Türkiye’s economic board will forgo a mid-year minimum wage increase in July, despite rising inflationary pressures throughout the year, as Treasury and Finance Minister Mehmet Simsek reportedly downplayed concerns about inflation and living costs during a closed-door meeting with government officials.

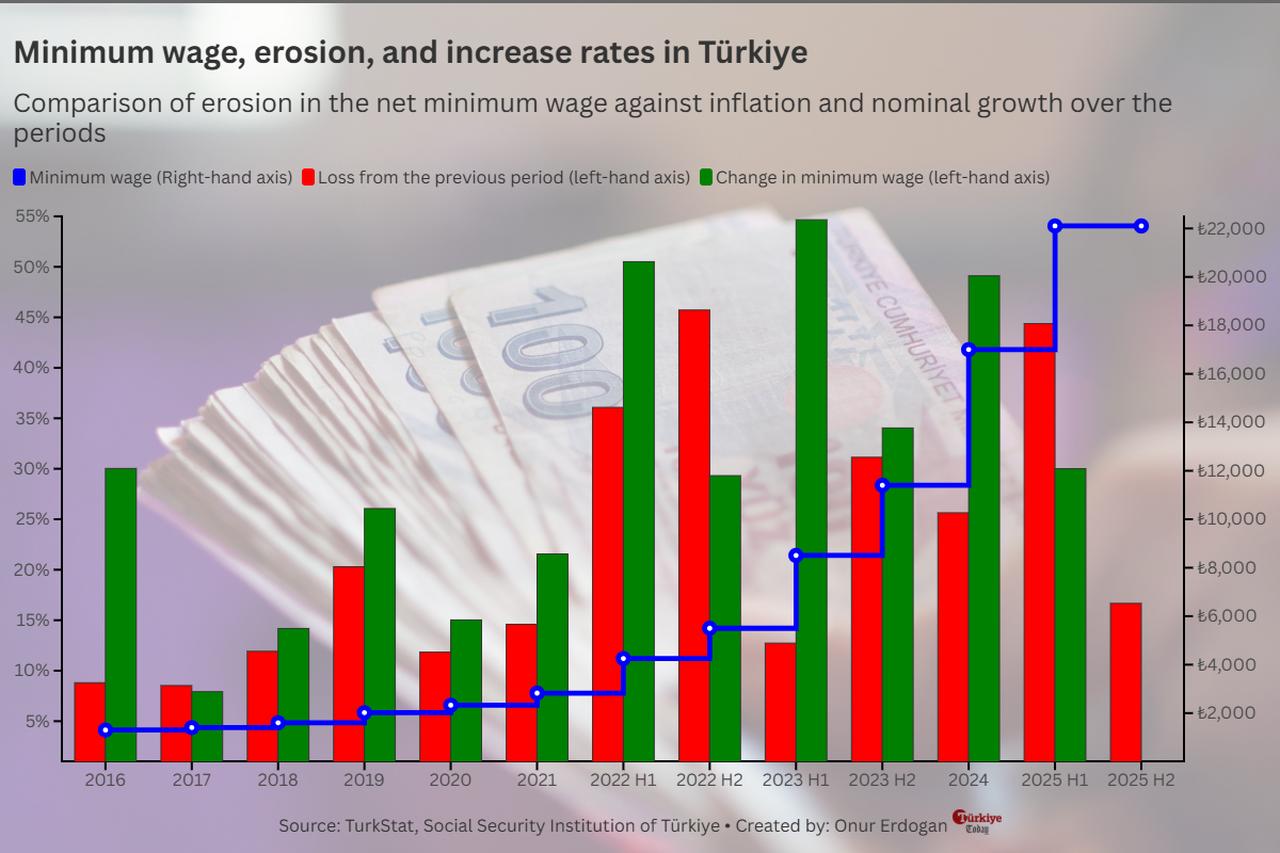

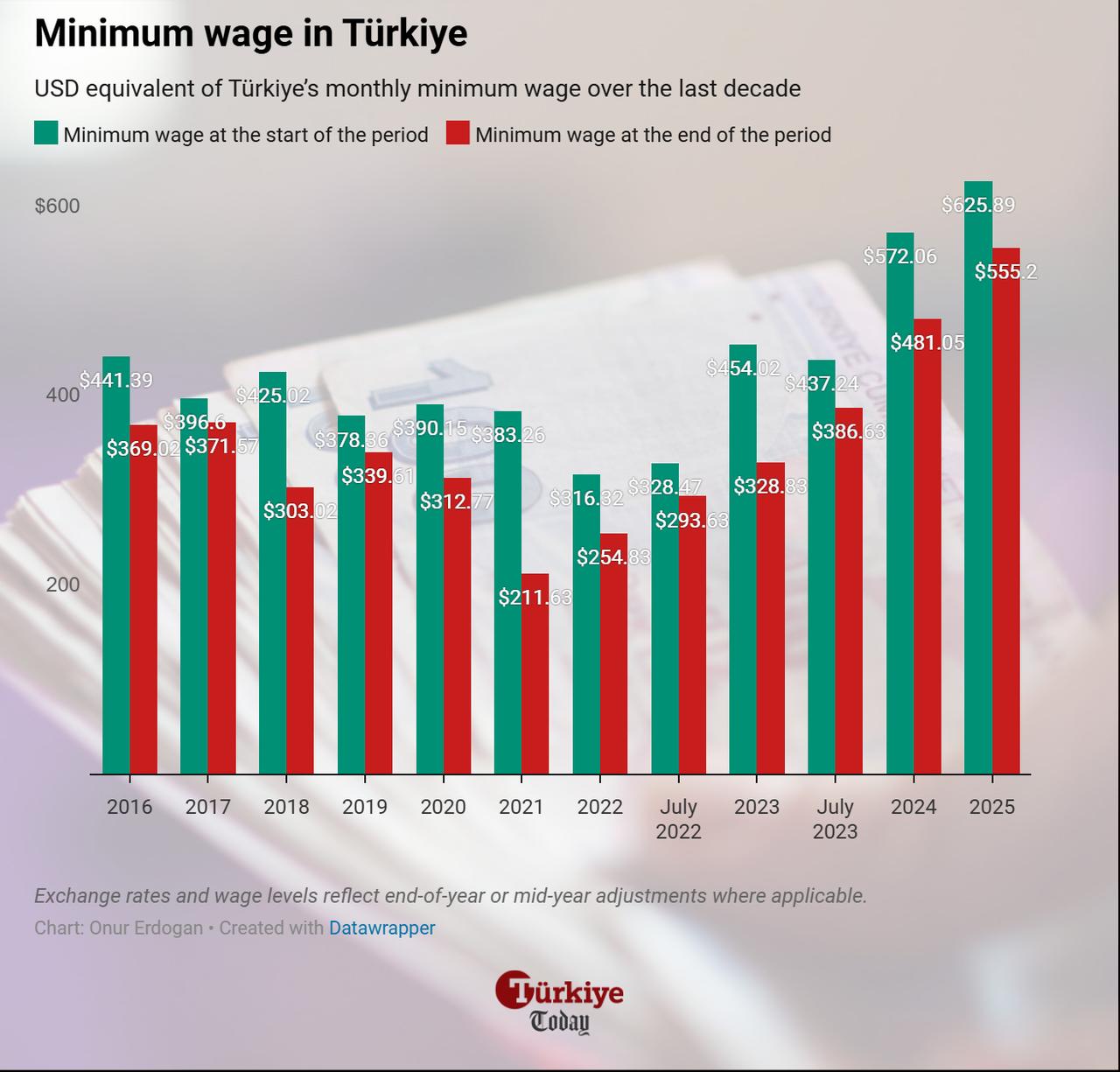

The minimum wage in Türkiye—earned by an estimated 42.8% of non-agricultural salaried employees, according to a 2021 central bank study—was last set at ₺22,104 ($548.91) in December, representing a 30% hike, still well below the annual inflation rate of 44.38% at the time.

According to a 2024 report by the Research Department of the Confederation of Progressive Trade Unions of Türkiye (DISK-AR), 83% of paid workers in Türkiye earn no more than 50% above the minimum wage.

TurkStat data shows the number of salaried employees in Türkiye stood at 15.88 million as of May 2025.

