Türkiye’s economy is estimated to have expanded by 4.1% in 2025, according to the International Monetary Fund’s (IMF) latest World Economic Outlook Update.

The Fund also raised its forecasts for the following two years, projecting gross domestic product (GDP) growth of 4.2% in 2026 and 4.1% in 2027, reflecting upward revisions from the October forecast, which had projected a more modest 3.7% growth for both 2026 and 2027.

Türkiye's economy grew by 3.7% year-on-year in the fourth quarter of 2025, and officials expect full-year growth to reach 3.3%, bringing GDP to $1.5 trillion.

The IMF estimated that the global economy grew by 3.3% in 2025 and expects it to maintain this pace in 2026 before easing slightly to 3.2% in 2027.

The Fund raised its 2026 forecast by 0.2 percentage points compared to its previous report, citing stronger momentum and a more stable external environment, such as easing trade tensions and continued technology-led investment, especially in sectors related to artificial intelligence.

The steady global growth reflects a mix of pressures from shifting trade policies and support from rising tech investment, easy financial conditions, and private sector adaptability, it noted.

World trade growth is expected to slow from 4.1% in 2025 to 2.6% in 2026 before rising to 3.1% in 2027. Meanwhile, global oil prices are projected to decline by 8.5% in 2026 due to weak demand and rising supply, with the average price per barrel expected at $62.13 in 2026 and $62.17 in 2027.

