Central Bank of the Republic of Türkiye Governor Fatih Karahan reassured Turkish business leaders that the year-end inflation target of 24% remains intact, noting that the disinflation process has continued uninterrupted for 13 consecutive months.

Türkiye's inflation fell to 35.05% in June, continuing its steady decline from 75.5% in May 2024 without interruption. The better-than-expected figures in June also prompted the Turkish central bank to resume interest cuts with a 300-basis-point reduction in July's meeting, bringing the policy rate down to 43%.

Speaking during a presentation titled Monetary Policy and Macroeconomic Outlook in the central Anatolian province of Kayseri, Karahan emphasized the central bank’s firm stance on maintaining tight monetary policy until price stability is achieved.

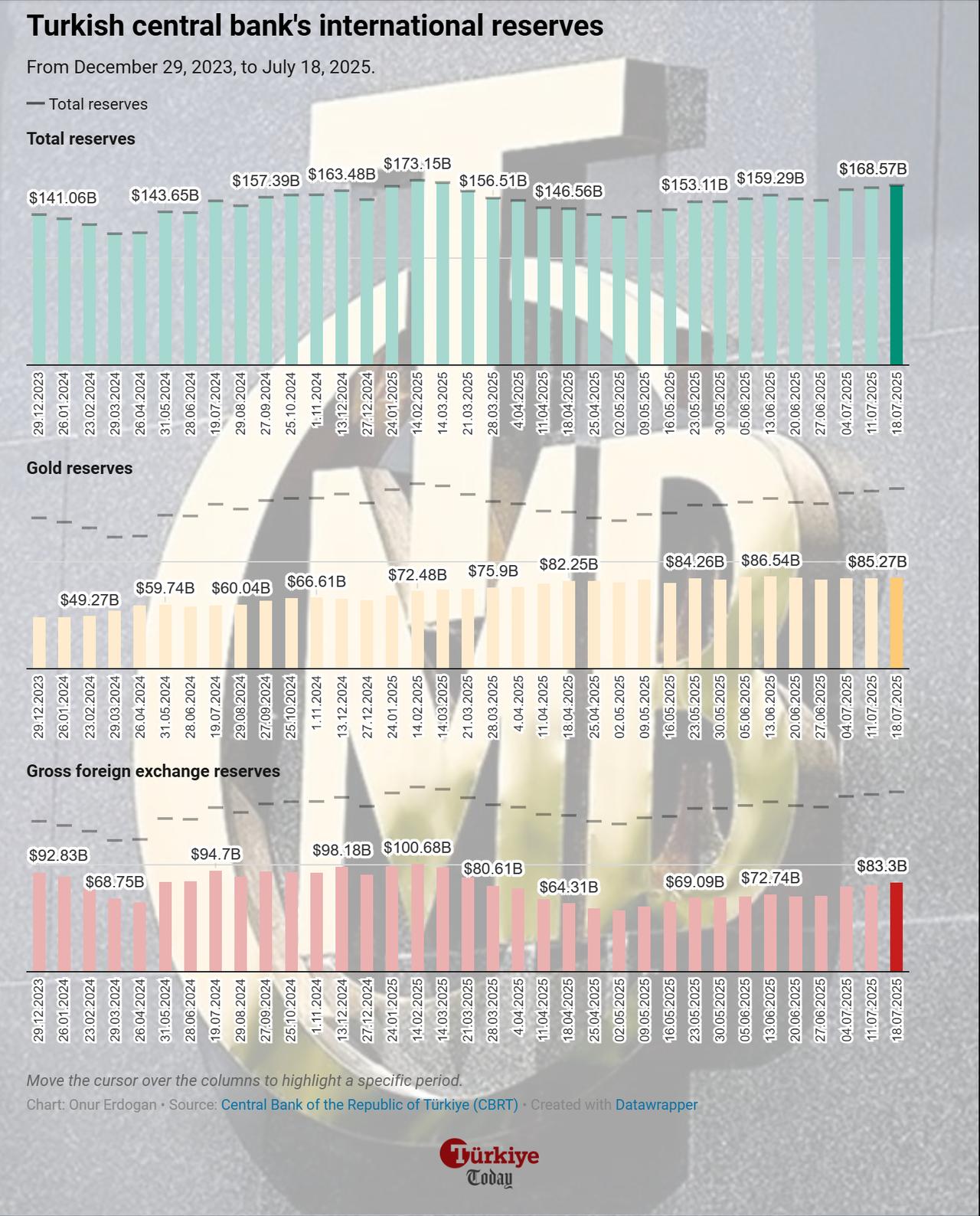

Karahan reported a notable improvement in Türkiye’s financial position over the past two years, pointing to a $105 billion increase in international reserves. Meanwhile, balances in foreign exchange-protected Turkish lira deposit accounts, known as KKM, declined by $130 billion.

As of July 18, FX-protected Turkish lira deposits had declined to $506.45 billion, while total international reserves had risen to $168.5 billion.

Introduced in late 2021 to curb dollarization and stabilize the lira, the KKM scheme guarantees depositors compensation for exchange rate losses on Turkish lira savings. While it temporarily supported financial stability, the program created a growing fiscal burden due to rising currency volatility and interest rate differentials.

Turkish central bank halted the opening of new FX-protected deposits and the renewal of existing ones with six- and 12-month maturities as of Jan. 20.

Karahan underlined that the ongoing tight monetary policy is aimed at achieving a durable decline in inflation. “The disinflation process, which began in June 2024, continues without interruption. We expect inflation to remain within our forecast range by year-end,” he said.

He added, “The tight policy stance—marked by demand rebalancing, real appreciation of the lira, and improved inflation expectations—will continue to support disinflation. Coordination with fiscal policy will further contribute to this process.”

Karahan explained that interest rate decisions will be based on actual inflation outcomes, their underlying trend, and forward-looking expectations. “If we foresee a clear and lasting deterioration in inflation, all monetary policy tools will be used effectively,” he said.

In its Second Inflation Report, the Turkish central bank maintained its year-end inflation targets of 24% and 12% for 2025 and 2026, respectively.

Karahan also highlighted the central bank’s engagement with the private sector. In 2025 alone, the bank consulted with 255 companies in Kayseri and nearby provinces, bringing the five-year total to 2,600 firms.

“We use timely and qualitative insights from these meetings in our decision-making processes and share expectations and suggestions with relevant public institutions,” Karahan noted. “We have established effective communication with real-sector representatives.”

Karahan stated that economic growth continues alongside a shift in sectoral dynamics. “Achieving lasting price stability will ensure a broader and more sustainable increase in national welfare,” he said.