Türkiye’s central bank governor Fatih Karahan, speaking during Parliament’s Planning and Budget Committee on Tuesday, reaffirmed the institution’s commitment to tight monetary policy, warning of persistent inflation risks and volatility in global markets. The bank would continue using all available tools to support disinflation and safeguard financial stability, Karahan said.

“While we remain committed to disinflation, we will closely monitor liquidity conditions and actively manage them using all available instruments,” he stated.

Karahan highlighted the impact of a broad U.S. tariff package announced on April 2, which has contributed to growing uncertainty in global trade. “Despite the postponement of some tariff decisions, uncertainty over trade and economic policy remains high, weighing on global growth and creating mixed inflationary effects across countries,” he said.

He added that weaker global demand has led to falling energy prices, while non-energy commodity prices have rebounded, mainly due to rising precious metal prices. “We believe global demand, geopolitical risks, and supply-side dynamics will continue to shape commodity prices,” he said.

Turning to the domestic outlook, Karahan said Türkiye’s consumption indicators point to moderate but resilient demand, noting that retail sales volumes increased in January and February, while real credit card spending showed signs of weakness. “Spending in services is relatively subdued. We are monitoring demand indicators closely and are prepared to respond if they jeopardize our disinflation path,” he added.

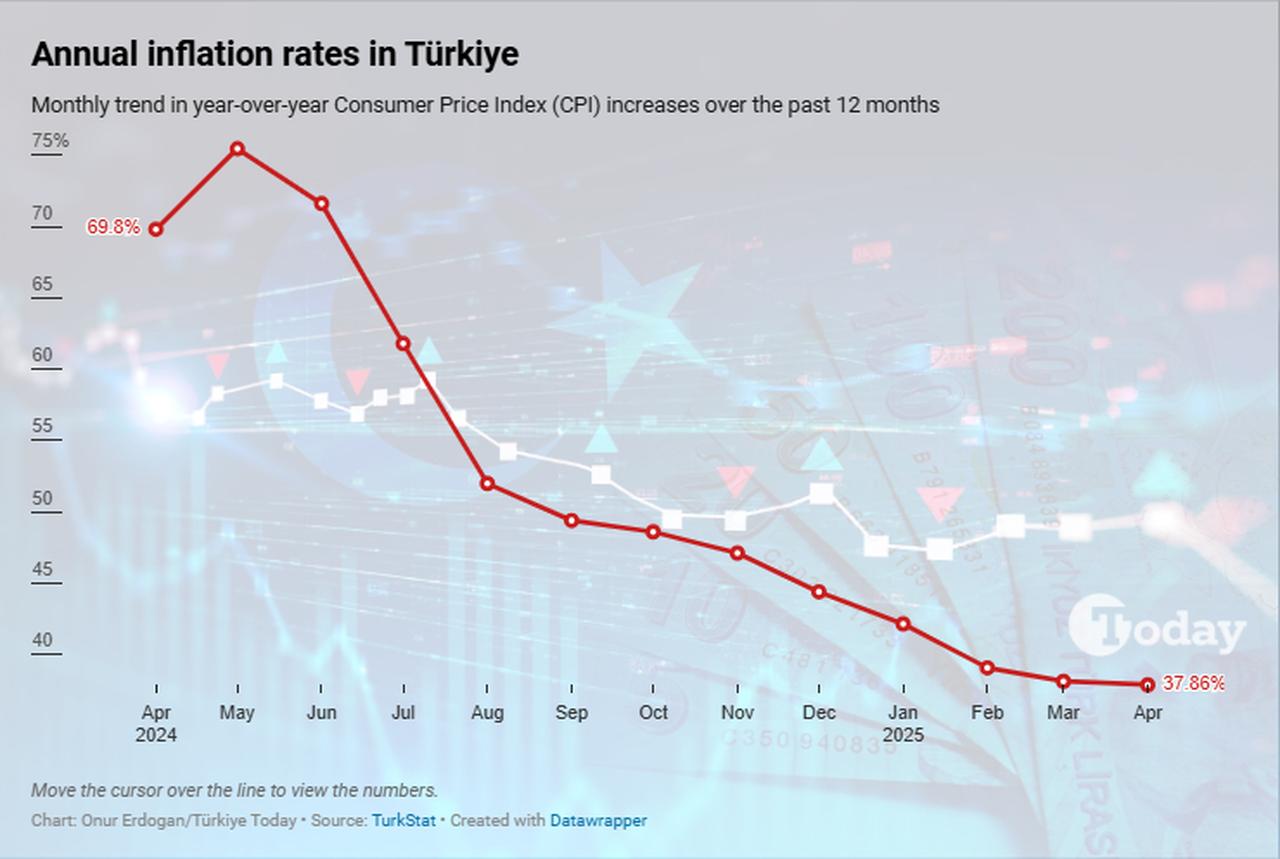

Karahan explained that the disinflation process remains underway, citing core inflation indicators that strip out temporary shocks and seasonal effects. “After a rise in January, trend inflation slowed in February and March but picked up in April due to market developments,” he noted.

Karahan acknowledged that inflation in services—such as rent and education—remains elevated due to backward-looking pricing behavior. However, lower global oil prices have helped ease headline inflation.

He noted that inflation expectations, which had begun to improve, stalled in April amid financial market fluctuations. “Expectations remain above our disinflation path, requiring continued tight monetary policy,” Karahan said. He added that the bank took precautionary steps in March to mitigate the impact of market volatility and support the Turkish lira.

