Turkish Finance Minister Mehmet Simsek said on Sunday that elevated housing rents remain the main reason inflation continues to run high despite recent progress in overall disinflation, adding that a nationwide housing campaign will begin "as soon as possible."

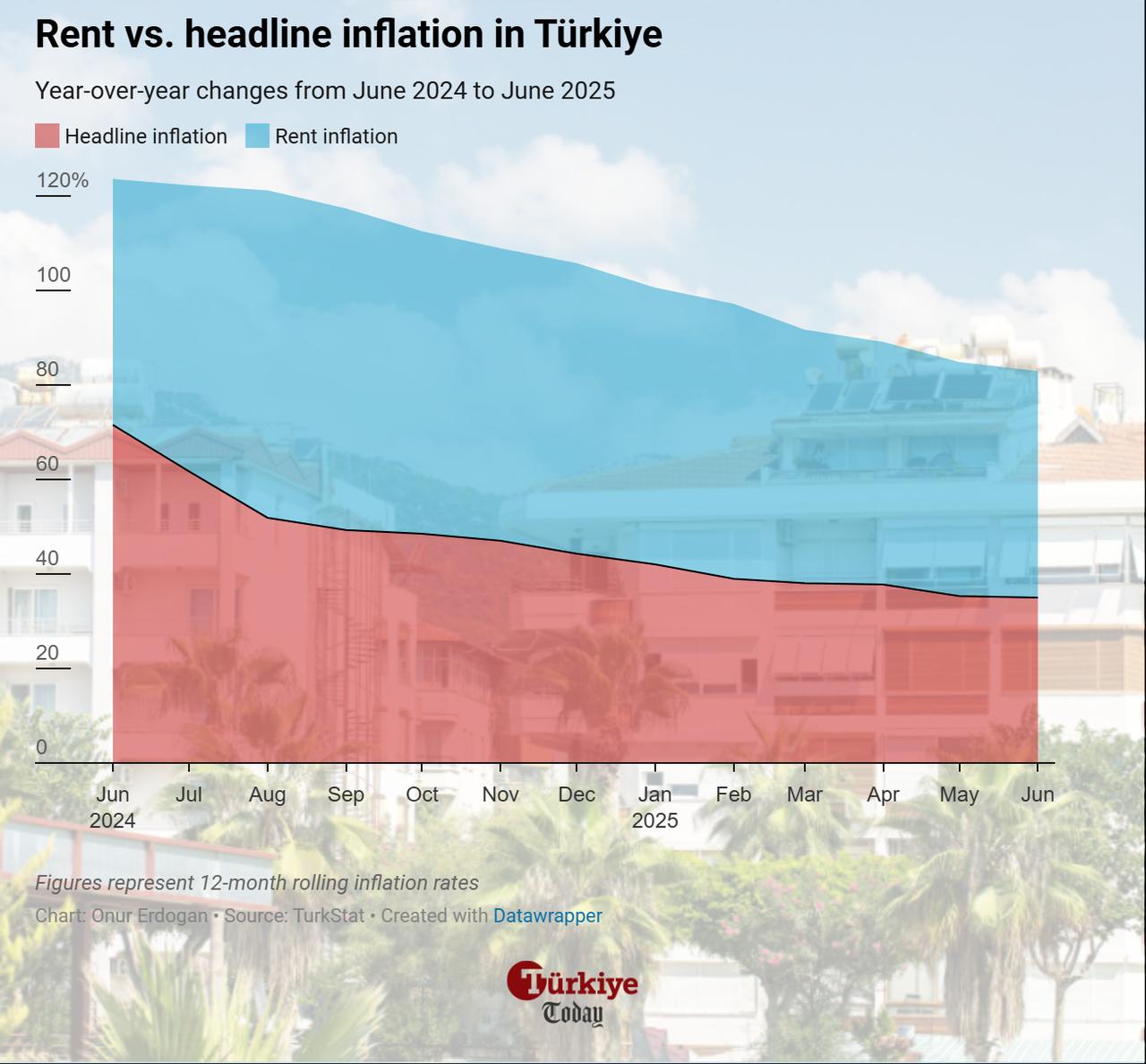

As of June 2025, rent inflation declined to 82.97% from 105.82% in December 2024, but it remains significantly higher than the overall consumer price increase of 35.05%.

