Türkiye’s total international reserves rose by $4.37 billion to $190.8 billion in the week ending December 12, according to data released by the Central Bank of the Republic of Türkiye (CBRT).

The CBRT reported that gross foreign exchange reserves increased by $1.89 billion to reach $78.65 billion, up from $76.76 billion the previous week. Meanwhile, gold reserves rose by $2.48 billion, from $109.68 billion to $112.15 billion.

Net reserves excluding currency swaps, a widely watched indicator of the central bank’s unencumbered foreign currency assets, also rose by $4.1 billion, reaching $66 billion.

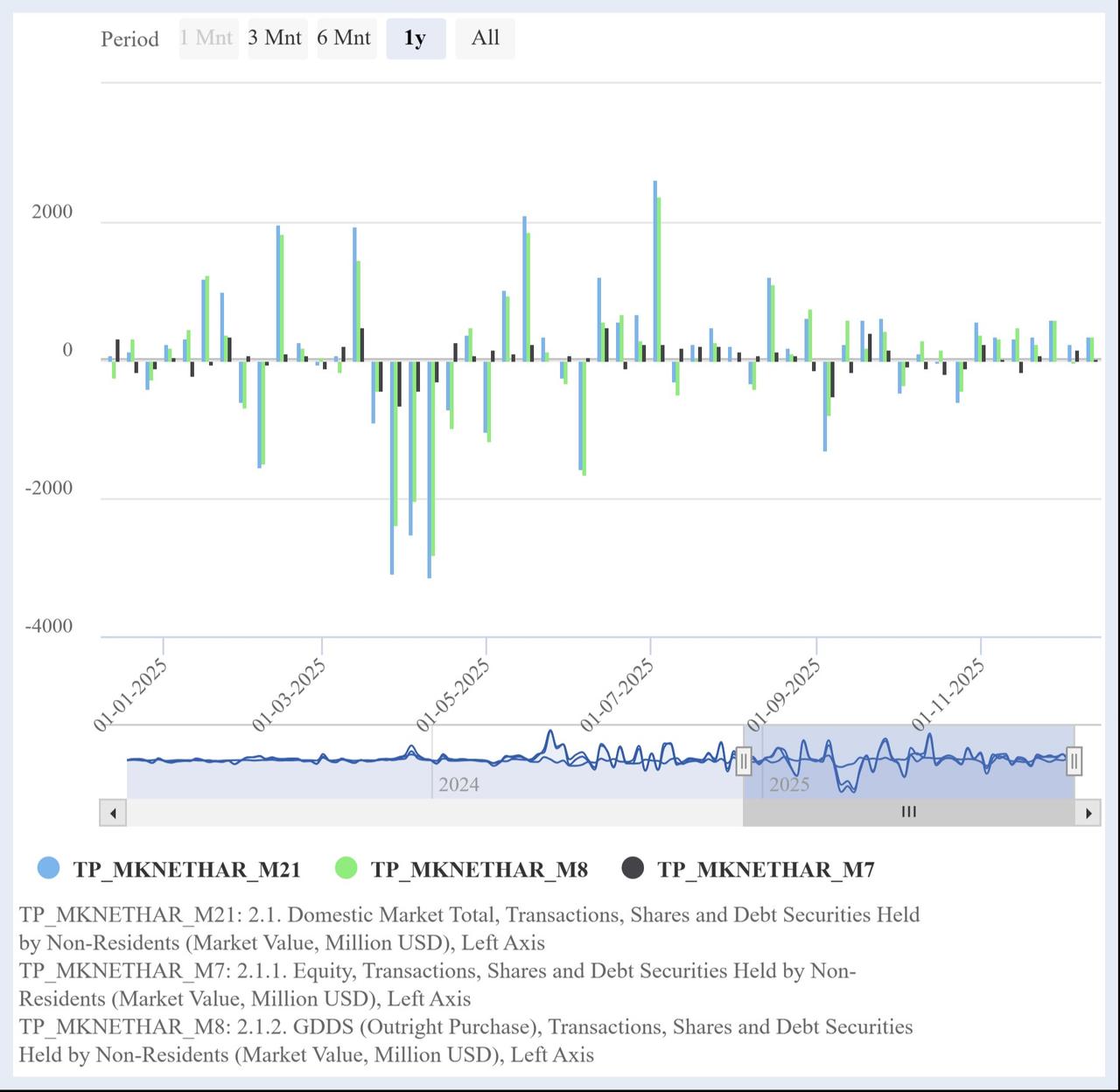

Foreign portfolio investors continued to show interest in Turkish assets, purchasing $339.6 million in government bonds, known as GDDS, and $26.3 million in equities during the same week.

The inflows extended foreign net purchases of Turkish bonds to a seventh consecutive week, while equity purchases marked the second straight week of gains. In contrast, foreign investors sold $1.8 million worth of corporate sector debt instruments.

Year-to-date, foreign investors have recorded net purchases of $1.6 billion in equities and $2.9 billion in government bonds. As a result, foreign holdings of Turkish equities rose from $31.96 billion to $33.07 billion during the same period, while their stock of government bonds increased from $17.48 billion to $17.78 billion, and holdings of non-government sector securities stood at $650.1 million.

Local brokerage firm Colendi Yatirim noted that the November inflation reading of 0.87%, which brought the headline rate to the lowest in five years at 31.07%, along with moderating food prices, has driven investor interest toward fixed-income instruments. However, the firm suggested that improving macro indicators including Türkiye’s sovereign risk premium (CDS) which recently fell to 212 and marked the strongest level since 2018 may soon prompt a shift toward equities as well.

“With the impact of normalizing food prices and a weak base effect in December, we expect the central bank to continue cutting interest rates in January," the brokerage said, indicating that improving sentiment may drive increased interest in Turkish stocks.

In the banking sector, total deposits in Türkiye’s banking system rose by 3.2% in the week ending December 12, increasing by ₺862.5 billion ($20.18 billion) to reach ₺27.67 trillion ($647.65 billion).

Foreign currency deposits held at Turkish banks amounted to $251.8 billion, of which $214.5 billion belonged to domestic residents, an increase of $602 million from the previous week.

On the lending side, domestic consumer loans grew by 1.2% week-over-week, reaching ₺5.5 trillion.