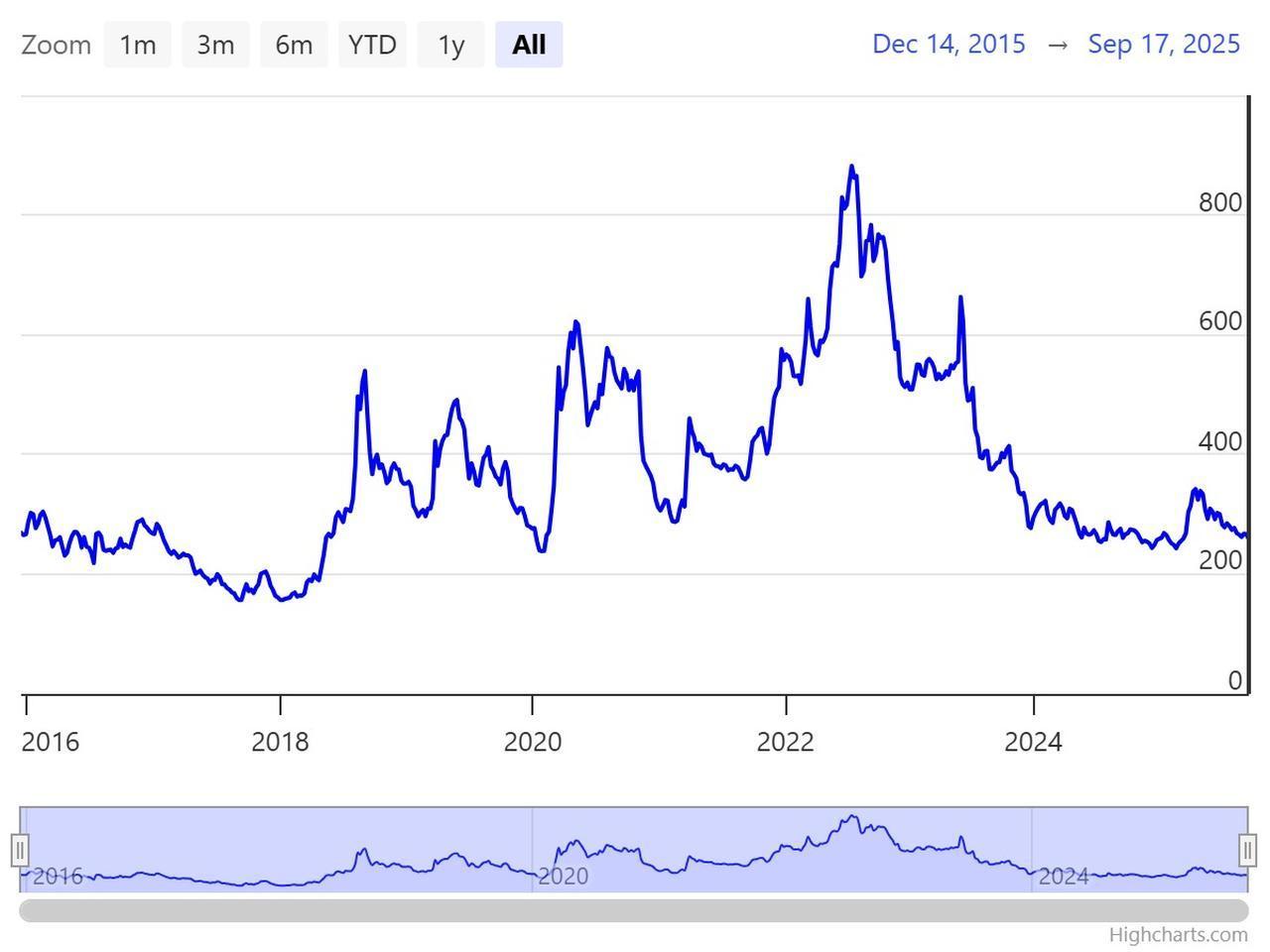

Türkiye’s five-year credit default swap (CDS), a measure of the cost of insuring government debt against default, fell to 240 basis points on Wednesday. This marks its lowest level since February 2020.

A credit default swap (CDS) is a financial contract that acts like insurance against the risk of a borrower defaulting on debt. The premium, quoted in basis points, reflects how risky investors consider that borrower to be.

The decline followed a period of volatility triggered by political developments.

After a court decision that removed the Istanbul chair of the main opposition Republican People’s Party (CHP), the CDS rate had briefly risen above 270 from 260.

Markets were reassured, however, when another court delayed a ruling on the party’s 2023 congress that could have threatened the leadership of current CHP chair Ozgur Ozel. The delay prompted renewed interest in Turkish assets, improving sentiment.

The Central Bank of the Republic of Türkiye (CBRT) also contributed to improved market conditions with a further 250-basis-point cut in its policy rate, aiming to provide relief to the real economy.

Two-year government bond yields, which had climbed to 37.57% during the short period of political turmoil, retreated to 36.38%.

A weaker U.S. dollar has further encouraged capital inflows into emerging markets, including Türkiye.

The euro–dollar exchange rate tested levels above 1.18, reflecting increased demand for currencies outside the dollar.

Türkiye’s CDS premium reached an all-time high of 882 in July 2022, when annual inflation climbed to 78.6% and the central bank’s net foreign exchange reserves, excluding swaps, fell into the negative zone at minus $52.4 billion.

Since mid-2023, the government has implemented a new economic program prioritizing disinflation through a tight monetary stance.

Inflation has been on a downward trend for 15 consecutive months since May 2024, reaching 32.9%.

At the same time, the central bank’s total reserves have risen to around $180 billion, while net foreign exchange reserves excluding swaps stand safely near $50 billion, helping boost risk appetite in domestic markets along with economic growth maintained for 20 consecutive months as of Q2 2025.

During the year, Türkiye’s CDS peaked at 370 in April, driven by political unrest following the arrest of then-Istanbul Mayor Ekrem Imamoglu in a corruption probe.