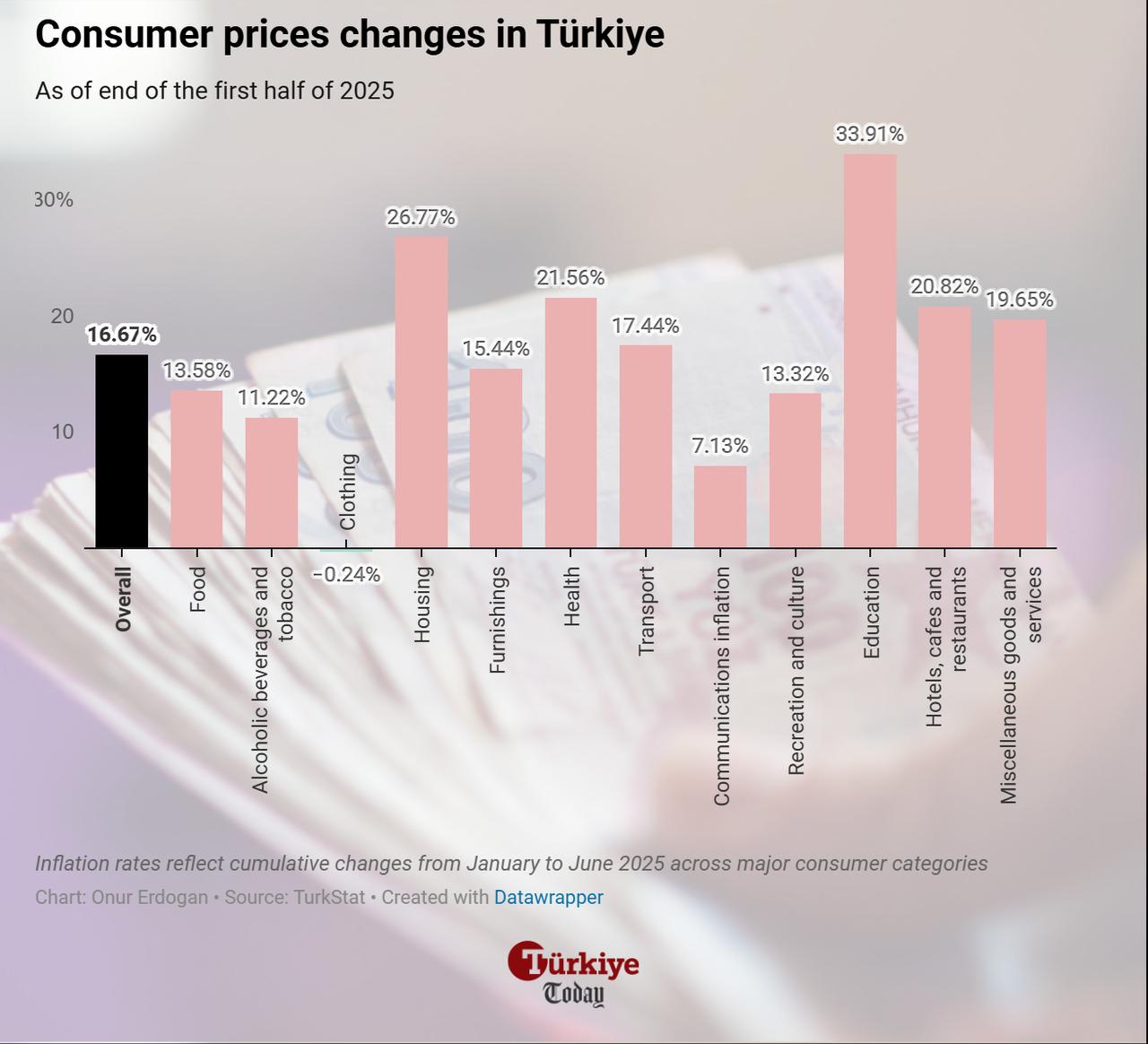

The same data reveals consumer prices rose by over 16% in the first half of 2025, eroding real wages by a similar rate and worsening the cost-of-living burden for Turkish households.

Among key expenditure categories, education, housing, and health—known as sticky-price groups for their persistent inflationary effects—saw annual increases of 33.91%, 26.77%, and 21.56%, respectively.

