This article was originally written for Türkiye Today’s weekly economy newsletter, Turkish Economy in Brief, in its Dec. 15 issue. Please make sure you are subscribed to the newsletter by clicking here.

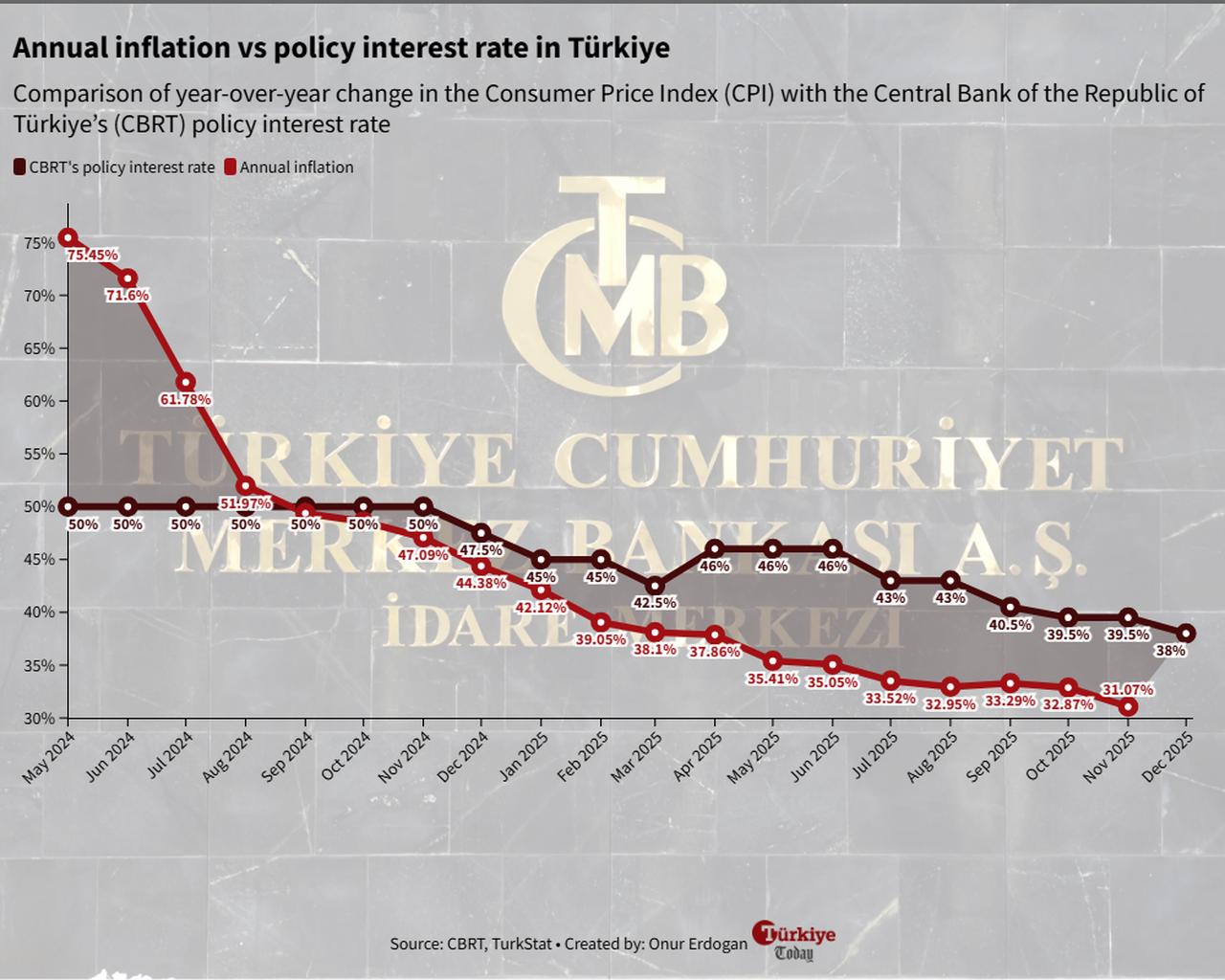

Scenarios for 2026 have gradually begun to emerge in the Turkish market. Following last week’s interest rate decision by the Central Bank of the Republic of Türkiye (CBRT), we also received the latest updates on inflation and interest rate expectations. To briefly recap:

In the announcement following the interest rate decision, the bank noted that "While inflation expectations and pricing behavior show signs of improvement, they continue to pose risks to the disinflation process."

The bank also emphasized that a tight monetary policy stance will be maintained in line with consumer inflation (CPI) data in 2026. Based on current developments and expectations, it appears that financial planning in 2026 will need to assume an average interest rate of around 30%.

In December, negotiations over the 2026 minimum wage remain a key focus for both markets and policymakers due to their direct impact on the labor market. The Minimum Wage Determination Commission held its first meeting to determine the 2026 minimum wage.

Representatives from the Confederation of Turkish Trade Unions (Turk-Is), which represents workers, did not attend, while government officials and representatives of the Turkish Confederation of Employer Associations (Tisk) were present.

Following a 20% minimum wage hike expectation from UK-based HSBC, U.S.-based JP Morgan projected a 25% increase. The Commission’s second meeting is scheduled for Thursday, Dec. 18.

As attention turns to this date, Labor and Social Security Minister Vedat Isikhan underlined the importance of maintaining dialogue throughout the process, stating that “Efforts will be carried out with an approach that protects workers’ income while safeguarding employment and macroeconomic balances.”

Meanwhile, Treasury and Finance Minister Mehmet Simsek made important remarks regarding price increases at the start of the new year, stating that if the revaluation rate—which captures the average annual increase in the Domestic Producer Price Index (D-PPI) and is primarily used to adjust tax-related figures—is 25%, “we will raise the items benefiting the citizens by 25%.

But other fees set or provided by the government will be kept below 20%,” he said.

Within this framework, initial expectations suggest that January inflation may come in around 3%–4%.

According to the CBRT’s December survey of market participants, the Turkish lira is expected to remain in the positive real interest territory in 2026.

The key factor here, as emphasized by the central bank, is the downward trend in inflation and interest rates. As long as this trend continues, expectations will continue to improve, which will likely be reflected in survey outcomes.

Looking at the impact on markets, the Borsa Istanbul (BIST) 100 Index sent strong signals last week. The index tested 11,331, marking the highest level since September 26. It closed the week at 11,311, remaining above the critical resistance level of 11,250. If the index holds above this level, the positive trend could gain further technical support.