Türkiye is among the countries that recorded a notable increase in corporate insolvencies, with bankruptcies rising by 23% in 2024 compared to the previous year.

This figure placed Türkiye 11th among the 47 economies covered, just after Sweden.

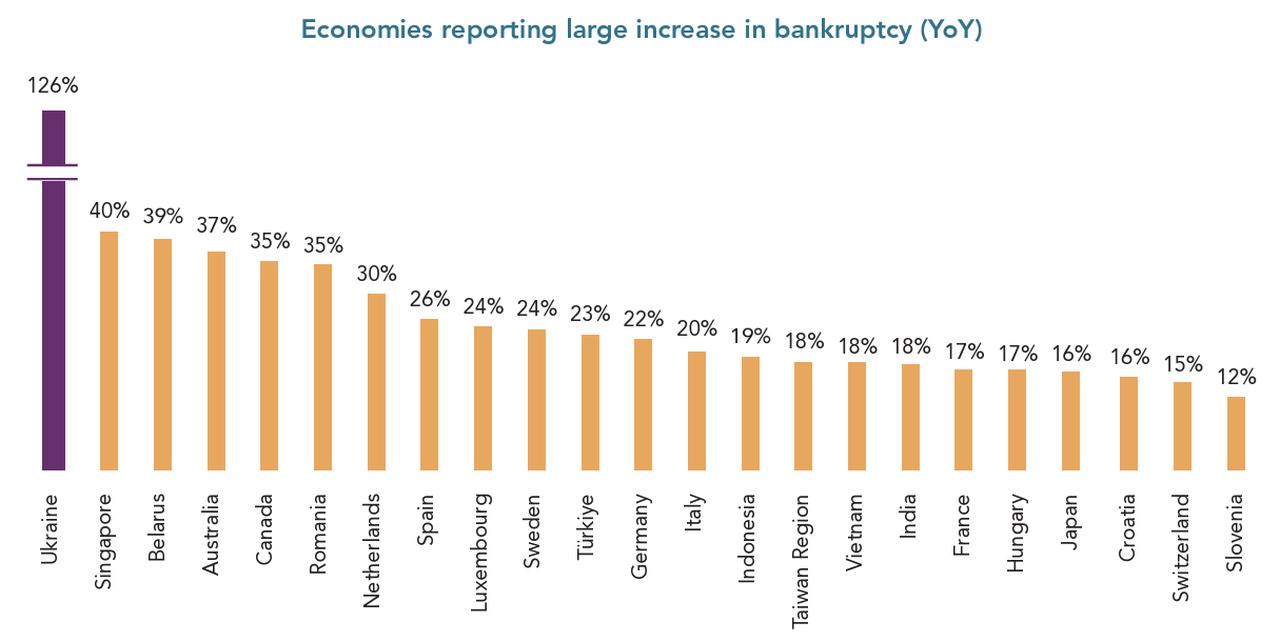

According to the Dun & Bradstreet Global Bankruptcy Report, Ukraine led the ranking with a 126% surge, as the ongoing war with Russia severely weakened the country's economic resilience.

The latest edition of the report reveals that business bankruptcies surged globally in 2024 and are expected to continue climbing throughout 2025, reaching levels not seen in over a decade.

According to the data, 65% of the monitored economies experienced an increase in bankruptcies, a marked rise from 53% in 2019.

Türkiye's increase in bankruptcies reflects mounting financial strain from persistent inflation, which peaked at 75.45% in May 2024, currency depreciation, and ongoing fiscal challenges.

Dun & Bradstreet’s local partner, CRIF, reported a total of 465 companies filed for bankruptcy in Türkiye in 2024, based on commercial registry records and official gazette announcements.

Sectors with low profit margins were particularly affected by the sharp rise in borrowing costs and weak consumer demand. Businesses reliant on credit have found it increasingly difficult to service their debt amid tight monetary conditions since 2023.

Julian Prower, Chief Operating Officer at Dun & Bradstreet International, noted that government support during the pandemic had artificially suppressed insolvency levels between 2020 and 2022.

"As policy support was rolled back and interest rates started to rise, the expected correction began in 2023 and accelerated further in 2024," he wrote in the report’s preface. "Sectors with tight margins, such as retail, hospitality, and construction, have seen heightened distress."

"Corporate bankruptcies will remain on an upward trajectory throughout 2025, with little relief expected until late in the year," said Dr. Arun Singh, Global Chief Economist at Dun & Bradstreet. He explained that while many businesses survived the initial shocks of the pandemic due to government aid and low interest rates, the removal of these support mechanisms exposed underlying vulnerabilities.

High borrowing costs placed significant stress on corporate balance sheets, particularly for businesses reliant on leverage. As interest rates remained elevated through much of 2024, firms faced tightening liquidity, reduced consumer demand, and sluggish global growth.

The report highlights how businesses that failed to integrate e-commerce effectively struggled to stay competitive, while those that went fully digital faced their own challenges as consumer preferences shifted back toward physical retail.

"This marks a significant shift, reflecting both cyclical pressures and structural challenges that businesses now face," Singh added.

The report also pointed to the adverse impact of geopolitical tensions and supply chain restructuring, which disrupted traditional trade patterns and disproportionately affected export-reliant firms.

Despite signs of easing inflation and potential interest rate cuts, the report warns that any relief for businesses will take time to materialize. "Geopolitical tensions will add further strain, driving supply chain disruptions and market volatility," it stated.

Refinancing challenges will persist, especially for businesses with lower credit ratings, and many will continue to struggle to secure new funding.

The report emphasized that proactive risk management, data-driven decision-making, and diversification of suppliers and customers are essential for businesses to weather ongoing uncertainties and position themselves for sustainable growth.