Speaking during a live television broadcast, Simsek said rent is the main factor keeping Türkiye's headline inflation elevated.

"It is the largest expense, and in major cities, it is at the heart of the cost-of-living problem,” Simsek said.

To address affordability, Simsek stressed the need to increase the housing supply rather than relying on cheap credit.

“We need a broad mobilization to boost housing construction,” he said, adding that the government has already begun coordinating with the Urbanization Ministry on plans to build at least 500,000 social housing units.

“Housing supply is the most critical factor in fighting the high cost of living,” Simsek said. “This issue cannot be resolved through low interest rates alone. We need to increase supply, and that requires a broad mobilization.”

According to a report by the Türkiye daily, Minister Simsek informed members of the ruling Justice and Development Party (AK Party) during a closed-door meeting that 15% of Turkish households currently have no opportunity to become homeowners under existing conditions.

He reportedly noted that the ministry plans to extend maximum mortgage maturities from the current 10 years to between 30 and 50 years for low-income households.

Türkiye also introduced a tradable real estate certificate program this week, allowing citizens to invest in housing projects through shares listed on Borsa Istanbul, offering an alternative to traditional mortgage financing.

Simsek explained that although the government had previously capped rent increases at 25% between 2022 and 2023 to contain rising living costs, this measure was recently lifted. As a result, rental inflation, which stood at 92% in June 2023, has eased slightly to 83% but continues to exert strong upward pressure on overall consumer prices.

He attributed the earlier spike in rent inflation partly to a legal cap that had limited annual rent increases to 25% over the past three years.

“We removed the ceiling because such long-term market interventions don’t deliver results,” Simsek said.

He also cited housing shortages following the February 6 earthquake, which affected 11 southeastern provinces of Türkiye, as well as demographic shifts, as contributing factors to the rental surge.

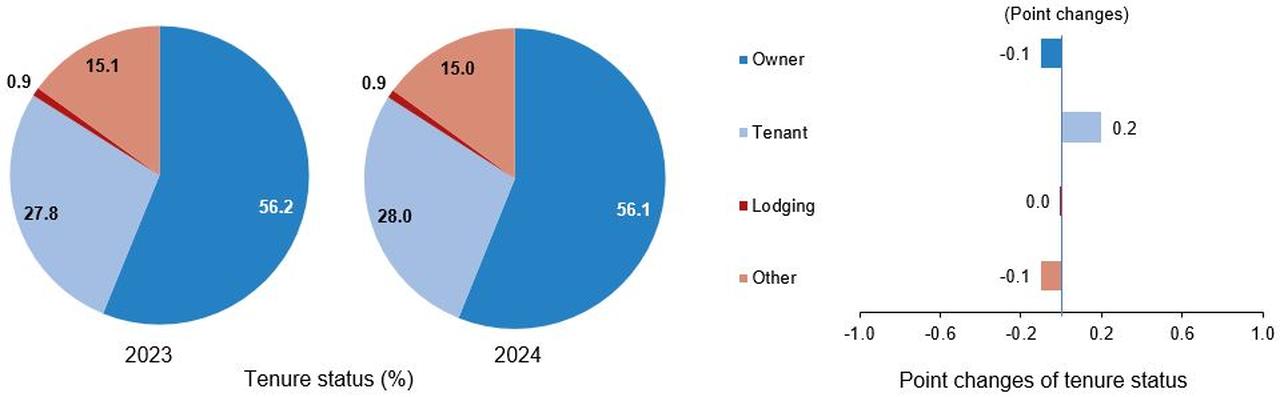

Referring to the Turkish Statistical Institute’s (TurkStat) 2024 Poverty and Living Conditions report, Simsek explained that only 28% of households in Türkiye are renters, yet housing costs continue to dominate urban budgets due to the severity of rental inflation.

