We've concluded another IDEF defense industry fair, held every two years in Türkiye and eagerly anticipated by defense enthusiasts.

This year marked the 17th edition, taking place for the first time at the expansive Istanbul Fair Center and an open section of Ataturk Airport with broad participation. Unfortunately, the fair's opening days coincided with what were probably Istanbul's hottest days of the year, making it nearly impossible to explore the outdoor areas as people sought shade wherever they could find it.

While the fair was quite exciting, the organizational problems that were evident at every fair once again became apparent. Long waits for entry cards in extremely hot conditions created tensions, and the mandatory badge entry requirement, despite pre-issued QR codes, resulted in very long queues.

For the past several years, IDEF has become a highly successful showcase for observing the progress of the Turkish defense industry. Considering Türkiye's geographical position, it was possible to see intense activity from countries wanting to enter regional markets. IDEF 2025 had far more foreign participants and delegations compared to other fairs, as expected.

Chinese defense industry companies and officials were notably present, demonstrating incredible market competition. I even witnessed deals being made in what could be called "under-the-table" venues—cafes and restaurants outside the fairgrounds, accompanied by cigarettes and tea. Interestingly, this reminded me how far technology has come: in an environment where no one spoke English, people were communicating with each other using simultaneous translation programs.

Turkish companies' booths were quite crowded. Military officials from Syria's new government could also be seen touring the booths during the fair. The fair attracted particularly strong interest from African and Middle Eastern delegations, while numerous European and American defense officials could also be seen circulating among the displays.

There were many new projects, products, and designs, but it's unknown which of these products displayed at the booths are ready for field deployment and which were developed solely for R&D purposes or capability demonstration.

