Major international banks ING, Goldman Sachs, and BBVA have released updated assessments on Türkiye’s economic outlook ahead of official September inflation data, reflecting continued concerns over price pressures.

Dutch lender ING forecasted a 2.4% monthly rise with annual inflation easing to 32.2%, while U.S. investment bank Goldman Sachs lifted its year-end estimate to 29% alongside a higher policy rate projection.

Spanish BBVA kept its 2025 forecast at 30% while raising its 2026 outlook to 23% with slower rate cuts expected.

ING Global analysts said in a recent report that seasonal factors such as food prices, adverse weather and the reopening of schools are likely to keep near-term price pressures elevated, even as the annual rate eases.

Goldman Sachs, meanwhile, attributed its upward revisions for the year-end figures to the lira’s depreciation in the second half of the year, raising its policy rate projection to 37% while keeping its 2026 inflation estimate unchanged at 20%.

In its September outlook, BBVA said the central bank would cut rates more gradually, projecting the policy rate to fall to 36.5% by the end of 2025 and 30% by the end of 2026.

The bank left exchange rate forecasts unchanged. It expects the lira to be 45 per U.S. dollar by the end of 2025 and 52 by the end of 2026.

The bank cautioned that risks remain tilted to the downside.

These risks include policy effectiveness, global market volatility, weaker investor appetite for emerging markets, potential shifts in U.S. policies under the Trump administration, and domestic political uncertainty.

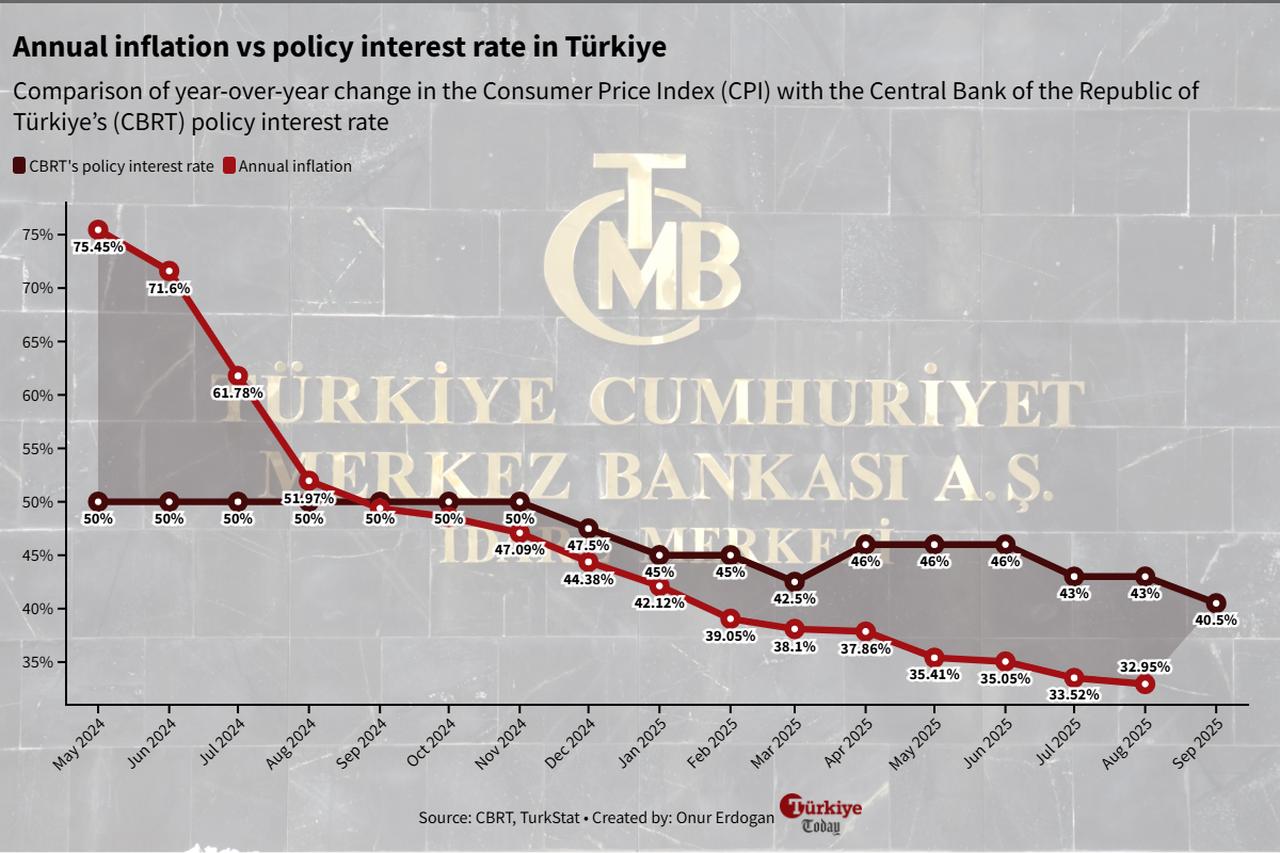

The Turkish central bank resumed monetary easing with a 300-basis-point cut in July, followed by a 250-basis-point cut in September, lowering the policy rate to 40.5%.

