Ethereum has rebounded more than 250% from its April lows, with Fed Chair Jerome Powell’s softer stance helping to fuel the rally.

Ether surged to a record high of $4,867 on Coinbase on Friday, its first new peak since November 2021, while bitcoin’s share of the crypto market slipped below 60% for the first time since March.

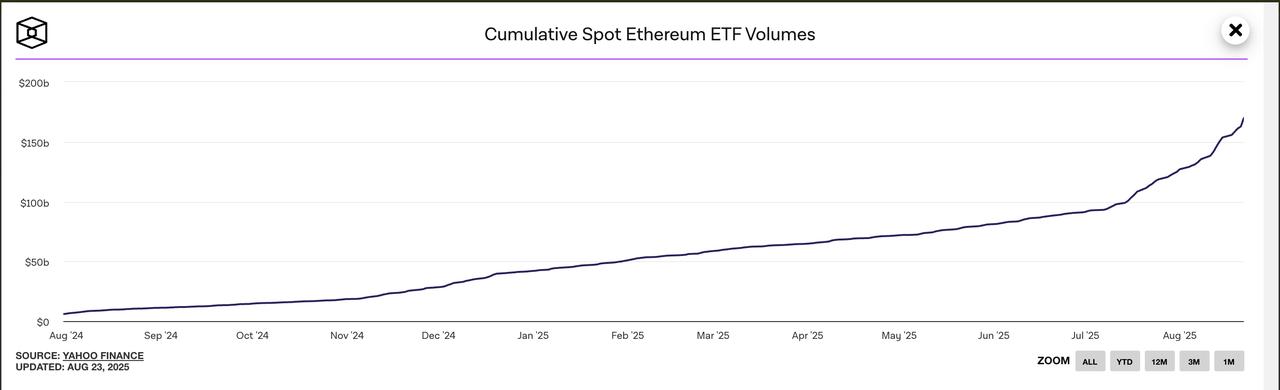

Ether is drawing fresh momentum from strong inflows into U.S.-based exchange-traded funds. On Aug. 21, the funds recorded $287.6 million in net inflows after four straight days of outflows, lifting total assets under management to more than $12.1 billion.

At the same time, corporate treasuries have been accumulating ETH at a rapid pace. Over the past month, firms including BitMine, SharpLink, Bit Digital, BTCS, and GameSquare added about $1.6 billion in holdings, pushing combined balances to nearly $29.8 billion, according to StrategicETHReserve.xyz.

“Ether is increasingly being seen less as a speculative asset and more as a utility-rich reserve asset,” said Ray Youssef, CEO of finance app NoOnes.

Standard Chartered has raised its year-end ETH target to $7,500 from $4,000, with a long-term projection of $25,000 by 2028. Other analysts see the token reaching as high as $13,000 in the coming months, citing sustained demand and limited supply at record price levels.

Ether’s rally has come alongside a sharp decline in bitcoin’s market dominance, which fell below 60% this week for the first time in four months. Bitcoin had commanded as much as 66% of total crypto market capitalization earlier this year.

The shift reflects renewed capital rotation into altcoins, led by large caps such as ether, as traders and institutions seek higher returns. Investment flows show the same trend: Ethereum-focused products drew $2.86 billion in the week ending Aug. 15, compared with $552 million for Bitcoin funds, according to CoinShares.

Monthly, ETH holdings have expanded by $2.96 billion, while bitcoin products saw $21 million in outflows.