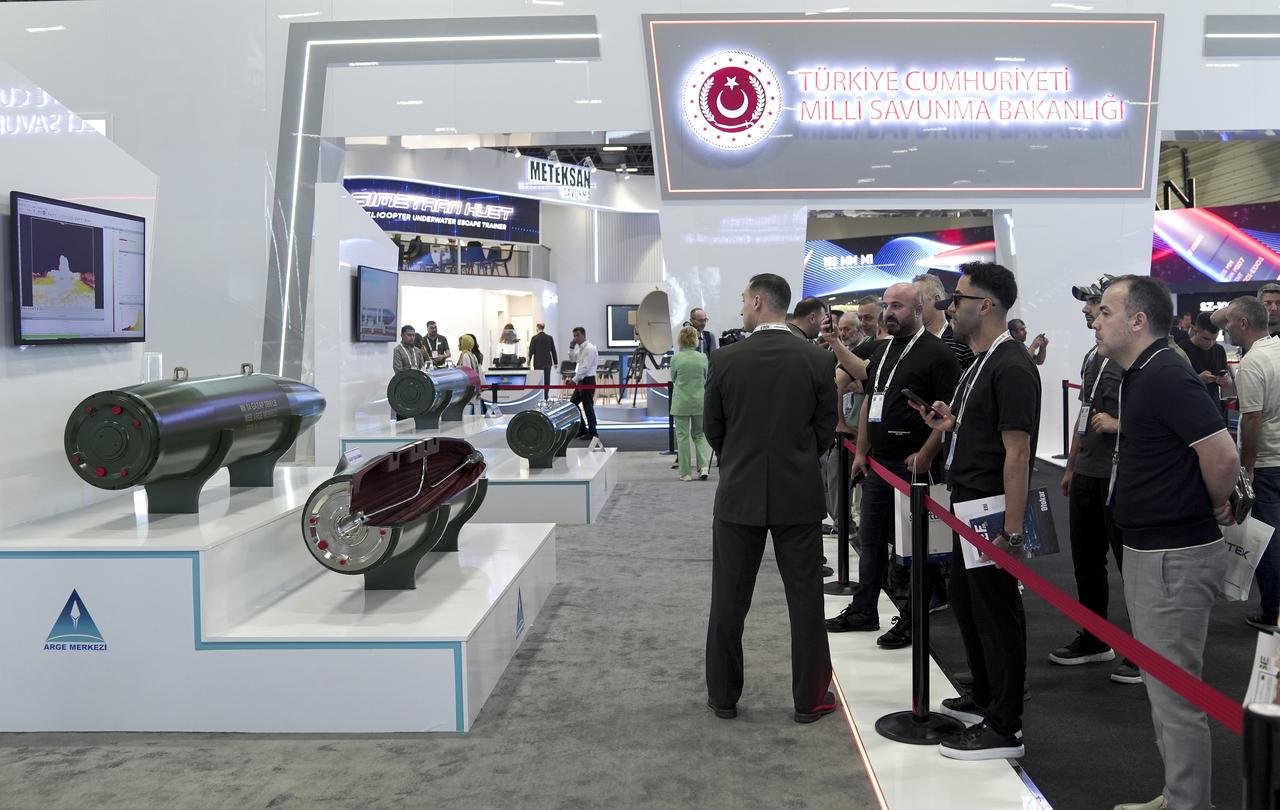

What emerged as perhaps the most attention-grabbing focal point at this IDEF was the Ministry of National Defense's R&D Center. From Unmanned Surface Vehicle (USV) to Ramjet-powered 155mm howitzer ammunition, Wankel engines, hand grenades, liquid-fuel rocket engine components, air-to-air missiles, and even 122mm rockets.

The R&D Center, revealing it had operated covertly for 12 years, made what might be called its "debut launch." Defense analysts and enthusiasts will undoubtedly subject the organization to intense scrutiny in the coming months.

One notable shift that caught my attention at the fair was the decreased focus on technical topics discussed. In past iterations of the event, these long, rewarding product-based conversations held with engineers at booths made the event much more accessible to the public, though this might have been due to the timing of my visit on the very first day.

The event attracted incredible crowds, sometimes making it impossible to walk without colliding with people. Despite this, it was quite a delightful fair with a strange but pleasant atmosphere.

Walking through the fair, it was possible to spot multiple Turkish defense industry companies displaying almost identical product lines, raising the question of how rational it is to spend effort, time, and money on the same areas with limited resources.

Additionally, the defense industry ecosystem was visibly divided into four parts: companies and factories directly linked to the Ministry of National Defense; companies and subsidiaries directly connected to the Turkish Armed Forces Foundation (TSKGV)/Presidency of Defense Industries (SSB); major private sector players; and SMEs, which are perhaps the backbone of the sector.

A significant threat lies ahead for SMEs. Having observed the fair and the sector for some time, it appears that large companies have started producing components and services that were previously outsourced to SMEs. Perhaps this is done in coordination with SMEs, but it is apparent that supporting these enterprises is vital to the sector.

These relatively small companies also made a strong impression at the fair. Unlike at other fairs, small companies not only presented final products but also conceptual development.