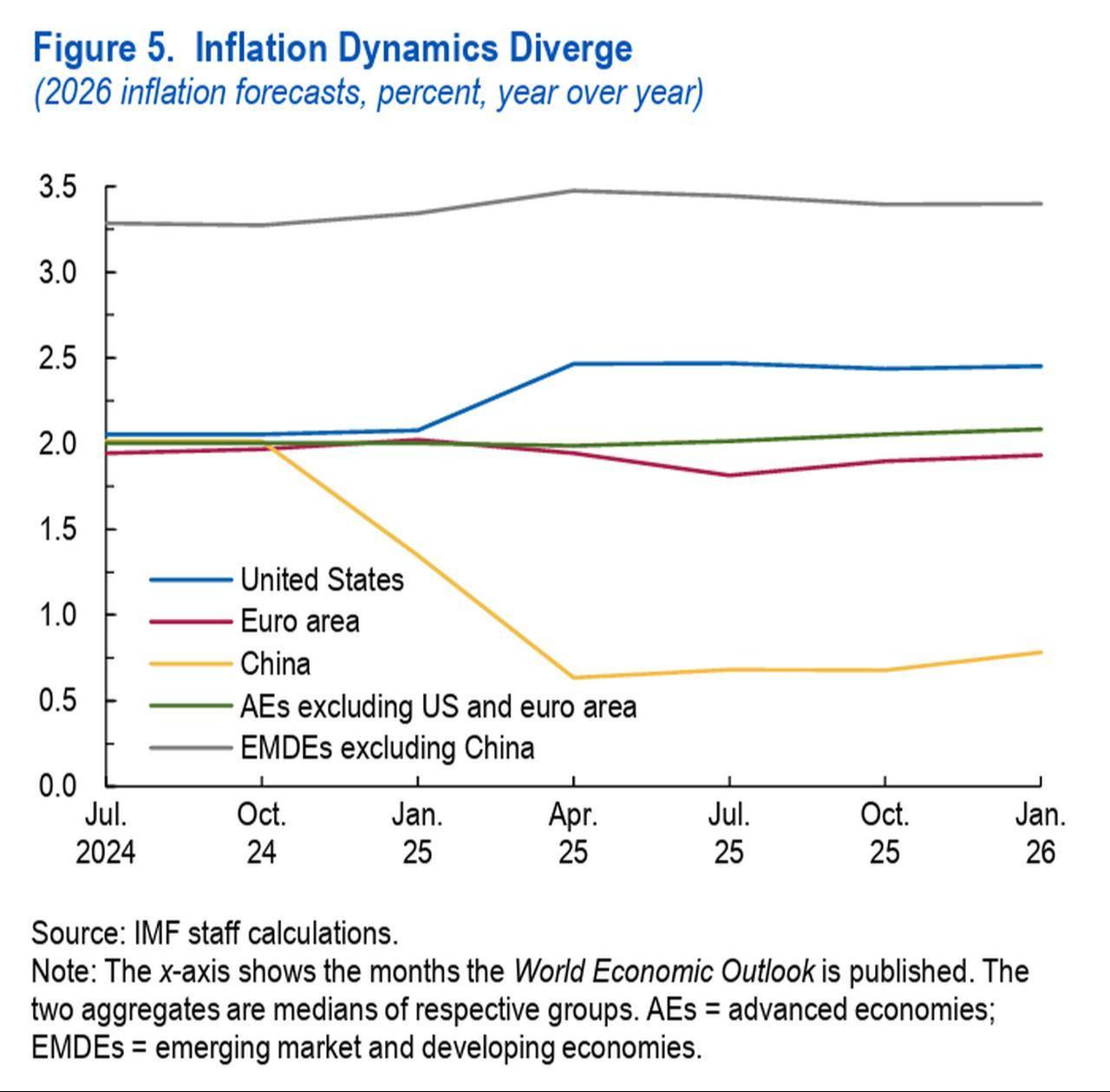

Global headline inflation is also expected to fall from 4.1% in 2025 to 3.8% in 2026 and to 3.4% by 2027. While inflation is gradually aligning with central bank targets worldwide, the IMF noted that the U.S. may return to its 2% target more slowly than other major economies.

The IMF raised its U.S. growth forecast for 2026 to 2.4%, up from 2.1%, citing stronger-than-expected GDP performance in the third quarter of 2025 and a rebound in early 2026 following the end of a federal government shutdown. Growth is projected to ease slightly to 2.0% in 2027.

The Fund noted that this upward revision also reflects fiscal stimulus from corporate tax incentives under the One Big Beautiful Bill Act, a 2025 U.S. law expanding tax cuts and public spending, and continued, though moderating, technology-driven momentum.

In the euro area, growth is expected to reach 1.3% in 2026 and 1.4% in 2027. The outlook reflects modest fiscal support, particularly from Germany, and powerful performance from member states like Ireland and Spain.

However, the region benefits less from the global tech investment surge, and structural headwinds—including lingering effects of past energy price shocks and euro appreciation—continue to weigh on industrial activity.

Germany’s forecast for 2026 was upgraded to 1.1%, while France is expected to grow by 1.0%. Italy’s outlook was revised slightly downward to 0.7%, whereas Spain saw an upgrade to 2.3% for the same year.

In Asia, China’s growth projection for 2026 was revised upward to 4.5%, driven by a yearlong trade truce with the U.S. and continued stimulus measures. However, the 2027 outlook was trimmed to 4.0% amid structural challenges.

India’s growth was revised up to 6.4% for 2026, maintaining momentum from earlier quarters. The IMF expects India to retain this pace into 2027.

Japan’s 2026 forecast was increased to 0.7%, supported by a fiscal stimulus package and gradual monetary policy tightening. The 2027 projection remains at 0.6%.

Among emerging markets, Russia’s growth outlook was downgraded to 0.8% in 2026 and 1.0% in 2027. The Fund cited weakening domestic demand and the waning effects of earlier fiscal support measures.

The report highlighted that rising investment in AI-related infrastructure and productivity tools is reshaping global growth patterns, particularly in the United States, China, and advanced Asian economies.

If adoption accelerates, the IMF estimates that AI could contribute up to 0.3 percentage points to global growth in 2026 and as much as 0.8 points annually over the medium term.

At the same time, the Fund warned that a sharp market correction involving AI-linked companies or a reassessment of expected productivity gains could slow investment and spill over into broader sectors.

It also pointed to ongoing geopolitical tensions, renewed trade disputes, rising public debt, and large fiscal deficits as key downside risks that could tighten financial conditions and disrupt global activity.

In a more favorable scenario, faster-than-expected AI adoption combined with easing trade tensions could boost productivity, strengthen labor market dynamics, and help sustain global growth, it said.