Real interest rates offered by the Turkish lira are expected to remain elevated as inflation slows only gradually, local lender Garanti BBVA said, adding that the central bank is likely to maintain a measured approach to monetary easing through the end of 2025.

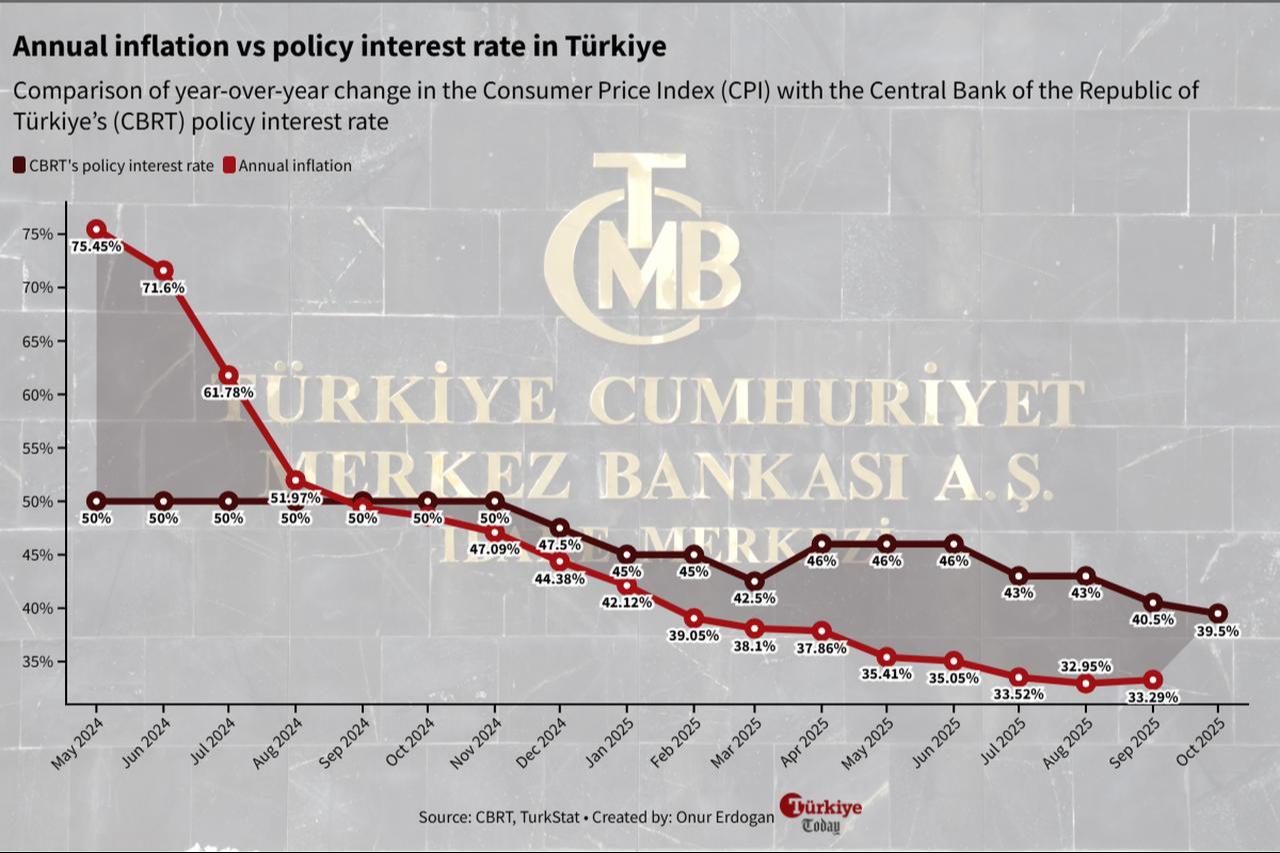

In its investor presentation on the 2025 third-quarter financial results published on the Public Disclosure Platform (KAP), the bank referred to the Central Bank of the Republic of Türkiye’s (CBRT) latest policy decision in October, which reduced the size of the rate cut to 100 basis points from September’s 250 basis points, bringing the policy rate to 39.5%.

"Real interest rates, currently around 6–7 percentage points, are likely to remain high as the disinflation process takes hold gradually," the bank said, adding that the pace of rate cuts will depend on the trajectory of inflation.

The bank also pointed out that consumer prices rose 3.2% month-over-month and 33.3% year-over-year in September 2025, well above expectations and breaking a 15-month streak of decline. It said this pattern suggests that annual inflation could end the year near 33%, down from 44.4% at the end of 2024, while underlying price pressures remain persistent.

The government’s Medium-Term Program for the 2026–2028 period projected year-end inflation at 28.5% for 2025 and 16% for 2026, while the CBRT maintained its interim target at 24% but outlined an expectation range of 25% to 29% with a 70% probability.

Garanti BBVA forecasted that gross domestic product (GDP) would expand by 0.5%–1% in the third quarter compared with the previous quarter, implying an annual growth rate of about 4.5%. With the economy growing 3.6% in the first half of the year, Türkiye’s full-year expansion could reach 3.5%–4%, with positive momentum likely to extend into 2026.

The bank added that private consumption is expected to remain below its long-term trend, while fiscal and external balances continue to improve.

Türkiye’s fiscal outlook has improved amid tighter public spending and stronger revenue collection, with the non-interest budget deficit narrowing to 0.6% of GDP in September, down from 2.3% in March 2025 and 2.1% in December 2024. The cash budget deficit is expected to come in at around 4% of GDP for 2025, above the official projection, and fiscal policy could become neutral in 2026 if current trends persist, it added.

The bank estimated that Türkiye’s current account deficit will remain moderate and easily financeable, reaching about 1.2% of GDP in 2025 and 1.5% in 2026, better than official targets. It said fiscal consolidation and external stability are expected to support the overall macroeconomic outlook, even as high real rates continue to anchor inflation expectations.