Türkiye’s overall foreign exchange (FX) position improved in the third quarter of 2025, led by the Central Bank of the Republic of Türkiye’s (CBRT) stronger balance sheet and an improved public-sector FX stance, but BBVA Research warned that corporate exposure to foreign currency risks is mounting and could test financial resilience if volatility returns.

In its latest Türkiye Quarterly Debt Outlook, the bank provided a detailed assessment of the country’s household, corporate, banking, and public debt dynamics, portraying a relatively stable macro-financial environment.

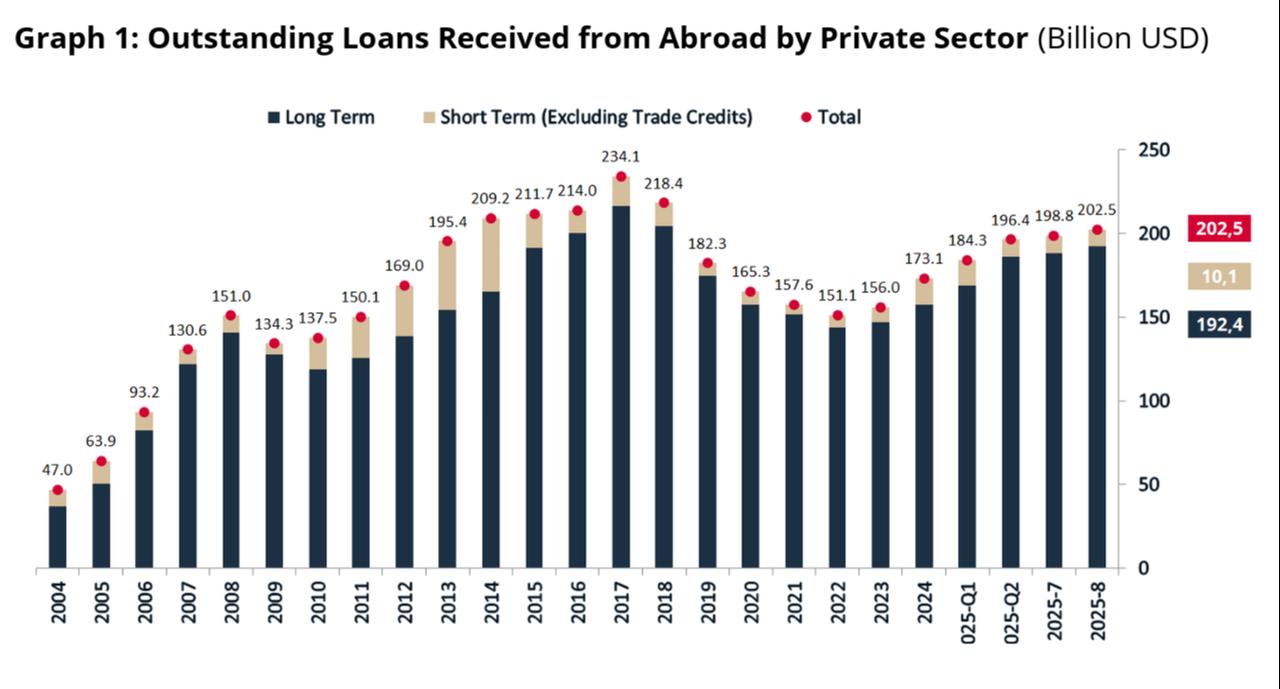

While public debt and banking-sector liquidity appear manageable, the report underscored several vulnerabilities stemming from the private sector’s expanding FX liabilities and reliance on short-term funding.

The bank described Türkiye’s financial outlook as one of "divergence" — with the public sector and banking system showing improved balance-sheet stability, while the corporate sector faces a renewed buildup of FX risk.

The report stressed that the extension of external debt maturities, the low public debt ratio, and the banking sector’s access to long-term financing provide a cushion for the broader economy. However, the persistence of high interest rates, elevated FX exposure among firms, and reliance on short-term liabilities "call for close monitoring" in the coming quarters.

BBVA Research said Türkiye’s corporate sector faces renewed currency vulnerability as its net foreign exchange (FX) short position — the gap between FX liabilities and assets — widened to $185 billion in August 2025, the highest level since 2018 and a sharp increase from $63 billion in 2023. The report warned that this growing mismatch heightens sensitivity to potential currency shocks, particularly if global conditions tighten or domestic rates remain high.

While firms retain access to international financing, their reliance on short-term derivative liabilities and import-related debt has expanded, weakening natural hedges provided by export revenues. BBVA noted that the ratio of exports to open FX positions has continued to decline since 2024, eroding earnings buffers. Still, corporate debt as a share of GDP remains below emerging and advanced economy averages, reflecting conservative leverage relative to peers in Latin America and Eastern Europe.

On the fiscal front, BBVA described Türkiye’s public debt as "manageable but increasingly costly." While the government’s debt-to-GDP ratio remains low by international standards, the interest burden has grown as disinflation progresses more slowly than expected, keeping nominal rates high.

The bank cited three key risks to fiscal stability: rising reliance on gold-denominated borrowing, shorter average maturities, and higher interest expenses relative to revenue. Even so, a domestic debt rollover ratio of 106% for 2026 and a narrowing primary deficit — down to 0.6% of GDP in September from 2.1% at the end of 2024 — indicate that near-term financing needs are under control.

BBVA noted that the improvement, driven by strong tax revenues and restrained non-interest spending, has eased fiscal pressure and supported debt sustainability. However, it cautioned that elevated inflation and high real interest rates continue to limit budget flexibility.

The report pointed to a shift in household portfolios, with financial assets-to-GDP declining to 38.7% in the second quarter from 39.6% in the first, as deposit growth slowed. This was partially offset by higher equity and mutual fund holdings.

BBVA identified the rapid expansion of money market funds, now totaling ₺7 trillion ($165.70 billion) ─around one-third of total deposits, as a key financial stability risk due to their short-term sensitivity to interest rate movements. Household debt remains low at about 9% of GDP, providing a cushion against potential shocks.

Meanwhile, Türkiye’s banks strengthened their external funding structure. Total foreign borrowing reached $201 billion by August, supported by an increase in subordinated debt and other long-term instruments that improved rollover ratios and FX liquidity.

Rising liquid foreign-currency assets, partly from overseas subsidiaries, also enhanced resilience to external volatility. Dollarization stabilized at around 40% of deposits, and the gradual wind-down of the government’s FX-protected deposit scheme (KKM) has not reignited currency substitution.

BBVA concluded that Türkiye’s improving macro-financial balance depends on sustaining access to external financing while reinforcing FX risk management in the private sector, particularly as corporate exposure grows alongside tighter global funding conditions.