Türkiye’s economy is expected to expand by 3.2% in 2025, the Organisation for Economic Co-operation and Development (OECD) said on Tuesday, revising up its July estimate of 2.9%.

In its Economic Outlook report for September, the OECD attributed this to resilient domestic demand and one-off factors earlier in the year, such as a build-up of inventories.

However, Türkiye's growth in 2026 is forecast at 3.2%, a slight downward revision from the previously reported 3.3%.

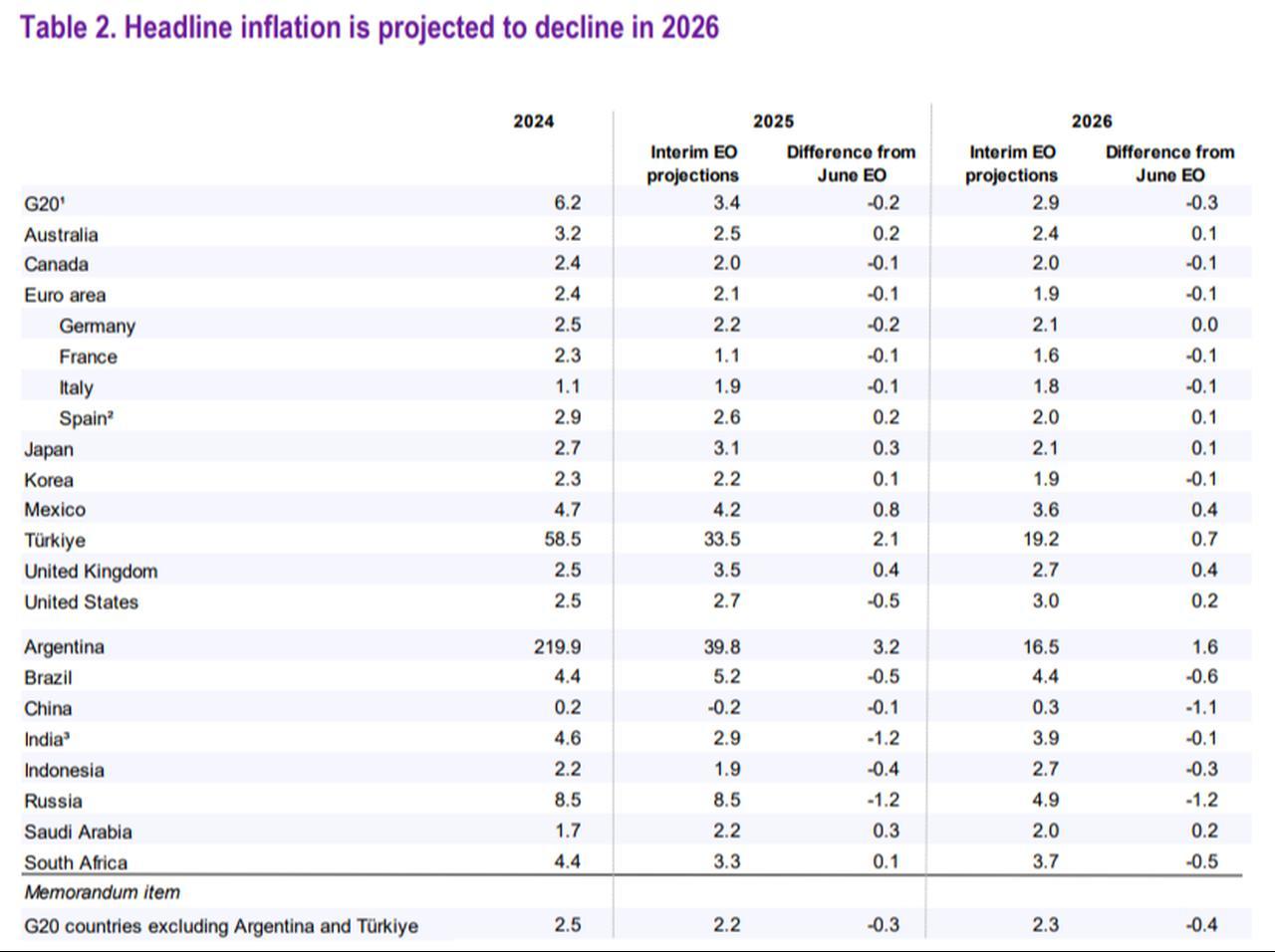

On the inflation side, the organization projects consumer prices to rise by 33.5% in 2025 before moderating to 19.2% in 2026.

These projections came under the official targets of the Turkish central bank and the newly updated Medium-Term Program.

The OECD also lifted its global growth forecast for 2025 to 3.2%, up from 2.9%, but kept its 2026 estimate at 2.9%, noting that stronger activity in emerging markets, including Türkiye, supported the upgrade.

At the same time, it warned that higher U.S. tariffs, which reached their highest level since 1933 under President Donald Trump's protectionist policies unveiled in April, will weigh on trade and investment in the coming year.

While the projections represent progress compared with 2024, notably when inflation averaged nearly 60%, the OECD cautioned for Türkiye that inflation remains well above the central bank’s target and will require strict policy discipline.

It noted that monetary easing may resume gradually in Türkiye but stressed that central bank independence is essential to anchor expectations and maintain credibility.

The Turkish central bank resumed rate cuts with two consecutive reductions in July and September, bringing the policy rate to 40.5%.

The report highlighted that Türkiye’s labor market is showing relative strength compared with other OECD members.

The unemployment rate fell to 8% in July, in contrast with rising joblessness in several advanced economies.

However, the OECD cautioned that sustaining real wage growth will require productivity gains rather than relying solely on nominal pay increases.

The OECD pointed out that many emerging markets delivered stronger-than-expected growth in early 2025, though often due to temporary factors.

In Türkiye, the first-quarter surge in stockbuilding added to output, while in Brazil, agricultural production boosted activity.

The organization expects these effects to fade, with growth normalizing in the second half of the year.

For emerging markets overall, inflation is expected to ease as domestic demand stabilizes.

Disinflation is projected to be especially sharp in Türkiye and Argentina, both of which are forecast to move from exceptionally high rates toward more moderate, though still elevated, levels by 2026.

The OECD noted that this adjustment will be crucial for reducing fiscal vulnerabilities, as high inflation has complicated debt dynamics in both countries.

In contrast, other large emerging economies such as India and Indonesia are expected to benefit from monetary and fiscal policy support, helping sustain relatively strong growth.

However, the report warned that tariff shocks, global financial volatility, and food price pressures remain common risks across emerging markets.

The OECD urged emerging-market policymakers to balance short-term disinflation with long-term growth strategies.

It emphasized the need for credible fiscal frameworks, enhanced structural reforms, and policies that strengthen competitiveness.

Improvements in digital skills, labor participation, and regulatory transparency were cited as key steps to support sustainable growth and accelerate productivity gains.