Central Bank of the Republic of Türkiye's (CBRT) total international reserves rose to $211.78 billion in the week ending Feb. 13 on rising global gold prices, while foreign investors extended their buying streak across Türkiye’s stock and bond markets.

Foreign currency reserves increased by $714 million, reaching $79.59 billion, while gold reserves posted a larger rise of $3.59 billion to stand at $132.2 billion, the data showed.

Net international reserves also moved higher, rising from $91.3 billion to $95.9 billion. Net reserves excluding swap agreements increased from $77.7 billion to $81.6 billion, indicating continued strengthening in the central bank’s underlying reserve position.

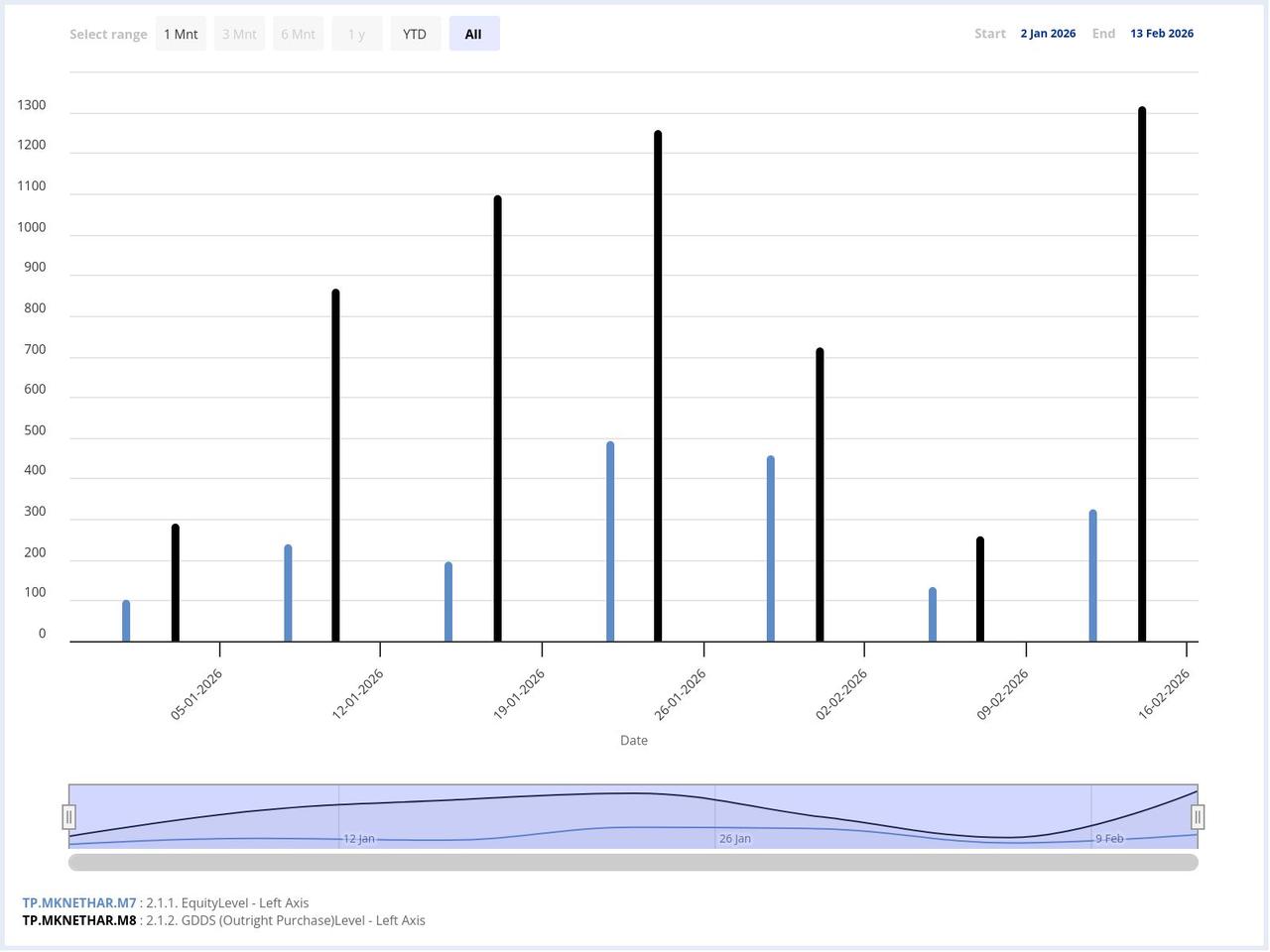

Foreign investors continued to channel funds into Turkish financial markets, recording net purchases of $322.20 million in equities and $1.30 billion in government bonds between Feb. 6 and Feb. 13.

This marked the eleventh consecutive week of net foreign buying in the equity market, bringing cumulative inflows over that period to $2.80 billion. Since the week of Oct. 31, bond markets have attracted a total of $8.10 billion in foreign purchases.

Since the beginning of 2026, foreign investors have acquired $1.90 billion in equities and $5.80 billion in bonds, excluding repo transactions.

The total value of equities held by non-residents rose from $41.54 billion to $44.01 billion during the reporting period. Government bond holdings increased from $22.57 billion to $23.35 billion, while holdings in corporate debt securities stood at $1.55 billion.

In the banking sector, total deposits in Türkiye reached ₺29.09 trillion ($664.6 billion) during the same week, rising by ₺222.23 billion, according to official data.

Foreign currency deposits across the banking system stood at $272.52 billion, including $234.27 billion held by domestic residents, with the remainder attributed to non-resident account holders.

Consumer lending to residents increased by 1.5% during the week, reaching ₺5.94 trillion, banking data showed.