The European Union’s recent acceleration of free trade agreements (FTAs), particularly with India and the Mercosur bloc, has sparked concern among Turkish trade experts and industry leaders, who warn that Türkiye risks being sidelined in its leading global markets.

While the EU deepens its economic ties with major emerging economies, Türkiye remains bound by a decades-old Customs Union that excludes Ankara from participating in free trade agreements signed by the EU and prevents it from securing the same advantages for itself.

If ratified, the EU-Mercosur deal, signed on Jan. 17 after 25 years of negotiation, could grant Argentina, Brazil, Paraguay, and Uruguay privileged access to the EU market. In 2024, trade between the EU and Mercosur totaled over €111 billion ($131.65 billion), comprising €55.2 billion in exports and €56 billion in imports.

At the same time, the EU and India are finalizing a comprehensive FTA and security pact, with the formal announcement expected during the EU-India summit in New Delhi. European Council President Antonio Costa and European Commission President Ursula von der Leyen attended India’s Republic Day celebrations on Jan. 25 as guests of honor.

The deal is positioned as a strategic counterbalance to U.S. tariffs and Chinese trade restrictions, while promising mutual access to new markets and technologies. The EU is India’s largest trading partner, with bilateral goods trade reaching €120 billion in 2024, including €71.3 billion in imports from India and €48.6 billion in exports to India.

Türkiye has been part of a Customs Union with the European Union since 1995, allowing for the tariff-free circulation of industrial goods.

However, unlike EU member states, Türkiye does not automatically benefit from EU FTAs due to the outdated scope of its Customs Union, which covers industrial goods but excludes agriculture, services, digital trade, and public procurement. The structural gap leaves Türkiye unable to secure reciprocal trade benefits with countries like India or Mercosur, despite being economically integrated with the EU, Turkish business leaders asserted.

Trade Minister Omer Bolat stated in late December that certain European Union member states are blocking efforts to modernize the Türkiye–EU Customs Union, despite the European Commission’s support for launching formal negotiations.

Commenting on the developments, Mustafa Gultepe, head of the Turkish Exporters Assembly (TIM), cautioned that Türkiye’s long-standing competitive edge in the EU market is weakening. "The EU is telling us, ‘You are important, but not indispensable,’" he told business-focused ekonomim.com. "This signals a shift from proximity-based trade to price-based competition."

Gultepe noted that Mercosur countries primarily export low- and medium-tech goods such as agricultural products, seafood, and minerals, which are unlikely to impact Türkiye’s high-tech exports. “We do not expect our exports of high-tech goods and product groups to the EU to be affected,” he said.

However, he warned that India’s growing industrial base presents a broader challenge, especially in chemicals, electronics, automotive, and defense. "India is not only competitive in chemicals; it is a country that could negatively affect our high-tech exports to the EU," Gultepe stated. Türkiye’s high-tech exports reached $112 billion in 2025, accounting for 43.5% of total goods exports, with the EU as the leading destination.

"Given that India remains one of the most competitive countries in Asia, we may experience export losses in labor-intensive sectors like ready-made clothing and textiles," he further emphasized. "Under current conditions, we have no chance of competing with India on price."

Alper Ucok, Germany Representative of the Turkish Industry and Business Association (TUSIAD), pointed to the EU’s FTA with Vietnam—signed in 2020—which led to a 35% increase in trade over five years. In contrast, he noted that Türkiye’s trade with the EU has seen only limited growth.