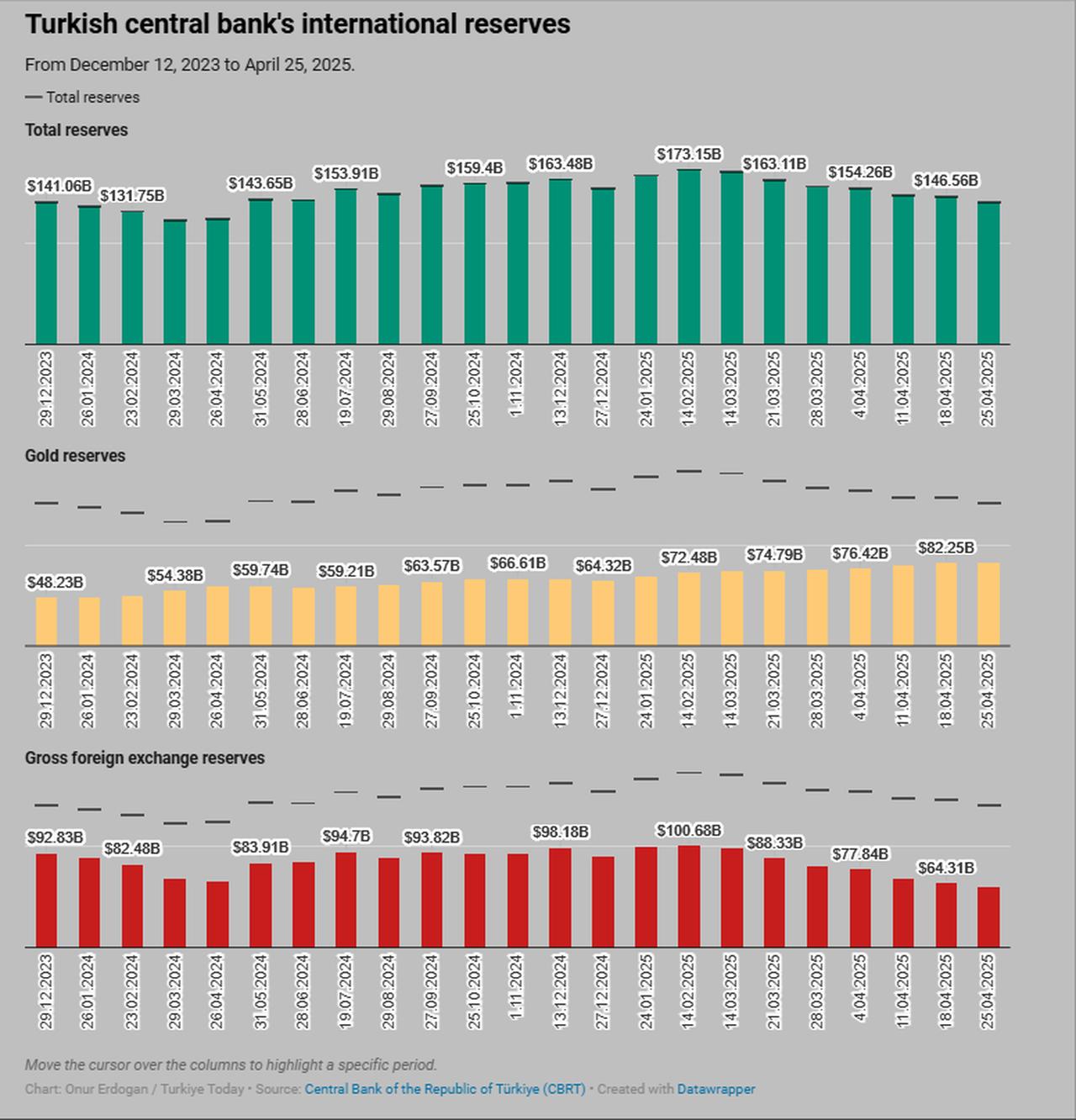

Despite financial turbulence, Türkiye’s foreign exchange reserves have improved. Between March 22, 2024, and April 25, 2025, gross reserves rose by $17 billion, while the net FX position excluding swaps improved by $81 billion. Karahan attributed this to rising confidence in the Turkish lira, although foreign currency demand has also increased.

The governor also discussed capital outflows, noting that declining global risk appetite has led to investor withdrawals from emerging markets, including Türkiye. “This trend intensified after the announcement of new tariffs in late March,” he said.

Karahan highlighted developments in Türkiye’s FX-protected deposit scheme (KKM), revealing that only 13.8% of maturing deposits over the past year reverted to foreign currency. “The decline in KKM balances has raised the share of Turkish lira deposits, strengthening monetary transmission and reducing the central bank’s balance sheet risks,” he said.

He stressed that the current tight stance will remain until inflation shows a lasting decline and price stability is secured. “Price stability is a prerequisite for sustainable growth and improved public welfare,” Karahan stated.

Addressing concerns over the exchange rate, Karahan emphasized that the central bank does not target a specific level but intervenes when needed to avoid excessive volatility. Responding to questions about foreign reserves, he said: “If a match ends 5–2, you don’t say you conceded 2 goals—you say you won by 3. We’ve moved from minus $60 billion to a positive reserve position.”