“Türkiye’s homeownership rate stands at 56%, but when you look closer, 72% of households do not pay rent—many live in family-owned buildings,” he said.

According to TurkStat, the share of tenants in Türkiye increased by 0.2 percentage points in 2024, while the share of homeowners and households living with others without paying rent (categorized as “other”) each declined by 0.1 points. The share of residents in state-backed housing for specific professions (“lodging”) remained unchanged.

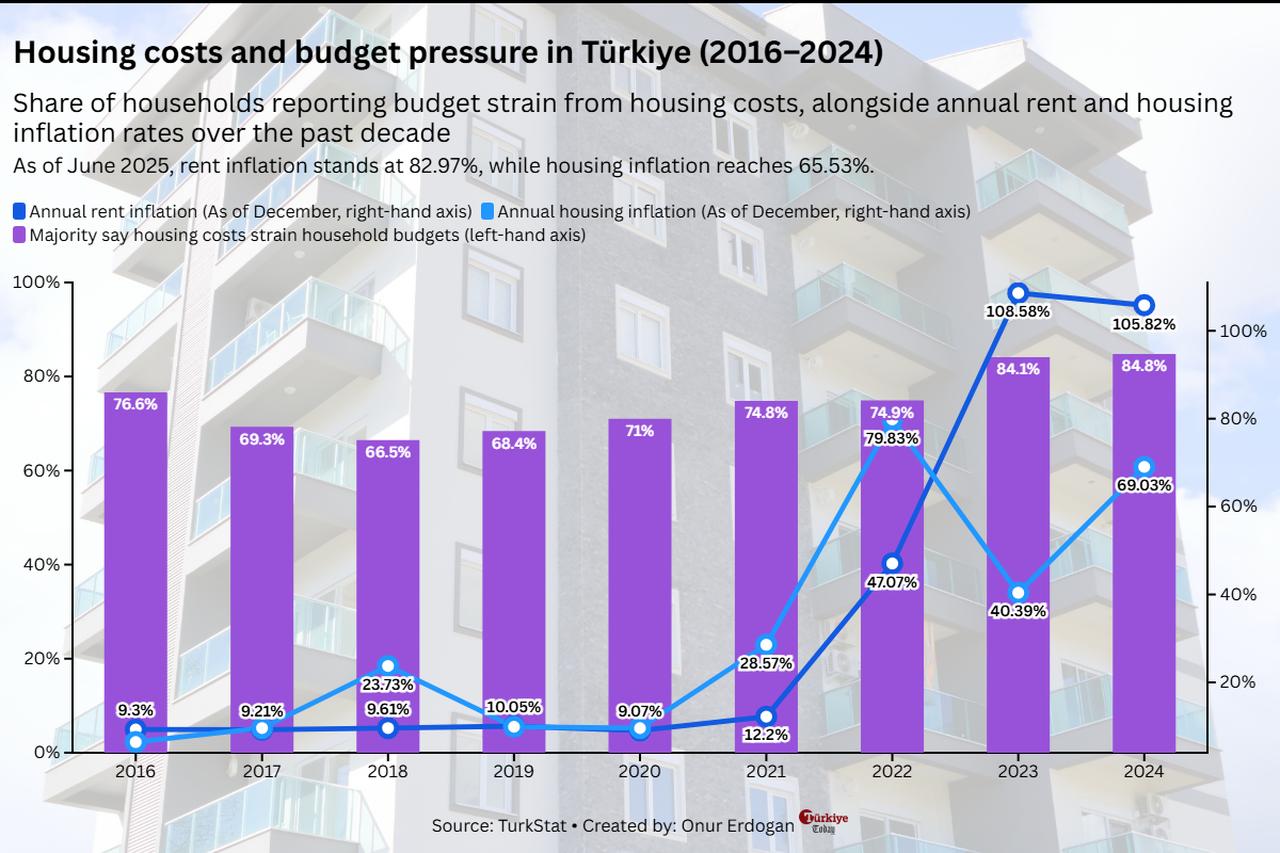

The same report also figures out that a consistently high share of households in Türkiye have reported financial strain due to housing costs over the past decade, with the figure hovering between 66% and 85% from 2016 to 2024.

