Türkiye’s Treasury and Finance Ministry and the Central Bank of the Republic of Türkiye (CBRT) have implemented coordinated fiscal and monetary measures to bolster the lira and reduce dollarization risks, effective as of Saturday.

Under the new regulations, which will remain in force until July 31, 2025, exporters are now required to convert 35% of their export revenues into Turkish lira, up from the previous level. Additionally, the incentive for converting foreign currency to lira has been increased to 3%.

As part of adjustments to the CBRT’s reserve requirement framework, the lira ratio target for corporate deposits has been reinstated. Furthermore, reserve requirement ratios have been raised for foreign currency deposits and foreign currency-denominated repo transactions with domestic residents. The interest rates and remuneration applied to Turkish lira reserve requirements have also been increased.

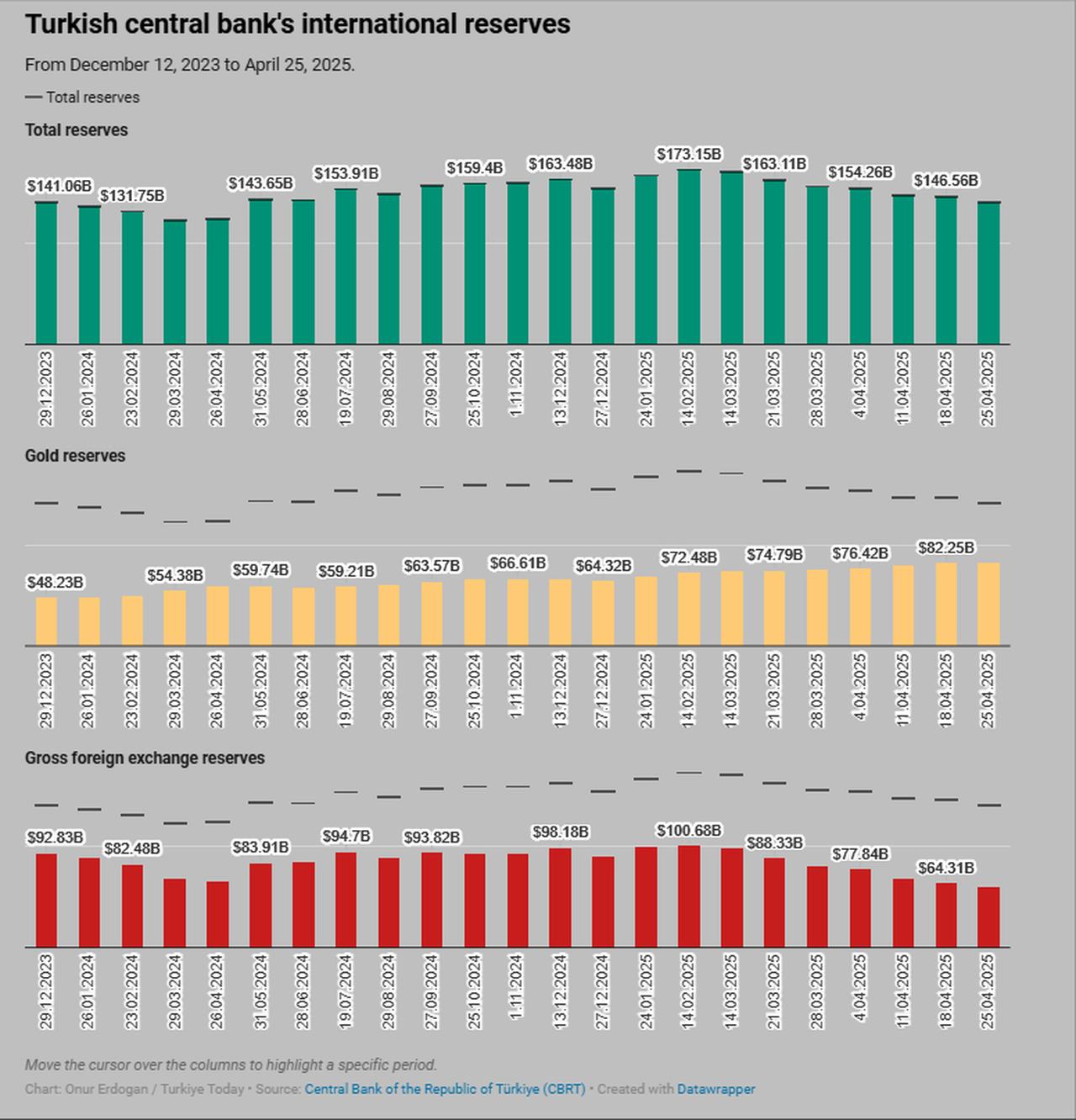

Türkiye's central bank reserves declined to $141.05 billion as of April 25, reflecting a 3.8% drop—or $5.5 billion—from the previous week. Since reaching a peak of $173.15 billion in February, reserves have fallen by more than $30 billion, driven partly by heightened market volatility following a corruption investigation involving Istanbul Mayor Ekrem Imamoglu on March 19 and a broader global market selloff in April.

In response to the surge in domestic demand for U.S. dollars, the Central Bank of the Republic of Türkiye (CBRT) has intervened by selling reserves in an effort to stabilize the market. Analysts estimate that over $55 billion may have been used during this period. Despite these interventions, the Turkish lira has depreciated by nearly 7% since mid-March.

As of Friday’s market close, the U.S. dollar/Turkish lira exchange rate stood at 38.5578.

The recent rise in foreign currency deposits has been largely driven by commercial accounts. Authorities expect the new measures to increase the share of lira-based assets within the banking system.

Meanwhile, data from the Banking Regulation and Supervision Agency (BRSA) indicates rising dollarization risks, as total deposits in Türkiye’s banking sector declined by ₺101.62 billion ($3.15 billion) in the week ending April 25, bringing the total to ₺22.53 trillion.

During the same period, Turkish lira deposits dropped by 0.3% to ₺12.39 trillion, while foreign currency (FX) deposits increased by 0.3% to ₺7.44 trillion. The total volume of FX deposits reached $232.74 billion, with $194.85 billion held by domestic residents. When adjusted for exchange rate effects, domestic residents’ FX deposits declined by $147 million.

Meanwhile, consumer loans extended to domestic residents rose by 1.5% to ₺4.24 trillion, including ₺558.73 billion in housing loans, ₺63.97 billion in auto loans, and ₺1.6 trillion in personal loans. The overall loan volume in the financial sector, including lending by the Central Bank, expanded by ₺121.75 billion to ₺17.62 trillion.