Türkiye’s Finance Minister Mehmet Simsek reassured investors ahead of Monday’s market opening, downplaying the potential impact of a possible closure of the Strait of Hormuz by Iran on the Turkish economy. He stated that the country is well-prepared for all threats and that the current economic program remains on track.

“We are conducting a multidimensional analysis of the potential impacts of rising geopolitical tensions on our economy and thoroughly evaluating possible scenarios,” Simsek said in a post on X, just before the opening of the Istanbul stock exchange.

Simsek also added that Türkiye’s financial institutions are ready to take swift and coordinated action to maintain market stability. He urged the public not to give credence to speculative claims about the economy based on assumptions about a potential Hormuz closure.

Highlighting the strength of the government’s economic program, Simsek said that Türkiye has significantly boosted its resilience to external shocks. He reaffirmed the country’s commitment to tackling inflation and pledged to continue all necessary steps to support disinflation.

Borsa Istanbul, Türkiye’s main stock exchange, opened the session lower, with the benchmark BIST 100 index falling by 0.9%. The banking index declined by 1.24%, while the holding index lost 1.2%. Among sector indices, forestry, paper, and publishing recorded the highest gain at 0.64%, while sports posted the steepest drop at 3.52%.

BIST 100’s accumulated losses have neared 5% since the escalation began on June 13, erasing earlier optimism over a potential rate cut.

Türkiye’s inflation extended its decline in May with a better-than-expected drop to 35.41%; however, the Turkish central bank held the policy rate at 46%, deferring a rate cut that markets had hoped for to July.

While the market expects rate cuts to begin at the June meeting, rising oil prices are deemed one of the key indicators, as the Turkish industry is heavily dependent on oil imports. Official data showed that the current account, excluding gold and energy, recorded a $1.94 billion deficit, while the overall current account deficit widened to $7.8 billion in April.

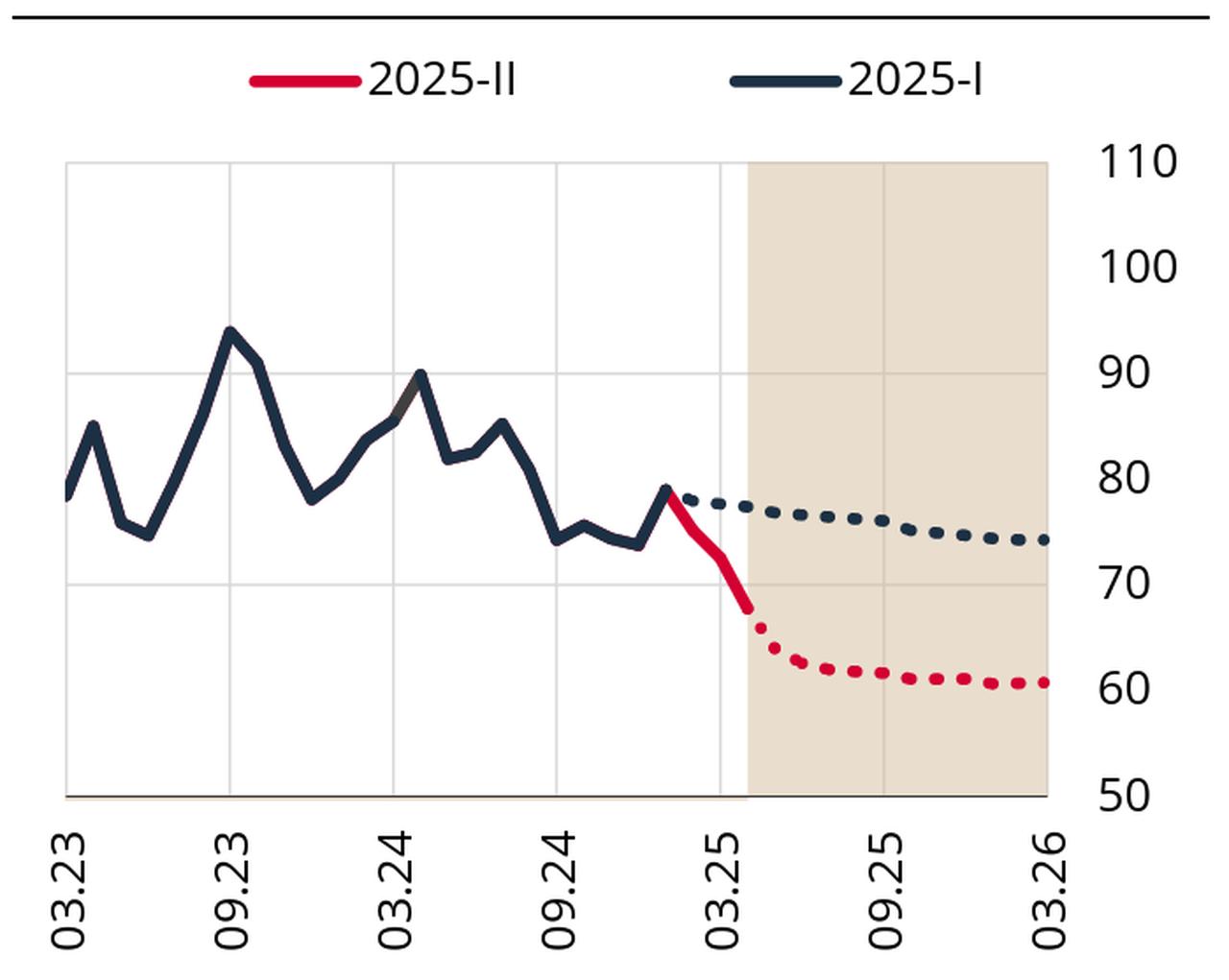

The Turkish economy board has viewed the decline in oil prices since January—amid global trade tensions and recession fears—as an opportunity to accelerate the disinflation path, with the Turkish central bank lowering its 2025 oil price forecast to an average of $65.8 per barrel in its 2nd Inflation Report released in May.

Amid heightened tensions over Iran's threat to seal the Strait of Hormuz—a critical route for 30% of global crude oil and 20% of liquefied natural gas shipments—Brent crude surpassed $80 on Monday, marking its highest level since January.

Regional tensions intensified on June 13 when U.S.-backed Israeli airstrikes hit Iran, triggering retaliatory missile attacks. Israeli authorities reported at least 25 deaths and hundreds of injuries, while Iran’s Health Ministry said over 430 people were killed and more than 3,500 injured in Israeli strikes.

Over the weekend, the United States escalated the conflict by striking three of Iran’s nuclear facilities with bunker-buster bombs and cruise missiles, specifically targeting the Fordo, Natanz, and Isfahan sites.

In response, Iran’s Parliament approved the closure of the Strait of Hormuz, with a final decision pending from the country’s Supreme National Security Council.