While rent inflation surged from 12.2% in 2021 to a peak of 108.58% in 2022, it remained elevated at 105.82% by the end of 2024.

Over the same period, general housing inflation fluctuated, reaching 69.03% in 2024. As of June 2025, rent inflation stands at 82.97% and housing inflation at 65.53%, underscoring the continued pressure on household budgets.

According to AI-powered real estate market tracker Endeksa, the average monthly rent in Türkiye stood at $581, while the average price of houses was $857 per square meter, with an overall average of $110,609 per unit.

Despite challenges in the housing sector, Simsek maintained that Türkiye’s broader disinflation efforts are producing results.

“Inflation ended 2023 at around 65%. Today, it is approximately 35%, and we expect to close 2025 with a rate below 30%,” he said.

The central bank’s latest projection, published in its second Inflation Report of the year in May, set a year-end inflation target of 24% in the baseline scenario, with an upper bound of 29%.

Simsek said the government expects to remain within this range. “We believe we’ll land below 29%. Last year, we had a deviation of two percentage points from our target,” he said.

He emphasized that the policy objective is to restore purchasing power. “Our core mission is to fight the cost of living and raise citizens’ real income,” Simsek added.

According to a June report by the Confederation of Turkish Trade Unions (Turk-Is)—Türkiye’s largest labor union confederation representing millions of workers—the monthly cost of a healthy and adequate diet for a family of four, known as the “hunger threshold,” rose to ₺26,115 ($643.82), exceeding the minimum wage of ₺22,104.

The “poverty threshold,” which includes other essential living expenses such as housing, transportation, education, and healthcare, reached ₺85,066.

These thresholds are widely used to assess the minimum income needed to avoid food insecurity and maintain a basic standard of living in urban areas.

