, and we must now reinforce this momentum with steps that also strengthen financial stability and growth dynamics,” he said.

“I’ve already instructed the relevant officials, and we’re currently preparing for this. We have no choice but to take this step.”

The announcement has drawn strong support from Türkiye’s business community, with Sekib Avdagic, head of the Istanbul Chamber of Commerce (ITO), welcoming the news, describing it as a potential solution to long-standing credit access problems faced by SMEs. "In the current environment, it’s nearly impossible for SMEs to remain competitive with such high borrowing costs,” Avdagic noted, urging for a swift reactivation of the CGF to enable production cycles to function reliably.

Mustafa Gultepe, head of the Turkish Exporters Assembly (TIM), also praised the initiative, pointing out that the average cost of credit in Türkiye now exceeds 50%. He said the reintroduction of the fund signals a government intent to support industrial output and sustain economic competitiveness while continuing its disinflation efforts.

In parallel with the government's CGF plans, the Treasury and Finance Ministry is preparing to roll out a new ₺30 billion ($970 million) loan package specifically aimed at manufacturing SMEs. In a brief to Anadolu Agency on Friday, Minister Mehmet Simsek said the package will include a ₺25 billion guarantee ceiling, with 85% of the loans backed by the Treasury.

The package will allocate ₺17.5 billion for operational expenses and ₺7.5 billion for capital investments. Eligible firms can receive up to 15 million liras for operational spending and up to ₺30 million for investment projects. Simsek emphasized that the program aims to offer “accessible and low-cost financing” to bolster the production and competitiveness of SMEs.

“Our policy remains selective. While we are resolute in combating inflation, we are also committed to supporting the real economy,” Simsek stated. “SMEs are the cornerstone of production and employment in Türkiye, and their strength is our priority”.

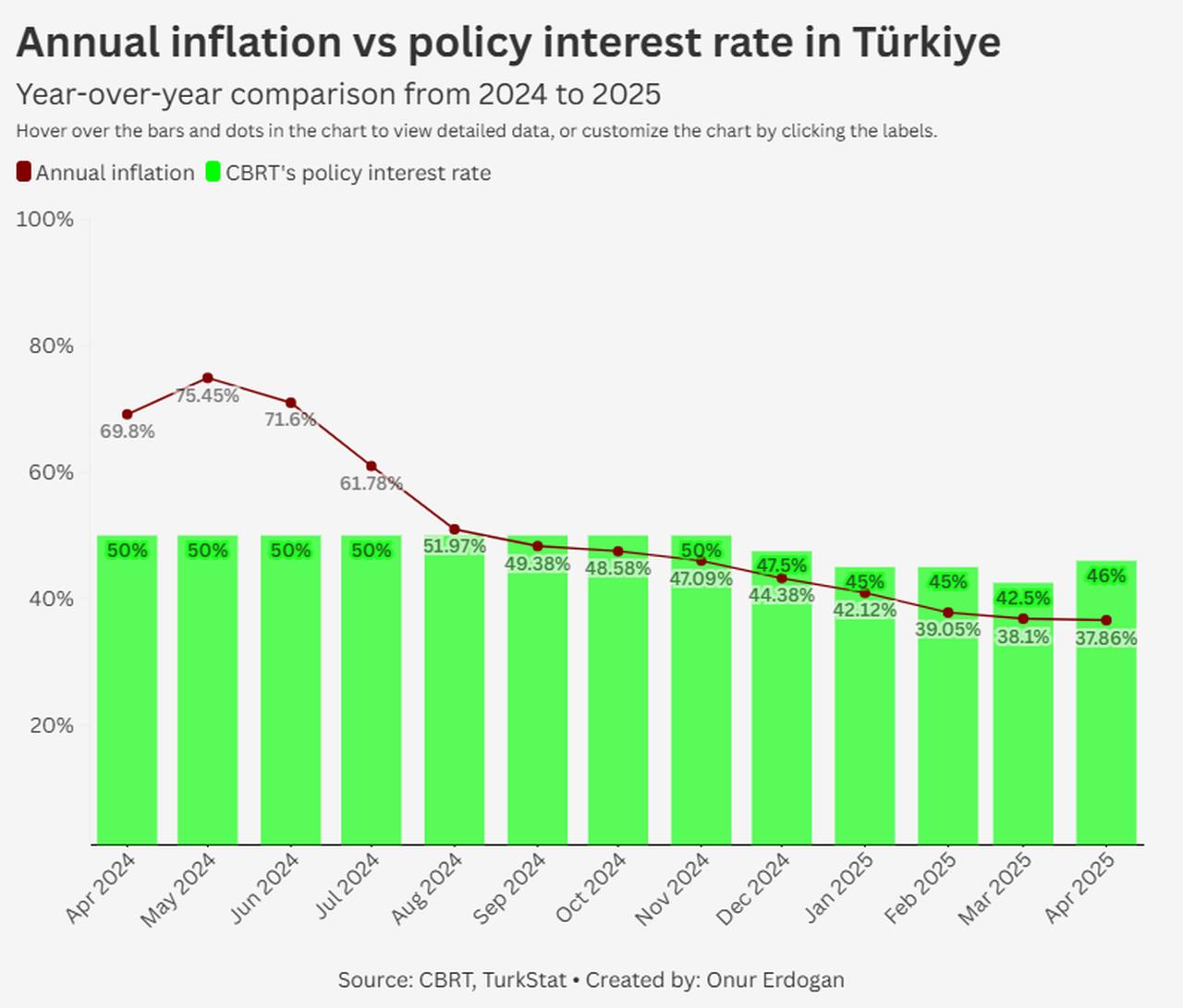

The revival of the CGF comes at a time when a significant portion of Turkish firms are reporting losses. In the first quarter of the year, 269 out of 539 publicly listed companies posted net losses—up sharply from 206 a year earlier. This downturn has been largely attributed to the Turkish central bank’s tight monetary stance, aimed at curbing stubborn inflation, which peaked at 75.5% in May 2024. To contain excess liquidity and dampen domestic demand, the central bank held its policy interest rate at 46% in its latest meeting in April, making it increasingly difficult for companies to access financing. As of May 9, commercial loan rates stood at 64.13%, according to the official figures.

The CGF, which shares loan risk between lenders and the Treasury, was last significantly expanded in 2016 and helped trigger a lending boom in 2017. However, that momentum faded following the currency crisis in 2018. To date, the fund has supported ₺929.5 billion in loans.

Meanwhile, financing concerns are also expected to dominate Türkiye’s upcoming Economic Council meeting organized by the Union of Chambers and Commodity Exchanges of Türkiye (TOBB). The forum will bring together top policymakers, including Vice President Cevdet Yilmaz and the country's economic ministers, to directly hear from business leaders.

TOBB President Rifat Hisarciklioglu is expected to echo industry demands to ease financing conditions, eliminate interest rate burdens, and support regional industries affected by recent natural disasters. The meeting is anticipated to last at least seven hours, allowing stakeholders from across Türkiye’s seven regions to outline their sector-specific challenges.