Türkiye’s high inflation continues to pose a risk to its credit profile, even as the agency revised the country’s credit outlook from "stable" to "positive" while affirming its "BB-" rating, Erich Arispe Morales, senior director at Fitch Ratings, told Turkish media on Monday.

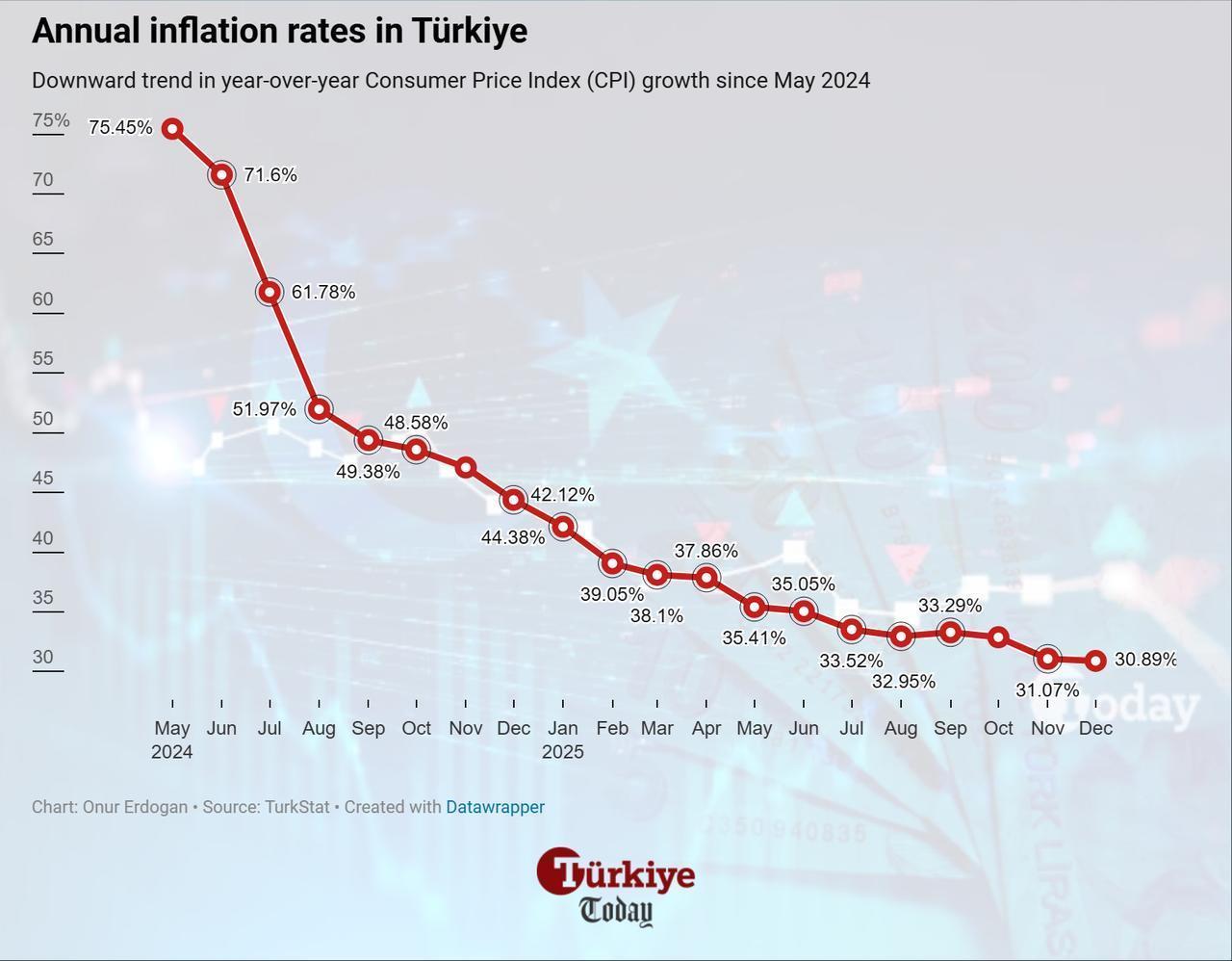

Although Türkiye has shown resilience against volatile global conditions, inflation remains far above the median for countries with a similar rating, Morales stressed, citing Fitch data that places the "BB-" rated median at 3.5% compared to Türkiye’s current rate of 30.9%, with an average of 27% projected for the year.

Morales said that Fitch remains confident that a tight monetary stance, supported by a compatible fiscal policy, can bring inflation down. However, he emphasized that the effectiveness of this strategy cannot be fully assessed within a six-month period.

He also noted that Fitch perceives a shift away from political interference in monetary policy. "There’s a growing view that the period of political intervention in central bank decisions has come to an end," he told Bloomberg HT.

Arispe highlighted the key drivers behind Fitch’s decision to raise Türkiye’s credit outlook, pointing to increased foreign exchange reserves, the phase-out of the FX-protected deposit scheme, and continued monetary tightening as factors that have helped restore investor confidence.

"These developments signal that credible steps are being taken to stabilize inflation, which should eventually reflect in Türkiye’s credit rating," he said.

Commenting on Türkiye’s financial assets, Arispe said Fitch’s baseline scenario includes a possible recovery in the Turkish lira, though he cautioned that this depends heavily on global conditions. "There is still a high level of global uncertainty, and Türkiye remains dependent on external markets," he said.

Whether international investors will increase their exposure to Türkiye hinges on a combination of local reforms and international sentiment, he added.