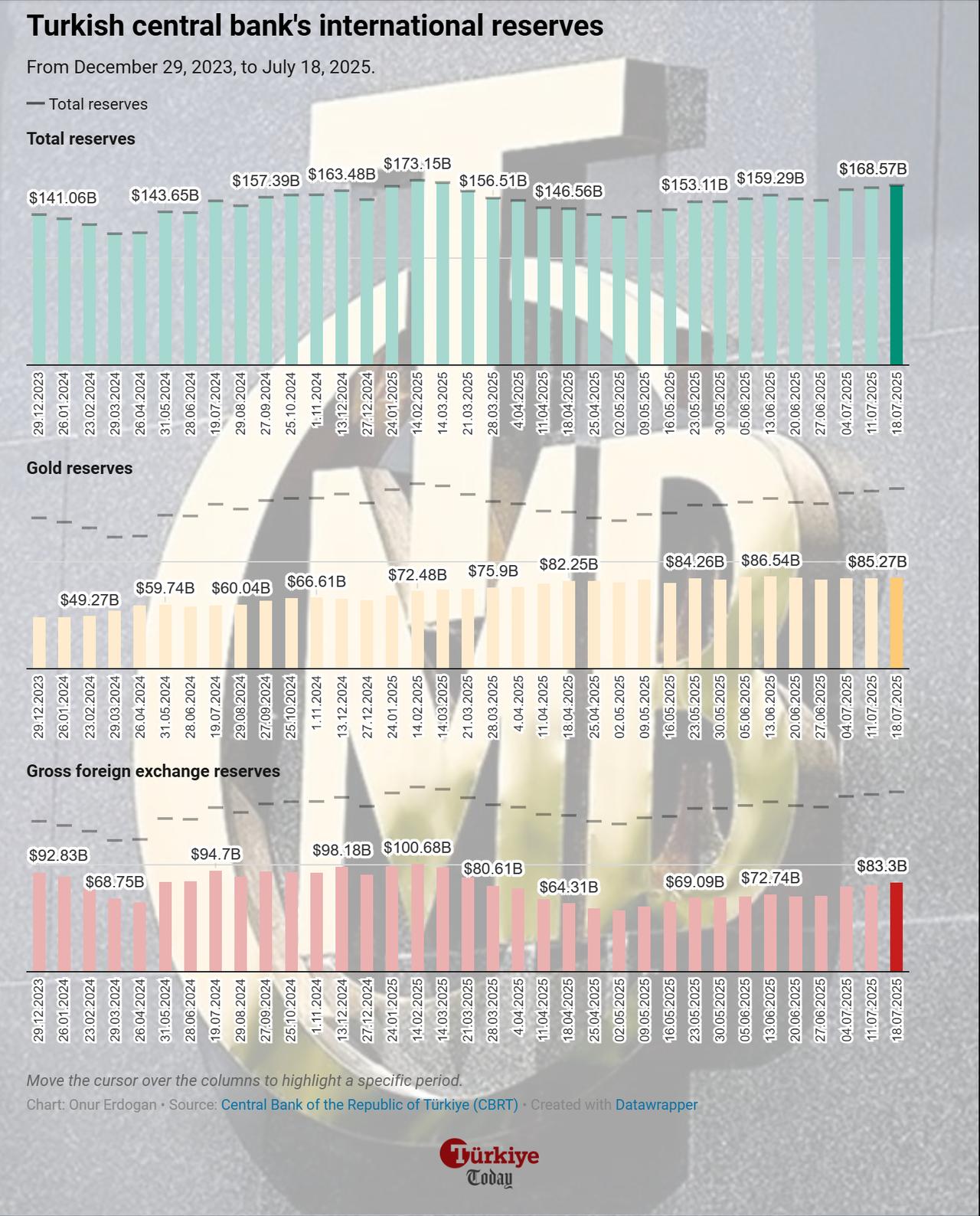

Simsek also addressed the impact of recent external and political shocks that occurred in March and April, stating that key indicators are recovering.

“We have returned to pre-shock levels. Net reserves are again close to $170 billion, and the stock market has rebounded by 98%,” he said.

In April, a downturn in the domestic market—triggered by escalating political tensions following the arrest of then-Istanbul Mayor Ekrem Imamoglu in a corruption probe, along with global trade concerns—prompted the Turkish central bank to intervene by selling U.S. dollars to curb dollarization.

As a result, total international reserves fell from $171 billion on March 14 to $138 billion in the week ending May 2.

During the same period, net reserves excluding foreign exchange swap agreements declined from $65.4 billion to $13.8 billion.

However, as of July 18, the central bank's reserves had rebounded to $168.6 billion. Net reserves excluding swaps also recovered, reaching $44.3 billion.

He noted that Türkiye’s credit default swap (CDS) spread, which reflects perceived investment risk, had dropped from 300 to 280 basis points. “We managed the process well and avoided panic. The program has proven its credibility,” Simsek said.

Regarding fiscal policy, Simsek said budget discipline remains intact. He acknowledged a potential minor deviation from targets but said the broader fiscal picture remains stable.

Türkiye’s central government budget posted a deficit of ₺330.2 billion ($8.14 billion) in June and ₺980.5 billion in the January–June period. By midyear, 44.7% of the ₺14.73 trillion ($363.14 billion) allocated for total budget expenditures in 2025 had been used.

Interest expenditures rose sharply, increasing by 93.5% year-on-year to reach ₺1.11 trillion. He also dismissed claims of widespread deterioration in the private sector’s financial health.

“Only 1.6% of commercial loans are classified as non-performing, well below the long-term average of 3.1%,” he said.

He added that individual loan delinquencies stand at 3.8% and that authorities are monitoring risk closely.

Simsek responded to criticism that Türkiye’s tax system disproportionately burdens wage earners. “We raised corporate tax to 25%, and for financial institutions, it is now 30%,” he said. “We did not increase income tax rates. Instead, we focused on previously untaxed income sources.”

He pointed out that earnings from foreign exchange-protected deposit accounts, which were once tax-exempt, are now taxed at 17.5%. “Our aim is to improve fairness in taxation,” he said.

Simsek noted that monetary policy alone cannot achieve lasting price stability. “We have to pursue supply-side solutions,” he said.

“The most important variable in tackling the cost of living is increasing housing supply.”