This article was originally written for Türkiye Today’s weekly economy newsletter, Turkish Economy in Brief, in its October 6 issue. Please make sure you are subscribed to the newsletter by clicking here.

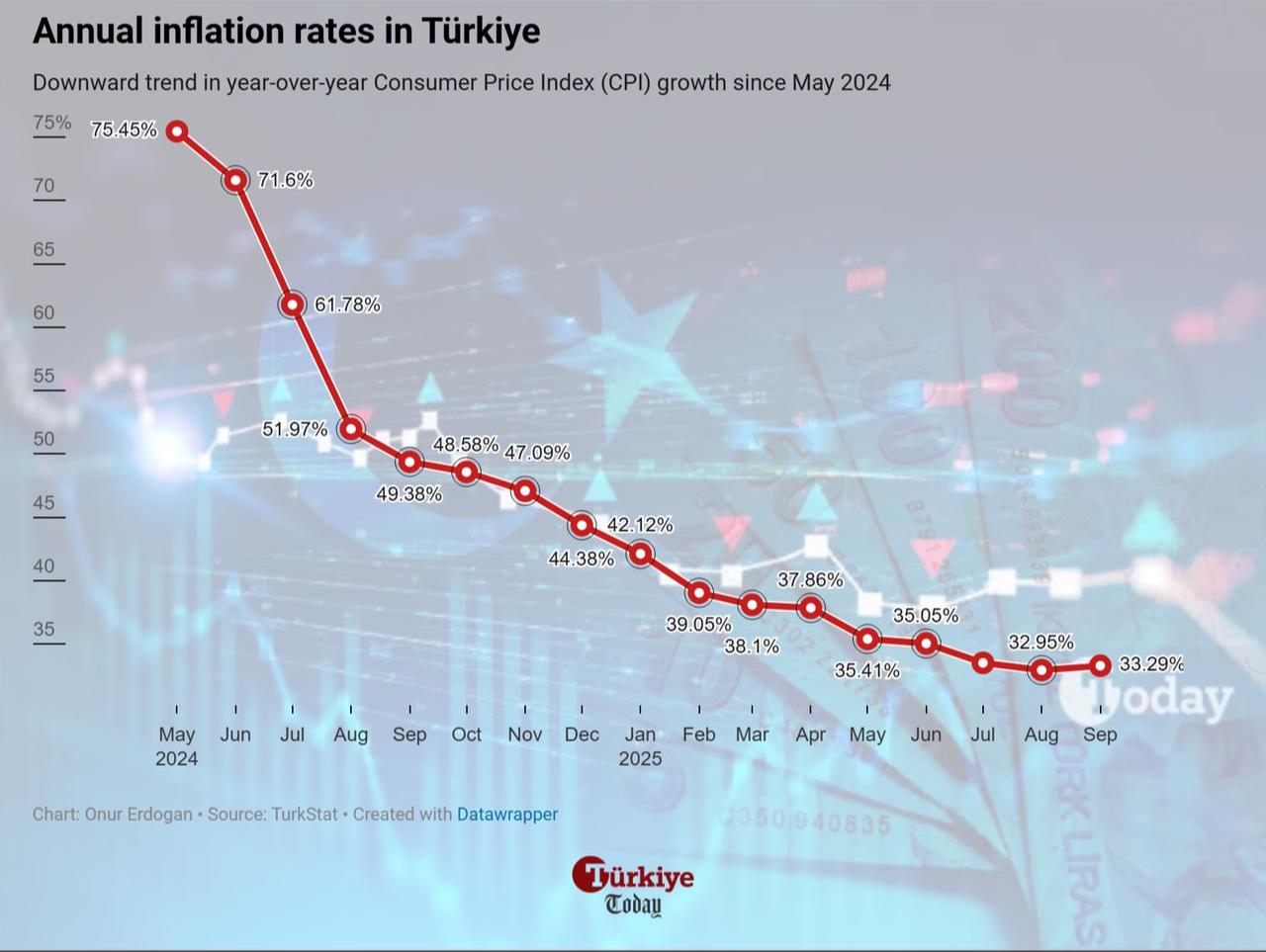

While the fight against high inflation in Türkiye has been ongoing for years and significant progress has been made, the Consumer Price Index (CPI) data released in September caused some confusion in the markets.

Inflation in September stood at 3.23% month-on-month, above expectations of around 2.5%. As a result, annual inflation rose by 0.3 points to 33.29%. In September, sharp increases were seen particularly in education, food, and transportation prices. Notably, annual inflation turned upward for the first time since May 2024.

Looking at the market reaction to the data, the Borsa Istanbul BIST 100 index fell by 2.02% on Friday alone, closing at 10,858 points. Thus, the index slipped back below the critical 11,000 level. On Friday, losses in the banking index reached as high as 4.36%.

Following the release of the September CPI figures, the prevailing view was that the Central Bank of the Republic of Türkiye (CBRT) would continue interest rate cuts with “smaller steps” and that year-end inflation could “exceed forecasts.”

In a report shared by Turkish lender Akbank, it was noted that the depreciation of the Turkish lira had been curbed and that the impact of the exchange rate on inflation dynamics was under control. However, the persistence of strong inflationary pressures raised “questions about transmission channels” and suggested that “sufficient progress has not been achieved in pricing behavior.”

The report also referenced the Monetary Policy Committee’s September statement: “If the inflation outlook deviates significantly from interim targets, the monetary policy stance will be tightened.” It projected that future rate cuts could continue in increments of 100–150 basis points.

A recent analysis by U.S.-based Citi forecasted that Türkiye’s year-end inflation could fall to 30% and the policy rate to 37%, following the CBRT’s latest rate cut in September from 43% to 40.50%.

Yet, the persistence of inflationary pressures is also tied to domestic dynamics: the value of “under-the-pillow” gold in Türkiye is estimated at around $500 billion, and with gold prices rising nearly 50% this year, the resulting “wealth effect” has continued to fuel consumer spending, making inflation harder to curb despite tighter monetary policy.