Türkiye's stock exchange, Borsa Istanbul, showed a sluggish performance in the first three quarters of 2025 as the benchmark BIST 100 index fell 4.7% in dollar terms, diverging from both developed and emerging markets, which recorded strong double-digit gains over the same period, according to a report by local brokerage Gedik Investment.

According to the report, while global equity markets benefited from increased risk appetite, Türkiye’s stock exchange experienced a volatile year, with periods of sharp rallies followed by deep corrections.

The underperformance drew attention to the challenges facing local investors compared with their counterparts in regions such as Latin America, Eastern Europe, and Asia.

The MSCI World Index, which tracks large, mid, and small-cap companies worldwide, advanced 16% through September, while emerging markets collectively rose 25%.

Latin America posted a 44% surge, Emerging Asia added 26%, and Eastern Europe recorded a 47% increase. By comparison, South Africa gained 39%.

Against this backdrop, Türkiye’s stock exchange, one of the prominent markets among emerging economies, remained behind all major global benchmarks.

Gedik analysts pointed to high domestic interest rates, political developments, and limited foreign capital inflows as contributing factors.

The index began the year at 9,661.34 points but slipped to the 9,000 level after the arrest of then-Istanbul Mayor Ekrem Imamoglu in a corruption probe, which sparked political turmoil.

The Turkish central bank’s April decision to raise its policy rate to 46%—pausing a rate-cutting cycle that had begun in December—further strained liquidity conditions and increased borrowing costs for companies.

External headwinds also played a role, most particularly U.S. President Donald Trump’s introduction of sweeping tariffs in April, which added pressure to global markets and intensified the challenges faced by Türkiye’s equities.

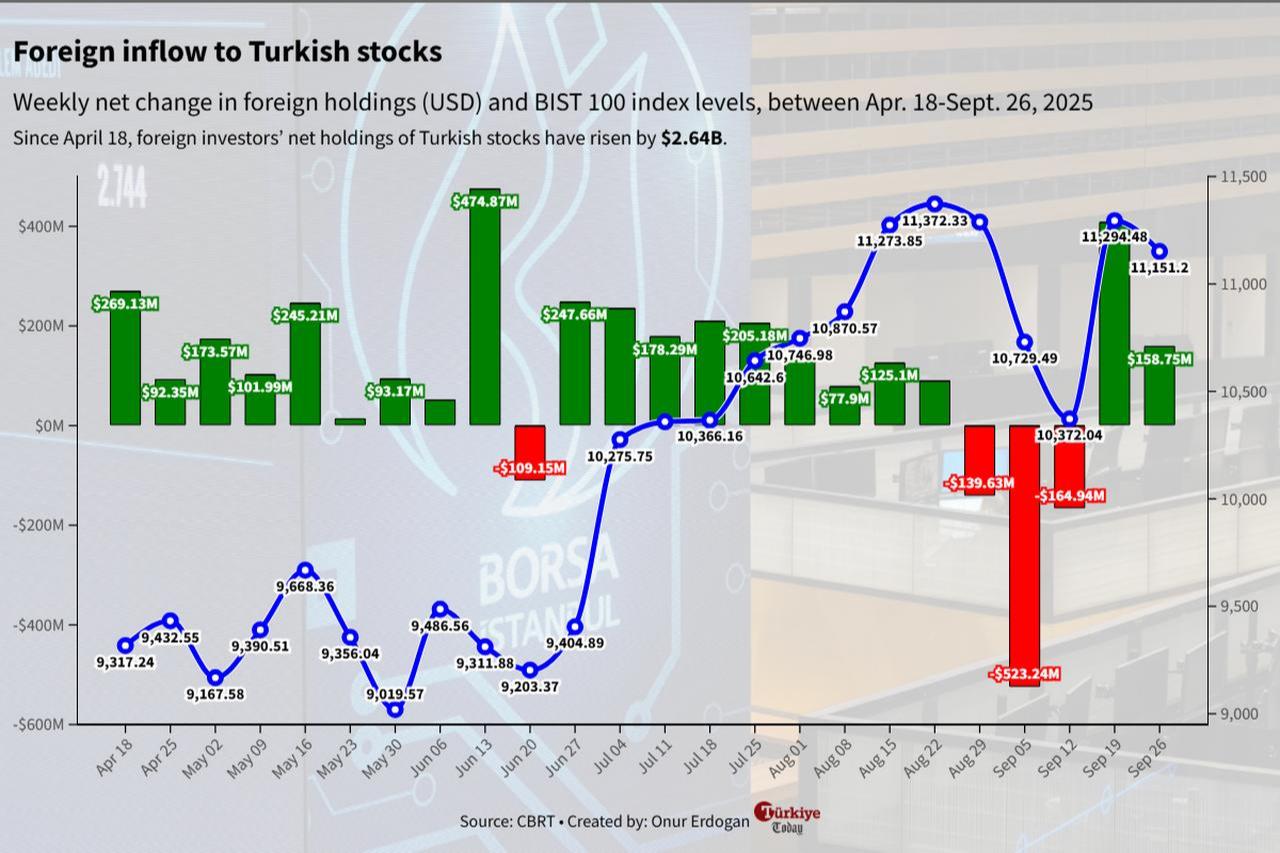

As political uncertainties eased by June, the BIST 100 regained momentum, supported by expectations that the central bank would resume monetary easing and boosted by robust foreign inflows, which had returned to net purchases by April 18.

Between June 27 and Aug. 22, foreign investors purchased more than $1.5 billion in Turkish stocks in a nine-week streak. Thus, the index climbed steadily, reaching an all-time closing high of 11,529.81 in late August.

This represented a 26% rally from the lows earlier in the year, led by banking and financial stocks, which rose more than 35%.

However, the rebound proved short-lived. Profit-taking, combined with higher-than-expected inflation readings in August and September, pulled the index back down.

By Friday’s close, the BIST 100 stood at 10,858.52 points, representing a 9% gain since the start of the year in Turkish lira terms, but still weaker when measured in U.S. dollars, as the lira depreciated by 15% over the same period.

Gedik Investment Research Director Ali Akkoyunlu noted that the BIST 100 currently trades at a 45% discount compared with similar emerging markets based on price-to-earnings ratios.

The discount demonstrates the potential for Türkiye’s equities, provided that disinflation continues and rate cuts are effectively reflected in market conditions, he added.

"If the decline in inflation persists and feeds into monetary easing, the BIST 100 index could stand out in terms of returns in the coming period," Akkoyunlu noted.