The Turkish economy is projected to maintain its monetary easing cycle and gradual disinflation process through 2026, London-based HSBC said, while noting that persistent inflation pressures and domestic political uncertainty remain key risks.

The report, authored by Melis Metiner, economist for Central and Eastern Europe, Middle East, and Africa (CEEMEA), forecasts that the Turkish economy will grow by 3.5% next year, driven mainly by domestic demand. Headline inflation is expected to moderate from 32% at the end of 2025 to around 20% by the end of 2026, roughly aligning with the Turkish central bank’s projections in its latest inflation report, though remaining above the government’s targets in the Medium-Term Program.

The bank forecasts a 150-basis-point cut at the December meeting, which would bring the policy rate to 38%. With further reductions expected, the rate is projected to fall to 25.5% by the end of 2026.

Although headline inflation is declining slowly, HSBC views maintaining gross domestic product (GDP) growth in the 3%–4% range as a priority for Turkish policymakers—even if that implies a gradual path to price stability. The bank warned, however, that upward surprises in inflation could prompt more measured rate reductions. Nonetheless, barring a currency shock, a pause in the easing cycle is seen as unlikely.

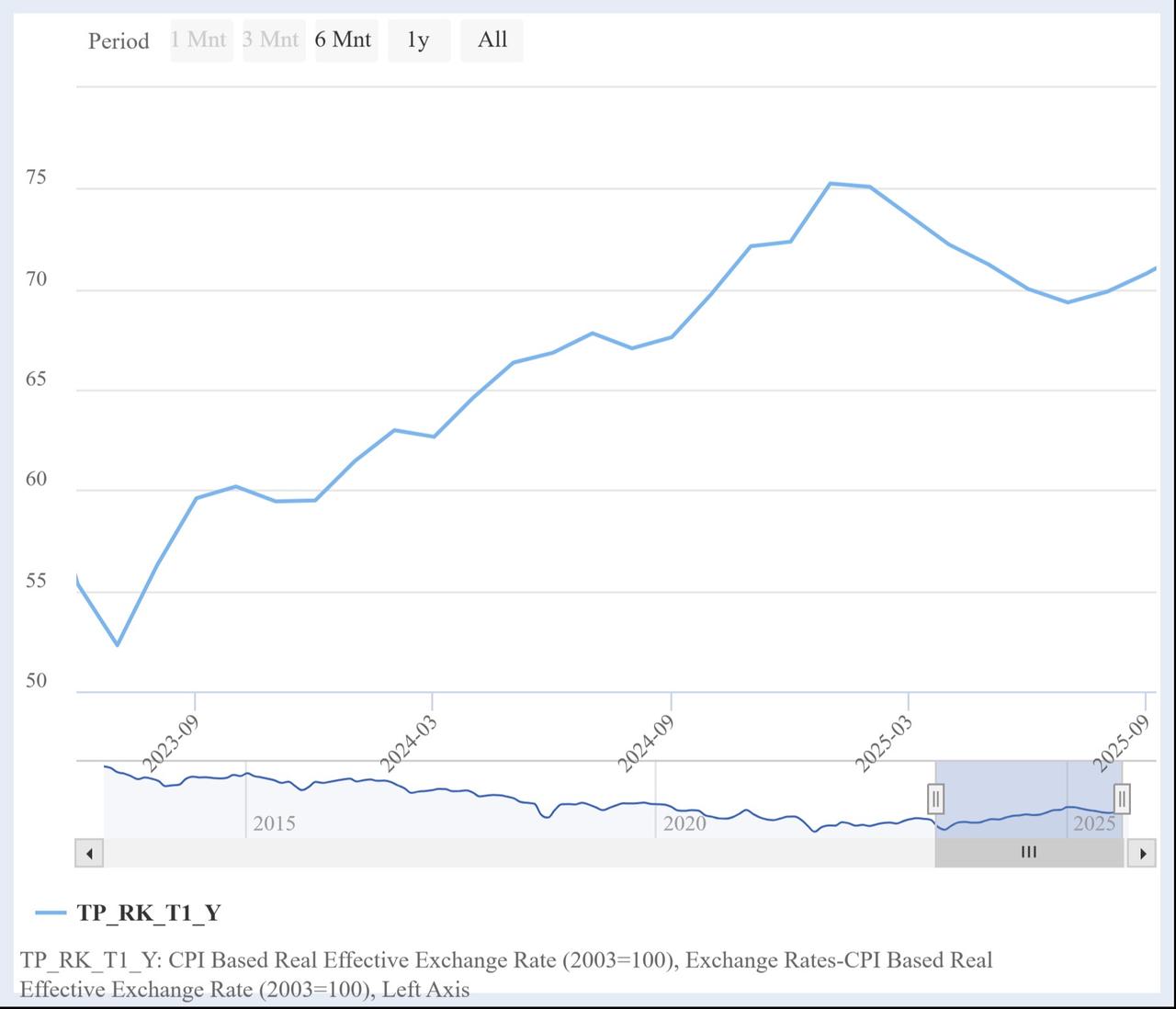

The report pointed to "diminished visibility" over the CBRT’s exchange rate policy, noting that Türkiye’s consumer price index (CPI)-based real effective exchange rate appreciated by 31% between June 2023 and December 2024. However, the real exchange rate has since stabilized and is expected to appreciate more modestly in 2026 compared to previous years.

This plateauing effect is partly attributed to sustained domestic demand and high inflation expectations, which HSBC believes will continue to exert upward pressure on prices—albeit at a slower pace.

The report flagged internal political developments as the primary source of uncertainty heading into 2026. Nevertheless, it noted that markets have responded positively to the consistent implementation of Türkiye’s macroeconomic stabilization program, now in its third year.

Türkiye’s policymakers have demonstrated a clear commitment to orthodox policy tools, helping to navigate the economy toward a controlled deceleration, while also addressing financial stability risks and phasing out distortionary measures, HSBC stated.

"Although price stability has not yet been achieved, the authorities deserve credit for steering the economy toward a soft landing and implementing key structural corrections," the report said.