Türkiye’s Finance Minister Mehmet Şimşek said Friday that the Central Bank of the Republic of Türkiye’s (CBRT) year-end 2025 inflation projection range of 25–29% will be difficult to achieve due to unforeseen challenges such as drought and geopolitical tensions, while reaffirming that the country’s disinflation process remains on track.

Speaking at the World Newspaper Economy Summit in Istanbul, Simsek noted that the ongoing economic program—launched in September 2023—has entered its second phase, focusing on reducing macroeconomic imbalances and maintaining fiscal discipline.

"Disinflation has begun and will continue. The recent figures do not change either perception or reality, as the conditions for disinflation remain favorable," he said.

Simsek explained that the program’s first stage centered on managing macroeconomic risks such as high inflation and a widening current account deficit.

The second phase, currently underway, aims to restore fiscal discipline and sustainability in external balances, while the third phase—set to begin next year—will focus on structural reforms designed to consolidate progress.

"The third stage will mark a transition toward single-digit inflation, a permanent budget deficit below 3% of GDP, and a current account deficit at or below 1%," he said, adding that these reforms are expected to enhance Türkiye’s long-term growth potential by improving productivity and competitiveness.

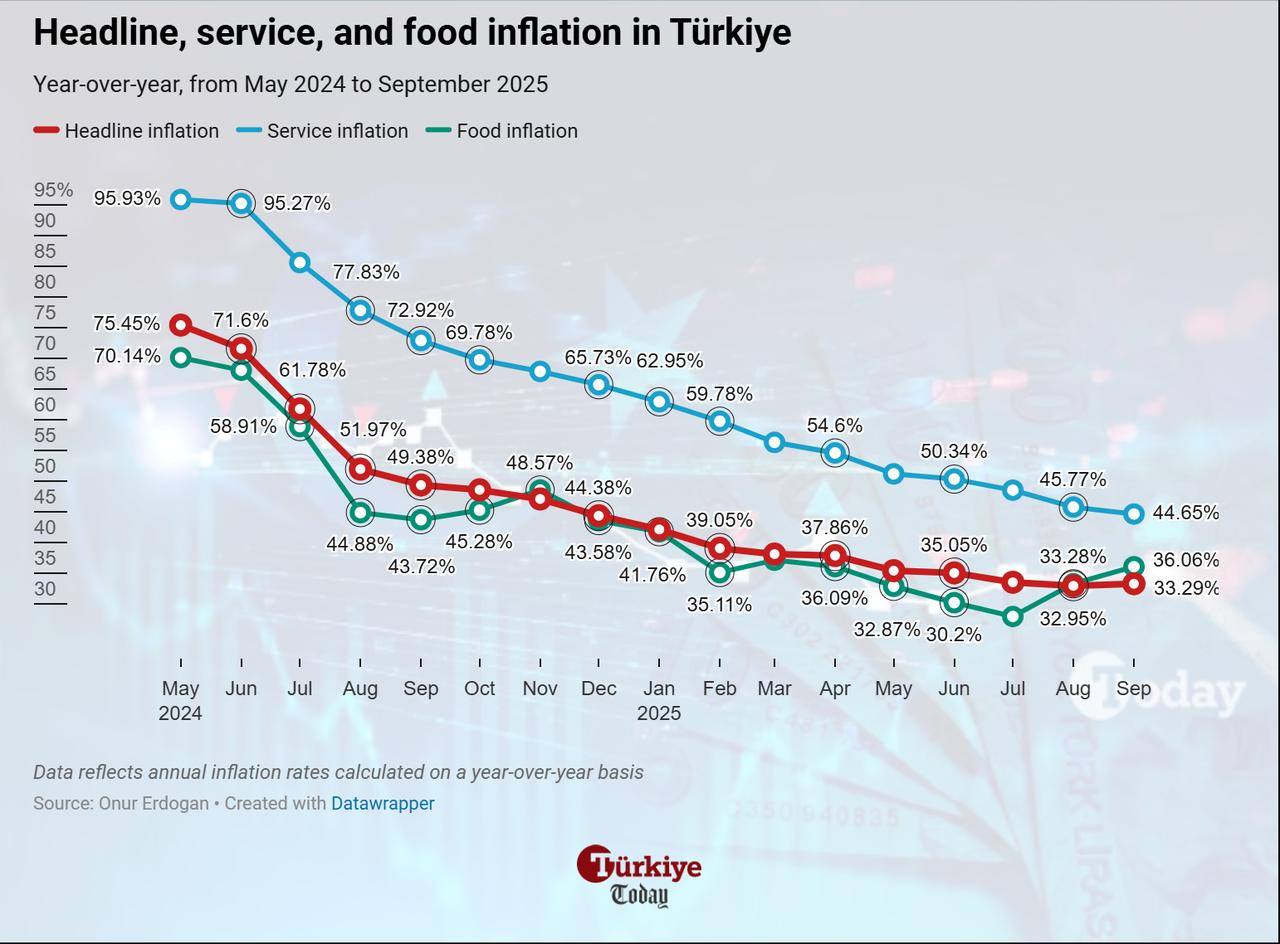

Türkiye’s inflation edged up to 33.3% in September, marking the first increase after a 15-month downward trend, mainly driven by rising food prices.

The minister emphasized that the disinflation plan did not anticipate a regional war, trade tensions, or the severe drought that has affected agricultural output.

"Some of these developments could not have been foreseen. Despite that, disinflation continues and will continue," Simsek said, underlining that the recent surge in food prices was temporary and largely driven by weather.

Simsek said both fiscal and monetary policies remain tight and mutually supportive, ensuring a coordinated effort to curb inflation. He added that the government will determine next year’s revaluation rates and certain fixed tax adjustments "in line with target inflation and within the budget’s capacity" to reinforce the central bank’s anti-inflation efforts.

He also highlighted the government’s priorities for industrial, green, and digital transformation, along with reforms in public finance. These measures, he said, are aimed at boosting efficiency and sustaining high-quality growth.

Simsek emphasized that Türkiye’s low public debt ratio compared with advanced and emerging economies provides room to finance the necessary structural transformation.

"A highly indebted country cannot allocate resources for transformation. Our relatively low debt level allows us to invest in productive infrastructure such as railway links connecting industrial zones to ports," he said.

Simsek also added that the Treasury aims to reduce the domestic debt rollover ratio below 100% to free up more resources for the real sector.

The ratio stood at 110% in September, down from 147% a year earlier, and is projected to average 115% in the October–December period, slightly below the ministry’s annual forecast of 119%.

He reiterated that the core objectives of the medium-term economic program are price stability, fiscal discipline, and a sustainable external balance—all serving the ultimate goal of achieving "sustainable high growth and fairer income distribution."

Despite the slower-than-expected pace of disinflation this year, Simsek remained confident that Türkiye will record stronger progress in 2025.

He said that the combined impact of tight monetary and fiscal policies, together with easing base effects in food prices, is expected to accelerate the decline in inflation through 2026.

"Next year, if drought conditions ease, headline inflation will decline more rapidly," he said, explaining that food inflation’s impact on overall prices will diminish, helping inflation fall at a faster pace.

He added that the temporary deterioration in inflation expectations observed in recent months is likely to improve next year as the effects of high food prices fade, and as the government strengthens policy coordination and communication to anchor public and market confidence.