Treasury and Finance Minister Mehmet Simsek addressed harsh public criticism of the disinflation process, acknowledging frustration among citizens who expect swift relief from the rising cost of living.

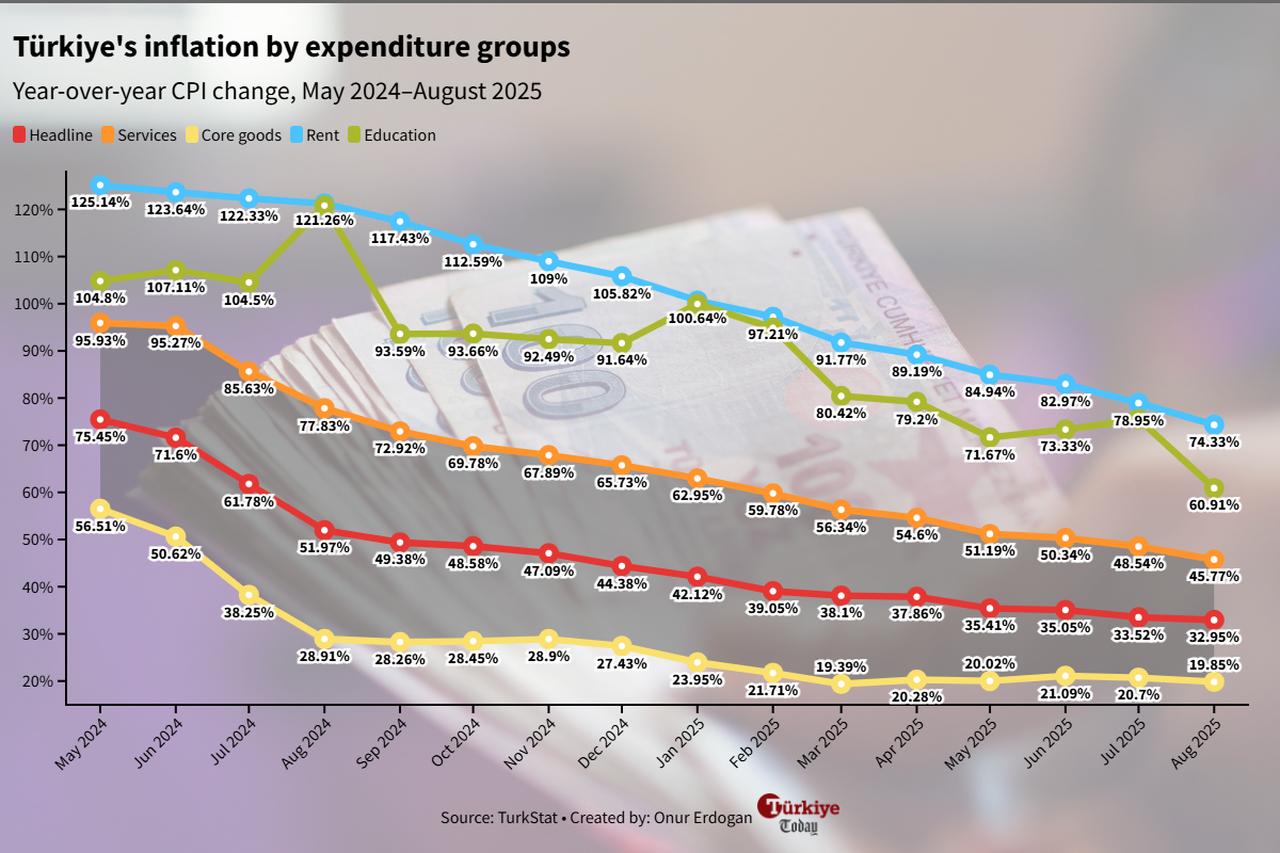

Simsek underlined that "fighting inflation is not an easy job," pointing to slow progress in sticky inflation groups like rent and education, citing them as the main factors that keep headline inflation above 30%.

"There is a process of adaptation to the past," Simsek said, stressing that progress is visible by highlighting that core goods inflation dropped below 20% in August.

Türkiye's inflation sustained its downward trend for the 15th consecutive month in August, easing to 32.9% from the peak of 75.5% in May 2024.

Sticky expenditure groups, which are usually less volatile than categories like food and energy, remained much higher at 74% and 60%, respectively.

Despite these pressures, Simsek underlined that the government expects headline inflation to fall below 30% by the end of this year.

"By the end of the year, we expect the budget deficit to be around 3.5% and the current account deficit to be below 1.5%," he said.

He added that while global financial conditions have become more favorable for risk appetite, low global growth, weaker trade, and rising protectionism remain challenging factors for Türkiye’s economic program.

Recalling that short-term internal and external shocks had affected the government’s economic program, Simsek said, "Türkiye kept it on track because we prioritized implementing the program with determination."

The minister said that Türkiye has reached a comfortable level in foreign reserves and has no difficulty in accessing external financing.

He explained that exports have increased by about 6% since the launch of the economic program, even as the European Union—Türkiye’s main trading partner—recorded slower growth.

"During this period, Türkiye’s share of European Union imports rose from 3.3% to 4%. There is no permanent loss of competitiveness as claimed. There are competitive sectors and those under strain, and we are supporting the ones under strain," Simsek remarked, addressing criticism that Türkiye is losing relative competitiveness due to higher costs stemming mainly from currency depreciation.

Simsek reported that 3,856 companies have applied for concordat, a legal restructuring mechanism in Türkiye allowing firms to delay debt payments while negotiating with creditors.

He underlined that these firms’ share in turnover, exports, employment, and total loans of the real economy was below 1%.

"There are complaints from the field that some firms are abusing the concordat mechanism. We discussed this with the Justice Ministry and are evaluating it through a joint working group. We are looking at how to prevent misuse and how to better protect commercial receivables," he said.

The minister stressed that access to financing is steadily improving.

"Exporters are currently borrowing at nearly half the market interest rate. The daily rediscount credit limit has been raised from ₺300 million ($7.26 million) to ₺4 billion ($96.89 million)," he explained.

He noted that the Treasury covers 70% of the loan interest paid by farmers and half of the interest paid by small business owners. "We have provided more than ₺160 billion in interest subsidies to farmers,” Simsek stated.

He added that Türkiye has launched investment programs such as YTAK and HIT-30 to strengthen domestic production of high-tech products.

"We are carrying a serious interest burden on the budget to support exporters, farmers, small businesses, and investors. In these areas, there is no problem with access to financing," the minister concluded.