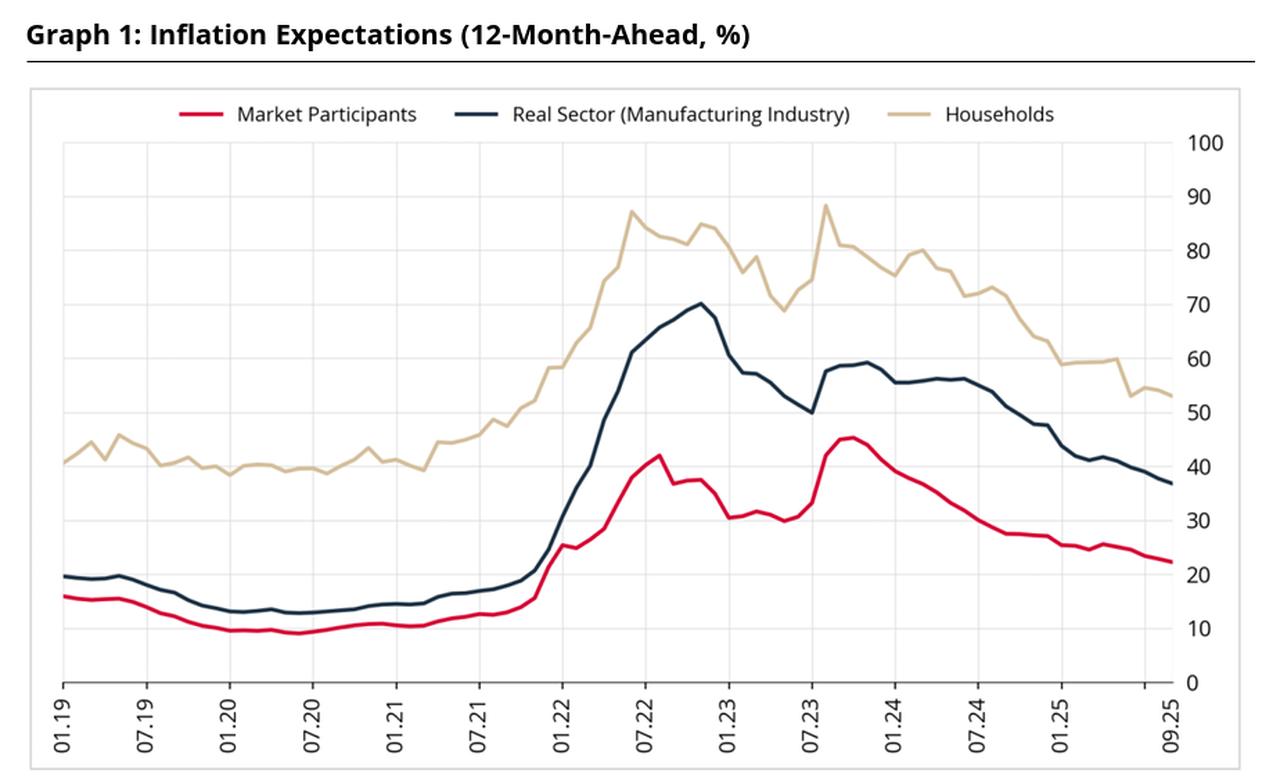

On the other hand, the Sectoral Inflation Expectations survey for September, released by the Turkish central bank, also showed that the 12-month ahead inflation expectation among market participants dropped by 0.5 percentage points to 22.2%.

For the real sector, which includes industrial companies, the forecast fell by 0.9 points to 36.8%.

Household expectations decreased more sharply, down 1.1 points to 53%.

According to the Central Bank of the Republic of Türkiye, the share of households expecting inflation to fall over the next year declined slightly to 27.4%, from 27.6% in the previous month.

The Turkish Statistical Institute (TurkStat) will release nationwide inflation figures on Sept. 3, which are expected to exceed 2% due to an uptick in the services group.

In August, inflation came in above market expectations, with a monthly rise of 2.04%, while the annual rate fell for the 15th consecutive month to 32.95% from a peak of 75.5% in May 2024.

Speaking at a presentation in New York this week, Central Bank Governor Fatih Karahan said monthly services inflation is expected to increase with the reopening of schools.