Türkiye’s declining inflation trend is expected to sustain real returns on lira-denominated assets through 2026, strengthening investor confidence and reinforcing capital inflows, according to Barclays Global Head of Economic Research Christian Keller.

Speaking at the World Economic Forum’s (WEF) 56th Annual Meeting in Davos, Keller told the state-run Anadolu Agency that the Turkish central bank’s monetary policy, which is steering the country’s disinflation path, has begun to yield results.

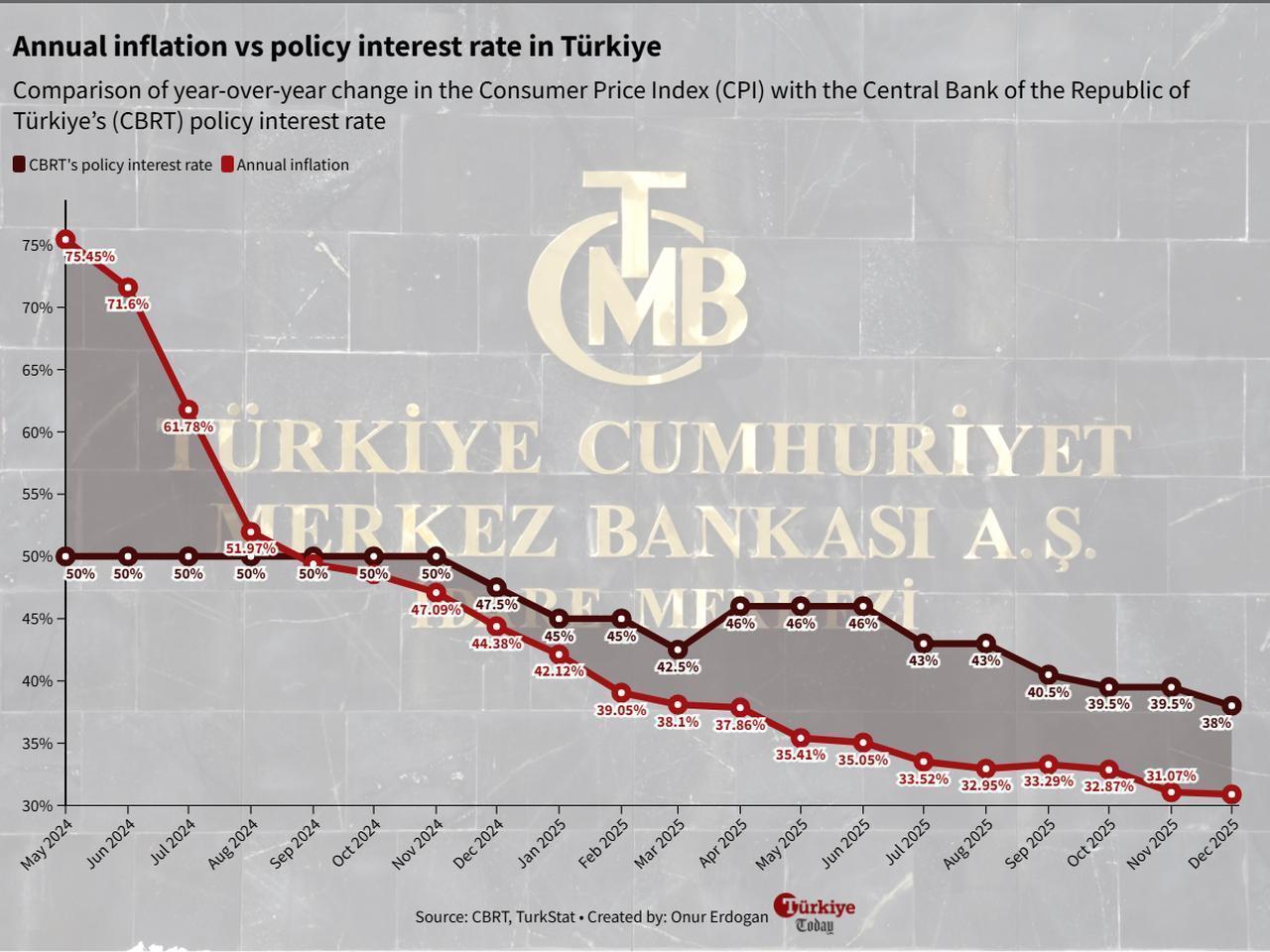

Keller said he expects inflation to continue declining steadily this year, adding that the central bank only changes policy rates when it sees, or can clearly anticipate, that inflation is falling. "This prevents the bank from trailing behind developments and gives investors confidence that the real interest rate will stay at a certain level," he said.

Türkiye's annual inflation fell to 30.9% in December 2025, while the policy rate stands at 38%, implying a 7.1% real return gap. This situation allows the central bank to implement further cuts at the next Monetary Policy Committee (MPC) meeting on Thursday, with market participants expecting a 150 basis point reduction. As of Wednesday, Türkiye’s two-year treasury yield declined to 35.44%.

Keller noted that the current macro framework is functioning effectively. "There is money flowing into Türkiye, the central bank is able to accumulate reserves, and at the same time, the country’s competitiveness does not appear to have been hurt," Keller added.

As of the week ending Jan. 9, the central bank’s total reserves rose to $196.08 billion, while net reserves excluding swaps reached $70.1 billion. Preliminary data indicate that total reserves have reached a new record above $200 billion this week, with net reserves excluding swaps above $80 billion. During the same period, the total carry trade volume also increased to $54.78 billion.

Keller said the Turkish economy frequently surprises to the upside in terms of growth, citing its underlying dynamism. The Turkish economy grew by 3.7% in the third quarter of 2025, and according to government estimates, the full-year growth rate was 3.3%.

He stressed the importance of continuing the ongoing macroeconomic stabilization program and underscored the central bank’s performance in rebuilding policy credibility. "The central bank is doing a good job in regaining trust," he noted. According to Keller, Türkiye is historically well-positioned to manage periods of global uncertainty. "Türkiye is one of the best countries in coping with uncertainty, and it has been that way for a long time," he said.

Keller highlighted that Türkiye’s geopolitical standing may offer a buffer against escalating international tensions. He pointed out that Türkiye is not currently in the "negative spotlight" compared to economies such as China, Russia, or European Union member states under U.S. pressure.

Emerging markets that maintain balance in global relations may be better placed to navigate volatility, Keller added. "If Europe revives its economy and invests more, Türkiye could also benefit," he said.