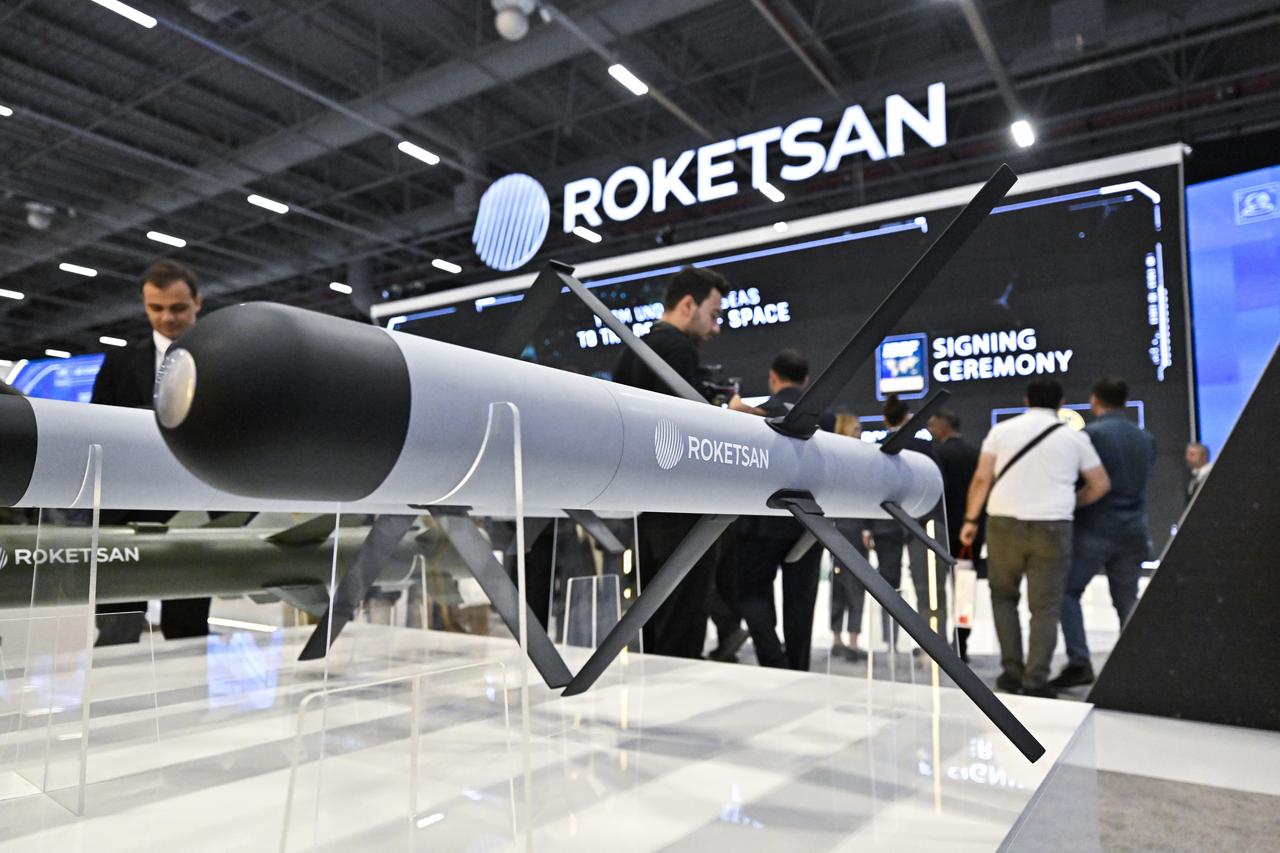

This year, Aselsan's booth stood out from previous ones, focusing more on concepts, high-tech and a clear and compelling explanation of the conceptual working principle of Türkiye's layered air defense system, Steel Dome. Aselsan, along with Roketsan and other companies, seems to be proceeding with its feet firmly on the ground.

Turkish armored land vehicle manufacturers have already proven themselves, securing exports, refining their work with feedback, and elevating their existing systems to a higher segment by developing vehicles with much more sophisticated technologies. Turkish land vehicle manufacturers have demonstrated immense potential in their field.

Turkish ammunition manufacturers seem to have adapted very well to current global demands, adapting their production plans based on the requirements. When asked about the guided 155mm howitzer ammunition, a senior official said: "Current demand is for the most cost-effective, simplest, and most basic ammunition—if it's the cheapest ammunition that is wanted, let's fire it and explode."

So, rather than spending effort on areas like guidance kits that would make ammunition more expensive, they've directed their efforts toward increasing production. According to information shared by a company, 96% of their production is exported, which is incredible.

To summarize, there were many, many products at the fair, but it's unknown which ones will enter the Turkish Armed Forces inventory or be exported. Although there's always been a feeling that wheels spin when it comes to serial production, with Türkiye's adaptation to NATO's 5% defense spending, production has visibly expanded. It may be a lifeline, but one should not expect it to offer a comprehensive solution.

We can say skilled personnel are prepared, companies are operational and products are ready—the most critical issue here would probably be financing the sector.

Additionally, another product that excited me was Aselsan's T-Link Data Link product. Türkiye has been conducting network-centric warfare for a relatively long time. Think about it, Türkiye's developed KAAN, Hurjet, F-16 OZGUR modernization, other aircraft, and helicopters and all other platforms need to communicate somehow, right? T-Link is the backbone that will provide this capability.

ASSAN Group also caught attention at the fair with the ASSAN 1000 horsepower hybrid power group. Considering global trends, it is likely to open new doors with its advanced technology that highlights Turkiye's advancement in the land vehicle sector. It also offers a much more economical solution compared to traditional power groups.

To conclude, IDEF 2025 delivered some expected products and some surprises. The Turkish defense industry demonstrated that it has decisively reached a "ready and set" phase.