Further rate cuts by the U.S. Federal Reserve will support Turkish banks by reducing funding costs and boosting valuations through a lower opportunity cost for international investors, HSBC Türkiye Chief Executive Burcin Ozan said.

Ozan emphasized that global monetary easing would complement domestic developments, creating a more favorable environment for Türkiye’s banking sector.

The Fed delivered its first rate cut of 2025 at the September meeting, lowering the benchmark rate by 25 basis points to a range of 4%–4.25% amid downside risks in the real economy reflected in weak job growth. According to the FedWatch Tool, markets also expect the central bank to follow with two more cuts of the same size at its remaining meetings in October and December.

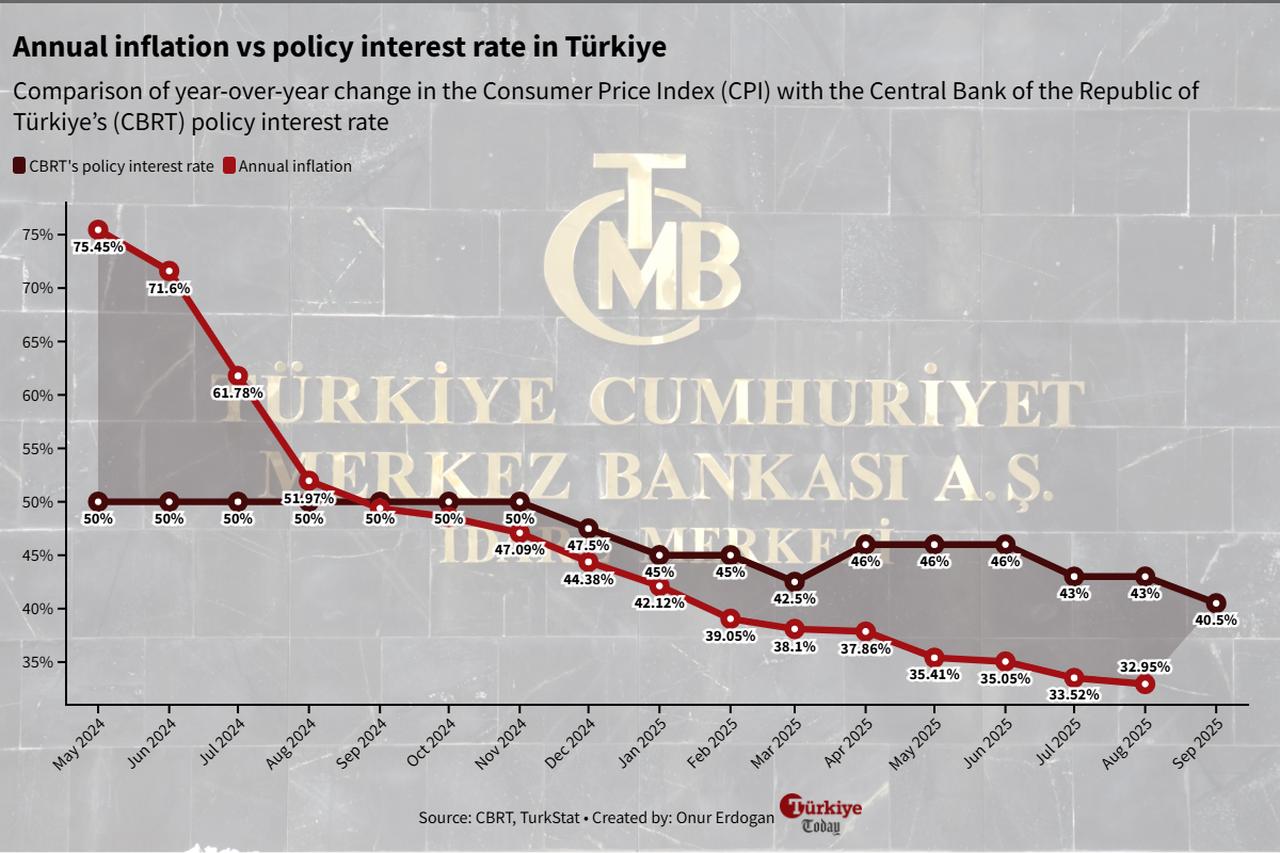

Türkiye is also entering a phase marked by slowing inflation and the Central Bank of the Republic of Türkiye’s (CBRT) shift toward interest rate reductions, with the bank resuming cuts in July and continuing at its September meeting, bringing the policy rate down to 40.5%, Ozan told state-run Anadolu Agency.

These conditions, combined with the gradual removal of macroprudential regulations—rules designed to safeguard financial stability—are improving efficiency across the sector, she noted.

"The program targeting macroeconomic balance brings stability, and the relaxation of these regulatory measures allows banks to improve efficiency and profitability," Ozan said.

According to Ozan, profitability in the banking sector is expected to rise beginning in the third quarter of 2025 as both global and local factors align.

HSBC Türkiye economists forecast inflation to reach 31% by the end of 2025 and fall to 19% in 2026, both above the targets set by the Turkish central bank and the government’s Medium-Term Program.

Türkiye’s inflation eased to 32.95% in August, marking the 15th consecutive monthly decline since peaking at 75.5% in May 2024.

The bank projects the CBRT’s policy rate to end 2025 at 35.5% before easing to 23% in 2026.

Ozan added that banks’ balance sheets, where assets generally carry longer maturities than liabilities, will further support profitability in the period ahead.