Turkish policymakers are closely monitoring deposit trends as the central bank governor Fatih Karahan implied Friday that changes in local Turkish lira deposit trends may affect the monetary policy, only one day after the government raised taxes on financial returns.

Karahan’s remarks came during a private meeting in London, prompting questions about the timing of the tax adjustment as the central bank prepares for a potential rate cut in July.

The Central Bank of the Republic of Türkiye (CBRT) is closely monitoring Turkish lira deposits held by local savers, viewing trends in these accounts as a key indicator for monetary policy, Karahan said, according to Bloomberg.

This is seen as a signal of the Turkish central bank’s cautious stance on resuming interest rate cuts, suggesting that the state of local deposits will have a substantial impact on upcoming decisions, according to the cited sources.

According to a decree published in the Official Gazette on Wednesday, the withholding tax on Turkish lira time deposits was raised from 15% to 17.5% for maturities up to six months, and from 12% to 15% for terms up to one year. The 10% rate for deposits exceeding one year remains unchanged. Investment funds were also subject to a tax increase, with the withholding rate rising from 15% to 17.5%. However, non-resident investors are not subject to these rates.

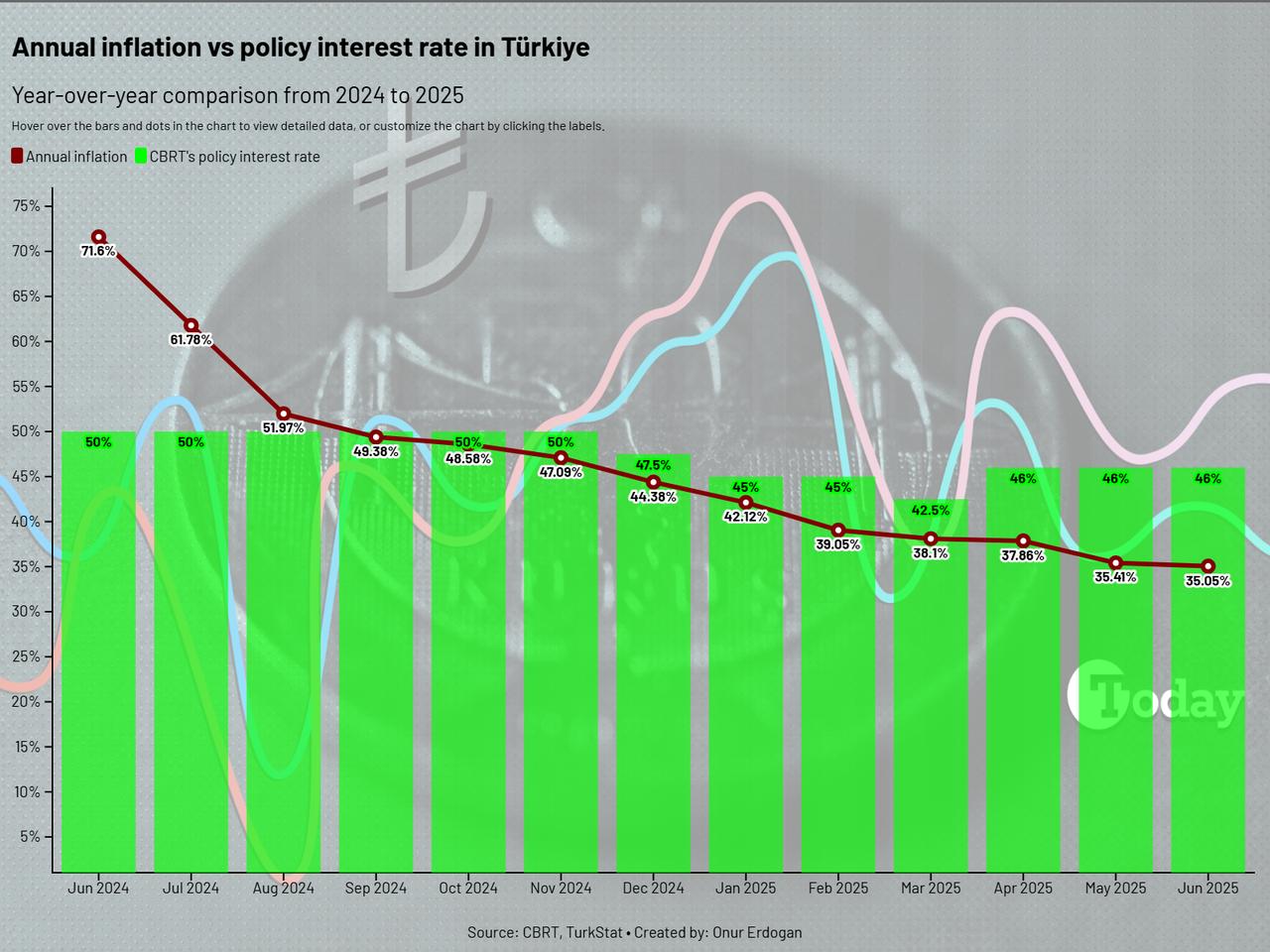

The adjustment was introduced following a positive week in Turkish markets, as annual inflation eased to 35.05% in June—beating forecasts and reinforcing expectations for long-awaited rate cuts by the Turkish central bank in July.

The policy rate has remained at 46% since April, while market expectations for the July meeting point to a cut of 250 to 350 basis points, with both domestic and international institutions anticipating easing within that range.

Despite the weighted average interest rate on deposits with maturities of up to three months remaining high at around 58% during the week ending July 4, total deposits in Türkiye’s banking sector declined by ₺522 billion ($13 billion), falling to ₺23.7 trillion. This included a 3.4% drop in Turkish lira deposits and a 1.7% decrease in foreign currency holdings.

The new tax adjustment is expected to put additional pressure on local deposit levels, potentially accelerating the decline in domestic savings.

The Turkish central bank’s next monetary policy meeting is scheduled for July 24.