Meanwhile, based on exchange rates, the minimum wage was equivalent to $625.39 at the beginning of the year but fell to $555.20 by the end of June, reflecting a 14% depreciation in the Turkish lira against the dollar.

At the ruling Justice and Development Party’s (AK Party) seasonal consultation and evaluation camp in Kizilcahamam, Ankara, held July 11–13, Minister Simsek answered questions from members of parliament, particularly regarding disinflation and economic well-being.

According to the Turkish newspaper Hurriyet, MPs focused their questions on the minimum wage, pensions, and public servant salaries. Some suggested reinstating biannual minimum wage hikes—a policy introduced in 2022 but discontinued in 2024.

Simsek emphasized the importance of balancing the economy, stating that wage increases without structural reform would be short-lived. “We could make such increases too, but unless deep-rooted problems are solved, they would quickly erode,” he said, warning of possible inflationary effects. “Once we bring inflation under control, we will have reset the system,” he added.

Annual inflation in Türkiye slowed for the 13th consecutive month in June, reaching 35.05%, still far from the central bank’s year-end target of 24%.

Türkiye posted a cumulative current account deficit of $16.03 billion between January and May, while the budget deficit for the first half of the year reached ₺980.5 billion ($24.26 billion) as of June.

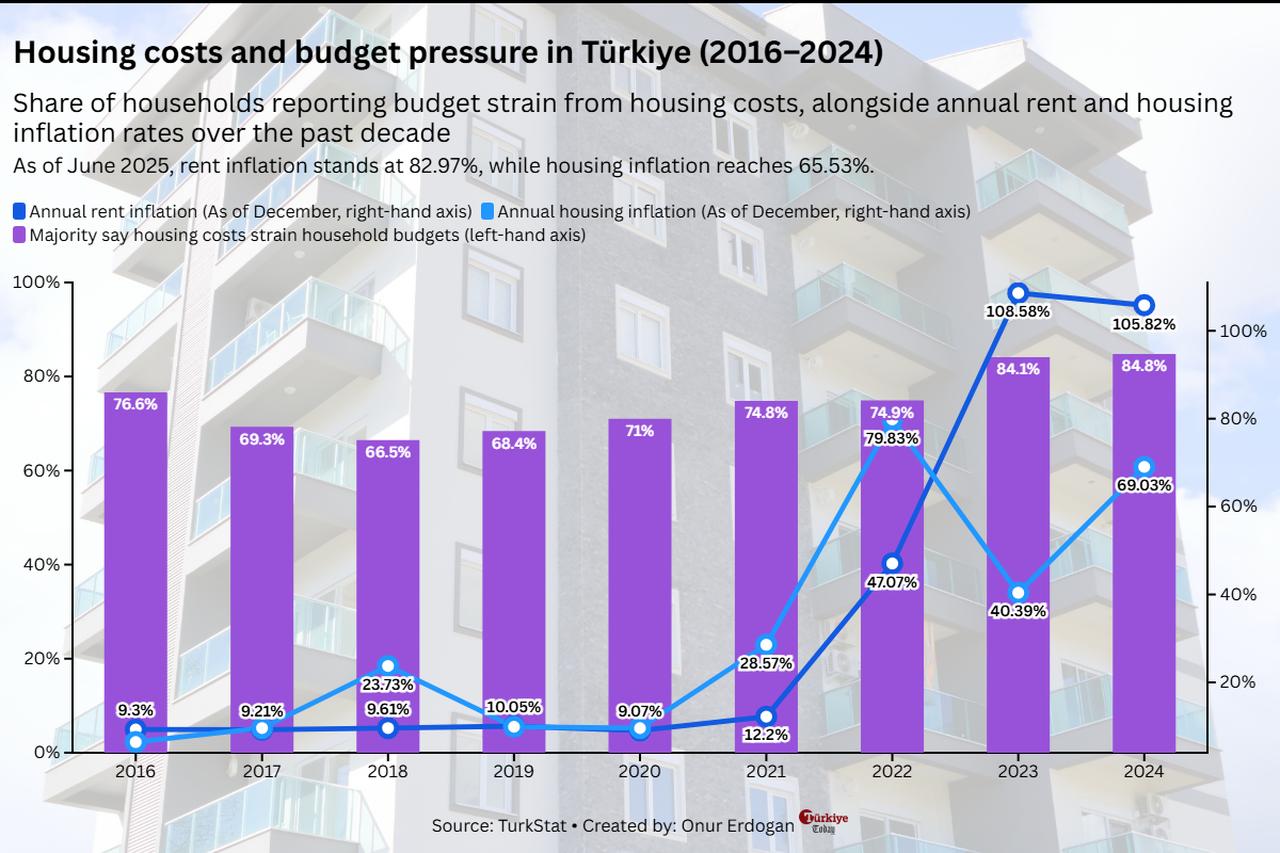

Addressing sticky inflation in housing, Simsek acknowledged the rent problem but characterized its impact as limited. 56% of the population are homeowners. Approximately 28% pay rent, and 14% of retirees are renters,” he said, citing 2024 data from TurkStat’s Poverty and Living Conditions Statistics.

Annual rent inflation stood at 82.97%, while overall housing inflation—including utilities, maintenance, and rent—was 65.53%. According to the same report, 84.8% of households reported budgetary strain due to housing costs—the highest level in a decade—marking an 18.3 percentage point increase from 66.5% in 2018.

84.8%, the highest in the past decade—an 18.3 percentage point increase from its lowest level of 66.5% in 2018.

Simsek also acknowledged high education costs, especially at private schools, but noted that only a small portion of the population is affected. Approximately, “10% of the population attends private schools, while 90% prefer public schools,” he said.

On an annual basis, education recorded the highest consumer price increase at 73.33% in June.

Pensions and public servant wages, which were raised by 16.67% and 15.57%, respectively, in July, also drew criticism.

The minimum retirement wage was raised to ₺16,881, still below the minimum wage, while the minimum public servant wage was adjusted to ₺46,990.

