BBVA has left its growth projections for Türkiye unchanged, expecting the country's gross domestic product (GDP) to expand by 3.5% in 2025 and inflation to ease to 31% by year-end.

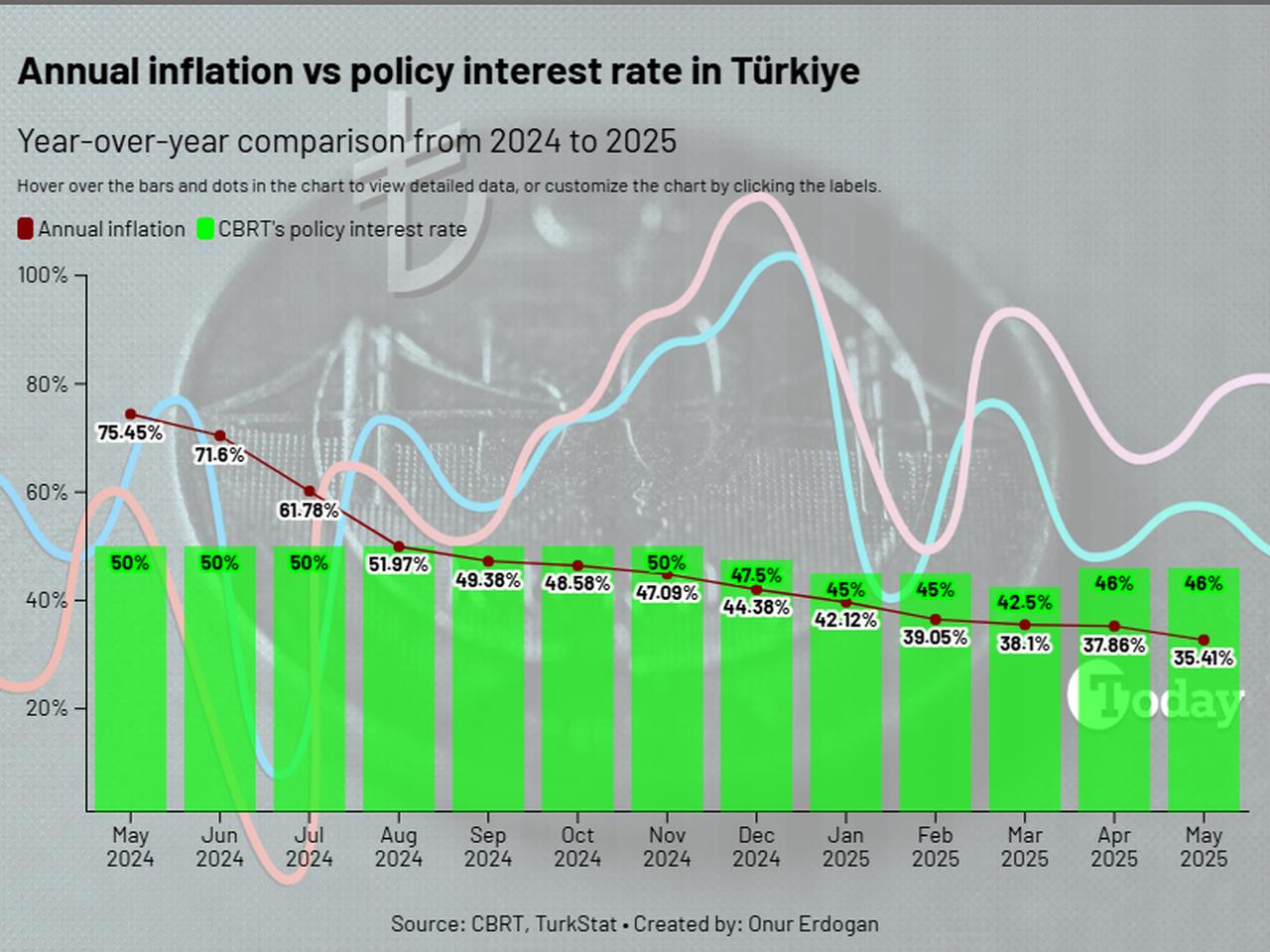

The bank also stated that the Turkish central bank is expected to hold the policy rate at 46%, keeping it unchanged to help control inflation.

The Spanish bank’s latest economic assessment cited robust performance in the first quarter of 2025, a lack of severe negative impact from anticipated quasi-fiscal policies, and weak external demand as the main reasons for maintaining its estimates.

In its report, BBVA Research stated, “Given the strong Q1 2025 performance and no dramatic effects from potential quasi-fiscal measures or weak external demand, we are keeping our GDP growth forecasts unchanged.”

Although Türkiye has seen some favorable developments in recent months, BBVA Research revised its inflation projections upward. The bank now expects consumer price inflation to reach 31% by the end of 2025, up from a previous estimate of 29%, and 21% by the end of 2026, compared to an earlier forecast of 20.5%.

BBVA Research attributed this revision to ongoing uncertainties around real interest rates, food prices, energy costs, and administered pricing policies.

It explained, “Despite recent positive surprises, we are maintaining a cautious approach in our inflation forecasts due to the unpredictability in real interest rates, food inflation, energy, and regulated prices.”

The report also outlines BBVA Research’s expectations for Türkiye’s monetary policy, projecting that the funding cost will continue to align with the policy rate, as observed since June 10.

The bank anticipates that rate cuts will resume from July and that the policy rate will eventually decline to 36% by the end of 2025.

On the exchange rate front, BBVA Research held its end-2025 and end-2026 forecasts steady at 45 and 52 against the U.S. dollar, respectively.

The bank noted that seasonal downward pressure in the foreign exchange market is likely to ease once summer ends, potentially creating room for further real appreciation, particularly if the inflation trend falls below 2%.

BBVA Research acknowledged that downside risks prevail for both inflation and growth projections, which could in turn negatively affect its interest rate and exchange rate forecasts. Nevertheless, the bank emphasized that ongoing domestic and external uncertainties warrant a cautious stance going forward.