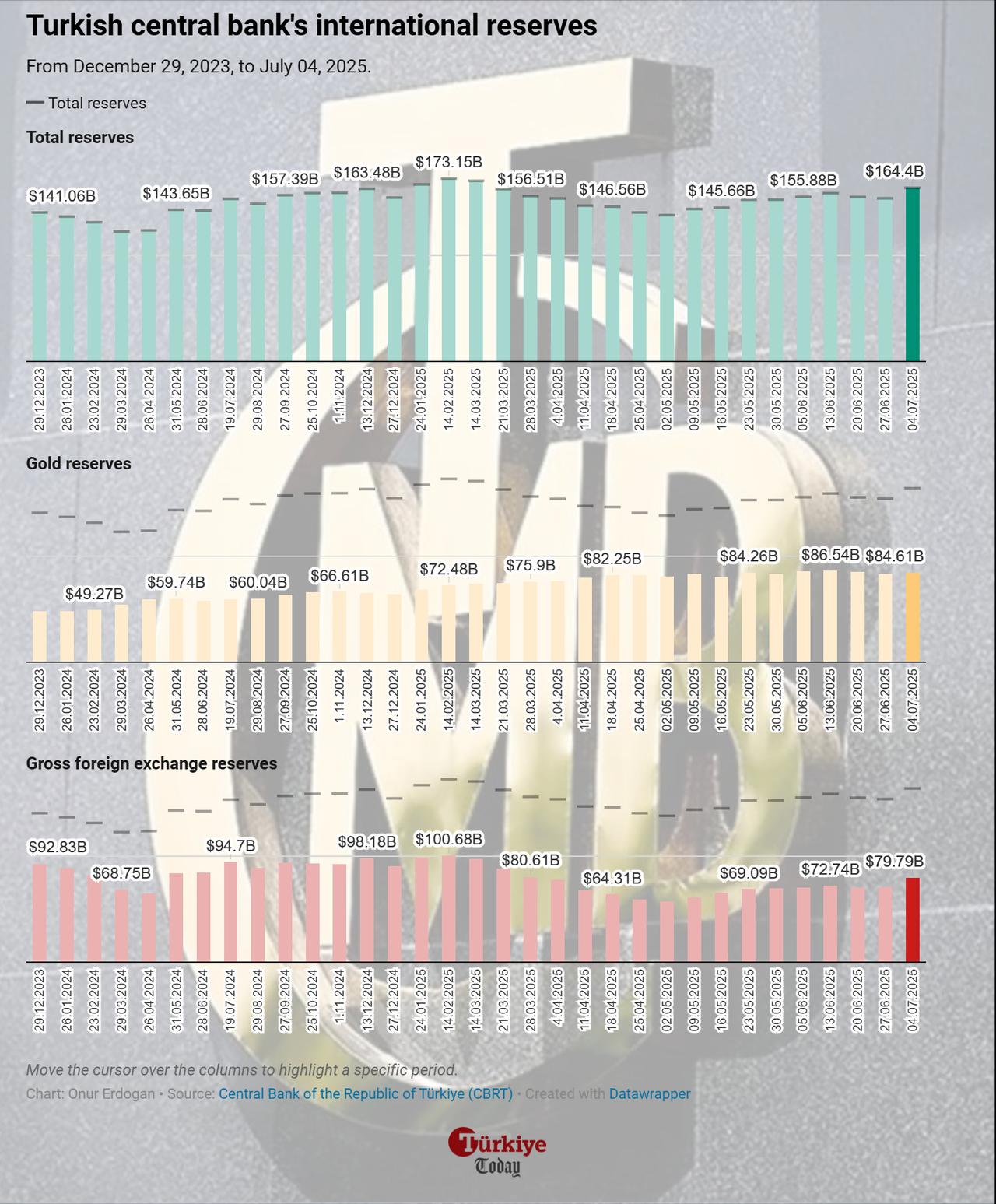

Turkish central bank recorded a nearly $10 billion increase in total reserves in the week ending July 4, reaching $164.4 billion—up from $154.4 billion the previous week—while non-resident interest in Turkish government debt saw the largest inflow in over 14 months at $2.38 billion.

According to the international reserves report released on Thursday by the Turkish central bank, the surge in reserves was mostly due to the bank's strategic currency purchases over the week, as gross foreign exchange reserves rose by $8.7 billion, reaching $79.8 billion.

Gold reserves also posted a modest gain of $1.3 billion, reaching $84.6 billion, supported by a limited increase in gold prices during the week.

In the same period, the central bank’s net international reserves rose by $11.1 billion to $57.5 billion. Excluding foreign exchange swaps, net reserves increased by $9.7 billion to $38.1 billion.

Foreign demand for Turkish equities and government debt securities (GDSs) rose sharply after June’s inflation data came in at 35.05%, below market expectations. The data further fueled expectations of a rate cut at the Turkish central bank’s July monetary policy meeting.

The central bank is widely expected to resume interest rate cuts in July, with forecasts ranging between 250 and 350 basis points.

According to the weekly securities figures, during the week, non-resident investors purchased $2.38 billion worth of Turkish government bonds—the strongest weekly inflow in over 14 months. Meanwhile, foreign investors slowed their equity purchases to $235 million, down from $248 million the previous week. Despite the moderation, foreign holdings in Turkish stocks rose from $28.6 billion to $31.6 billion, while bond holdings increased from $11.9 billion to $14.7 billion.

On the domestic front, the total deposits in Türkiye’s banking sector fell by ₺522 billion ($13 billion), amounting to ₺23.7 trillion. The decline was driven by a 3.4% drop in Turkish lira-denominated deposits and a 1.7% fall in foreign currency deposits.

Foreign exchange deposits held by domestic residents dropped by $4.1 billion after adjusting for exchange rate effects. However, consumer loans continued to grow, with domestic credit increasing by 0.8% to ₺4.6 trillion.

Housing loans accounted for ₺585 billion, personal loans for ₺1.73 trillion, and credit card balances for ₺2.24 trillion.