Rents and other service-related costs now contribute over half of Türkiye’s headline inflation, even though services represent less than 40% of the country’s official consumer price index (CPI) basket, a study released by the International Monetary Fund (IMF) showed.

The report shows that services, which contributed under 30% of headline inflation in late 2021 following a sharp currency depreciation, accounted for 50–55% of total inflation in 2024 and 2025, reflecting greater inertia than goods inflation.

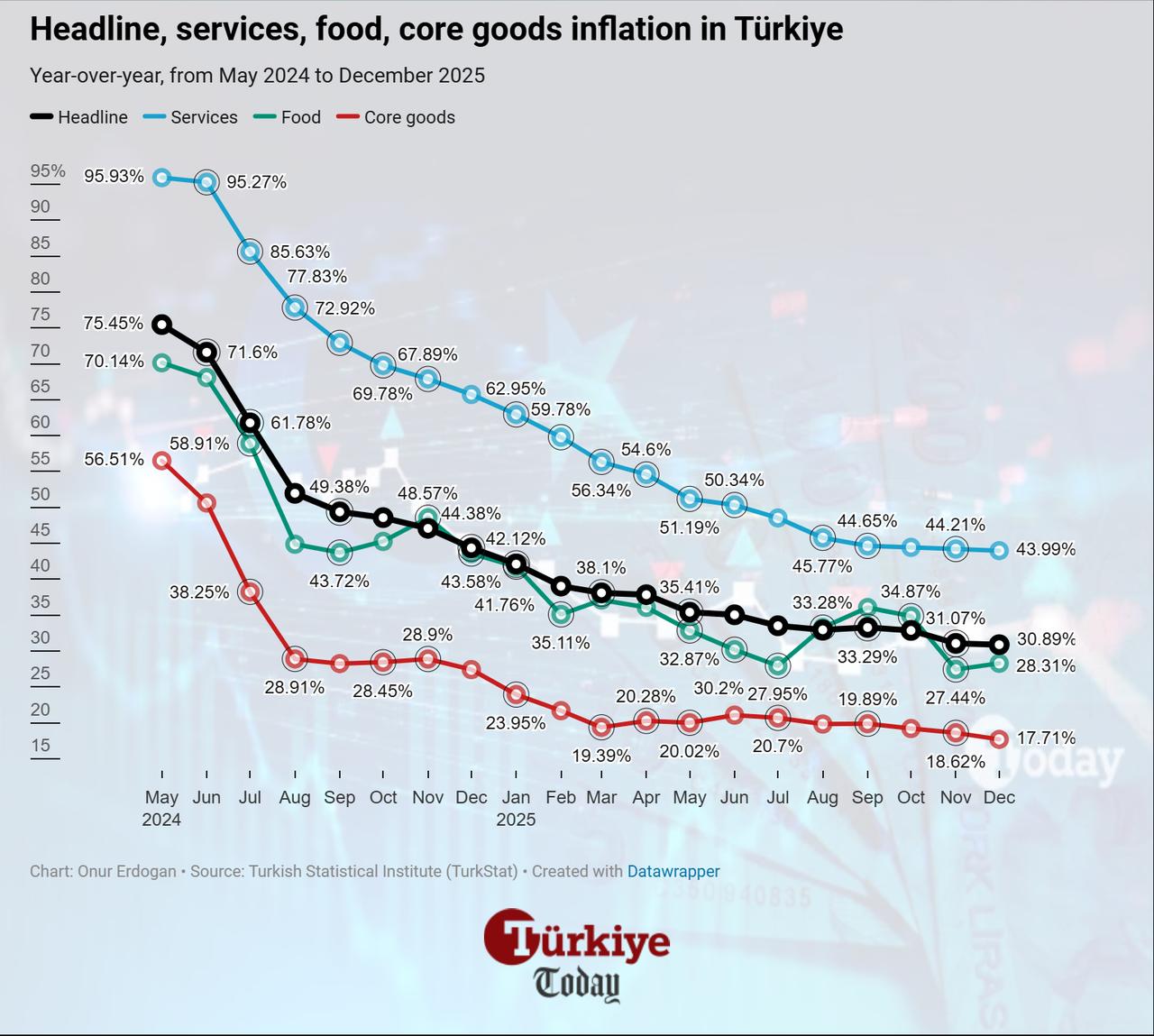

According to the IMF, while goods inflation surged rapidly in response to the sharp depreciation of the lira, it began to decline by late 2022 following currency stabilization. Services inflation, on the other hand, rose more gradually but persistently, even as the Turkish lira stabilized and policy rates were tightened.

The report identified rental inflation as a key contributor to persistent services inflation. Between early 2022 and late 2024, the contribution of rent to services inflation rose from under 5% to over 25%.

During the summer of 2024, rental prices climbed as high as 120% year-on-year, following the removal of a 25% rent cap that was first introduced in 2022 to limit increases.

Even with some remaining administered prices and energy subsidies in place, the IMF concludes that service price pressures were broad-based across sectors, including hospitality, education, communication, and transportation.

Drawing on international comparisons, the paper found that services inflation in Türkiye is now more persistent than in most emerging markets, with the relative price of services rising more sharply than goods since mid‑2022.

The IMF’s structural model estimates that a 10 percentage point depreciation of the Turkish lira typically raises goods inflation by approximately 5 percentage points within three months, while services inflation increases by only 1 percentage point over the same period.

The cumulative pass-through of exchange rate changes to inflation is also markedly lower for services, about 20% compared to 45% for goods prices within six months.

This muted responsiveness helps explain why services inflation remained elevated throughout 2023–2024, even as exchange rate volatility eased and monetary policy tightened significantly. From March 2023 to March 2024, Türkiye’s central bank raised its policy rate from 8.5% to 50%, yet sequential month-on-month inflation remained sticky, driven largely by services, the report noted.

The paper concluded that exchange rate stability alone may not be sufficient to reduce inflation when services inflation is highly persistent, calling for complementary policies to address inflation inertia, such as reforming backward-looking wage and contract indexation and avoiding reliance on discretionary price controls. Instead, forward-looking, rule-based mechanisms are recommended to restore credibility and dampen inflationary expectations.

Türkiye's annual inflation eased to 30.9% in December, down from 44.4% in 2024. While goods inflation declined to 25% from 36.1%, services inflation remained considerably higher than the headline rate at 44%, with rent inflation, having peaked at 105% in December 2024, still elevated at 61.6%.

In a recent presentation to global investors during meetings held in London and Washington, Treasury and Finance Minister Mehmet Simsek argued that persistent inertia in services is a "low probability" scenario for 2026, noting that the rate has already dropped from 90.7% in 2023.