U.S-based investment bank Goldman Sachs has advised investors to take long positions in the Turkish lira and three other frontier market currencies against the U.S. dollar, citing improved macroeconomic conditions and stronger reserve buffers.

In a note published on Wednesday, strategist Victor Engel said the bank recommended an equally weighted basket consisting of the Turkish lira, Nigerian naira, Ghanaian cedi and Kazakh tenge. The strategy set a total return target of 7.5% and a stop-loss threshold of -3.5%, with a projected 12-month nominal carry of approximately 14%.

The expected gains mainly come from carry trades, where investors borrow in lower-yielding currencies like the U.S. dollar and move funds into higher-yielding local assets such as government bonds.

Engel said macroeconomic fundamentals across frontier markets had strengthened, pointing to international reserves reaching historical highs. Higher reserves helped support currency stability and reinforced investor confidence in local financial markets.

He also noted that disinflation trends across these economies supported elevated domestic interest rates, increasing the appeal of local debt instruments. These yield levels played a central role in carry trade strategies by providing steady income streams to investors holding local currency positions.

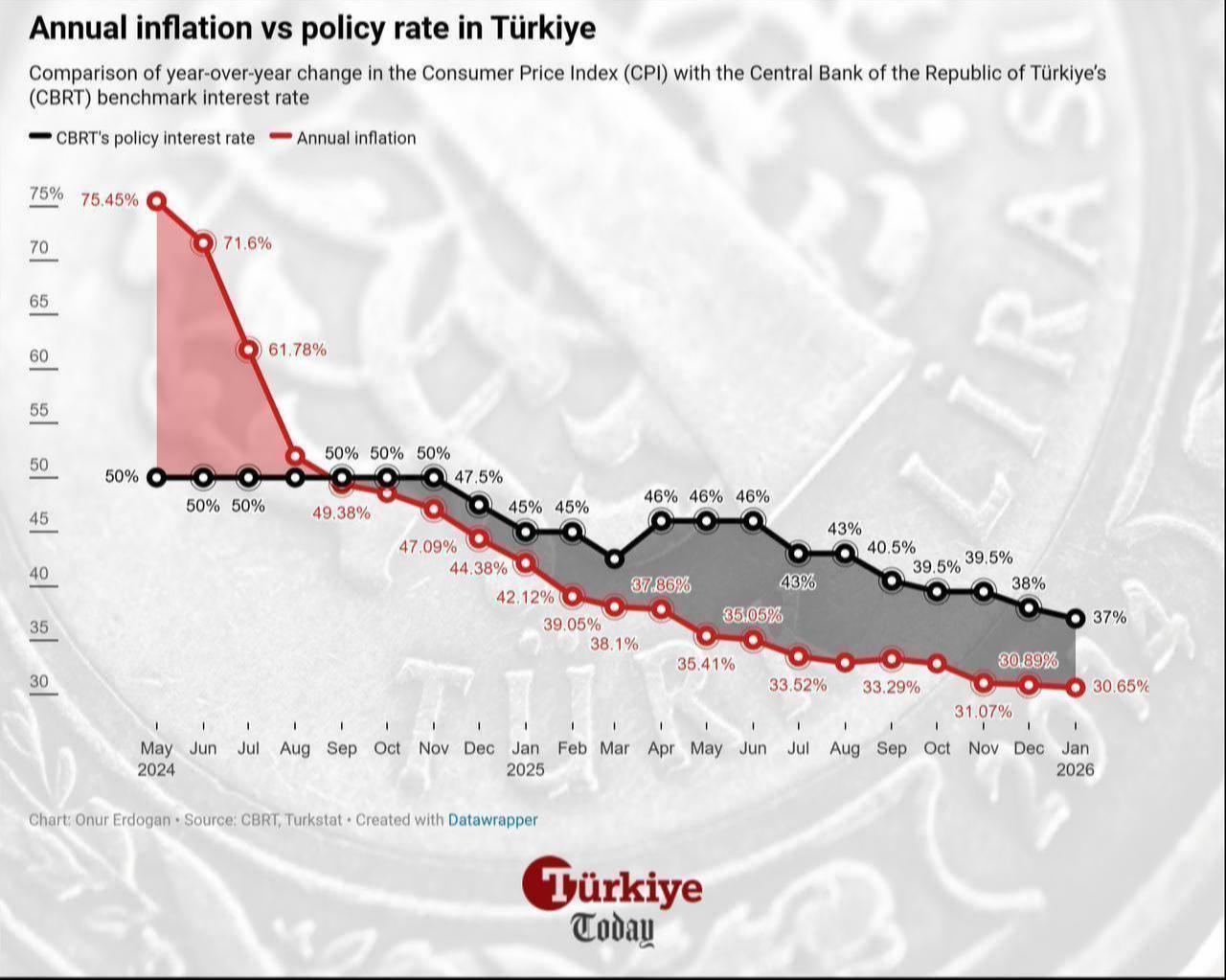

In January, Türkiye’s annual inflation extended its downward trend, falling to 30.7%, even as a higher-than-expected monthly increase prompted the Central Bank of the Republic of Türkiye (CBRT) to slow the pace of easing, delivering a 100-basis-point cut that brought the policy rate to 36%. As of Thursday, the 2-year Treasury yield stands at around 36.3%.

According to Engel, currency movements in frontier markets were increasingly shaped by domestic policy decisions rather than global market swings, which could help limit volatility compared with broader emerging market currencies.

Despite the positive outlook, Goldman Sachs warned that currency positions in frontier markets carried structural risks due to relatively limited liquidity. Concentrated investor positions in these markets could reverse quickly if negative shocks occurred, potentially increasing volatility.

The bank also observed rising foreign participation in local debt markets, including those of Türkiye, Egypt and Nigeria. While this trend increased market sensitivity to investor positioning, Engel said strong reserve levels and policy backing could help offset potential downside risks.

As of the week ending Feb. 6, total carry trade exposure in the Turkish market stands at around $55.48 billion, up 77% from a year earlier, based on data from the BRSA and the CBRT.