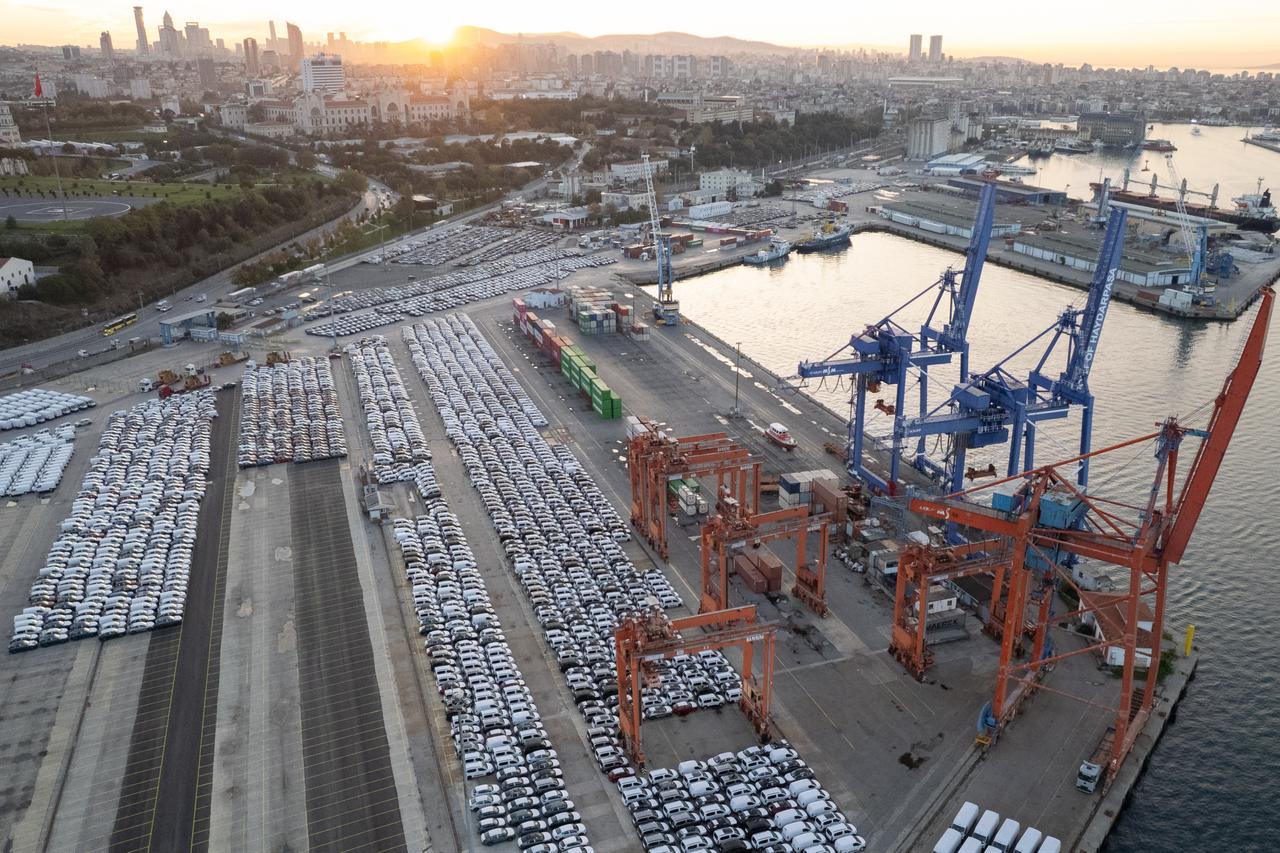

"Meanwhile, Türkiye’s trade with the EU has grown very slowly. One of the main reasons is the lack of modernization in the Customs Union," he said. In 2025, Türkiye became the EU’s fifth-largest trading partner, with Turkish exports rising 7.8% to $117 billion, pushing bilateral trade to $232.7 billion.

The EU's ongoing free trade agreement negotiations with India could have "geoeconomic consequences" beyond trade, potentially paving the way for the future realization of the India–Middle East–Europe Economic Corridor (IMEC), from which Türkiye has been excluded, he argued.

Türkiye also faces a growing structural disadvantage as the European Union continues to broaden its network of free trade agreements (FTAs), Ayhan Zeytinoglu, President of the Economic Development Foundation (IKV), said. "While Türkiye currently has FTAs with around 24 countries, the EU has trade and partnership agreements with nearly 80 countries and regions," he said.

"Countries that sign FTAs with the EU can enter the Turkish market through the Customs Union, but Türkiye is unable to access those same markets on equal terms."

Zeytinoglu emphasized that the latest developments have made the modernization of the Türkiye–EU Customs Union more urgent than ever. "Türkiye must accelerate structural reforms, improve legal certainty, enhance the investment climate, and move relations with the EU to the top of its policy agenda."