Karahan said current data supports the bank’s year-end inflation forecast for 2025. The wide forecast band reflects global uncertainty and oil price fluctuations. He added that if not for recent policy actions, inflation and reserve levels would have been significantly worse.

On the labor market, Karahan noted that many workers leaving jobs are finding new employment in higher value-added sectors. “While this transition may pose short-term employment risks, it strengthens the economy in the long run,” he said. He also clarified that many individuals counted as underutilized labor are in fact working full-time but seeking better opportunities, an effect amplified by post-pandemic shifts in work preferences and the rise of flexible models.

Karahan rejected media claims that the central bank blames inflation on minimum wage hikes. “We never said minimum wages cause inflation. What erodes wages is inflation itself. Our goal is to reduce inflation permanently to restore purchasing power,” he said.

He also clarified that the bank did not sell any gold in 2024. “Our gold holdings actually increased by 50 tons compared to last year,” Karahan stated. He explained that previous liquidity-driven gold swaps were closed, creating the appearance of a decline.

Karahan said that avoiding the issuance of higher denomination banknotes helps reduce informal economic activity. He noted that households remain focused on high-inflation items like food and rent. “Food prices have improved compared to last year and now trend below headline inflation,” he said.

He also estimated the impact of recent agricultural frost on inflation to be around 0.4 percentage points.