The government proposed a 16% raise for public workers in the first half of 2025 and 8% in the second half, prompting backlash from labor unions.

The Confederation of Turkish Trade Unions (Turk-Is), the country’s largest union, warned that over 600,000 workers could strike in August if the government fails to meet expectations.

According to Turk-Is, the monthly food expenditure for a family of four (hunger threshold) is ₺26,115. The total income required to meet all basic expenses (poverty threshold) is ₺85,066 ($2,106).

The monthly cost of living for a single worker is ₺33,587—₺11,482 more than the minimum wage.

The average monthly cost of living in Istanbul, home to 16 million people, reached ₺93,465 in June 2025, a 47.13% increase from the same month last year, according to the city’s planning agency.

Rising living costs were also reflected in consumer loans, which surpassed ₺2.2 trillion ($173.68 billion) as of June, up 34.68% year-on-year. In response, the Banking Regulation and Supervision Agency (BRSA) launched a loan restructuring program for indebted individuals last week, capping interest rates at 3.11% and offering repayment terms of up to 48 months.

The main reason Türkiye opted not to raise the minimum wage mid-year is concern over its inflationary effects due to higher business costs.

According to the Central Bank of the Republic of Türkiye’s (CBRT) 3rd 2023 Inflation Report, a 1% rise in the minimum wage is estimated to increase consumer inflation by 0.06 to 0.08 percentage points within a year, with most of the impact occurring in the first two quarters.

In the third inflation report of 2021, it was estimated that, when measured by wages per employee, the inflationary effect is about 0.10 percentage points. When accounting for total labor payments—including both wage and employment impacts—a 1% increase could push inflation up by 0.2 percentage points over a year.

Based on these estimates, a 16.67% minimum wage hike could add 1–1.33 points to inflation, while the same increase measured across total labor costs could raise inflation by up to 3.33 points.

Inflation is also the key metric for a possible rate cut by the central bank, which is expected to resume easing at the next Monetary Policy Committee (MPC) meeting. Forecasts by global and local banks suggest a potential cut of 250–350 basis points.

The Turkish central bank kept its policy rate at 46% in June, citing inflationary pressures. However, its decision statement hinted at a dovish outlook: “Accordingly, the policy rate will be determined in a way to ensure the tightness required by the projected disinflation path, taking into account realized and expected inflation and the underlying trend.”

CBRT will announce its next interest rate decision after the MPC meeting on July 24 at 2:00 p.m. local time (GMT+3).