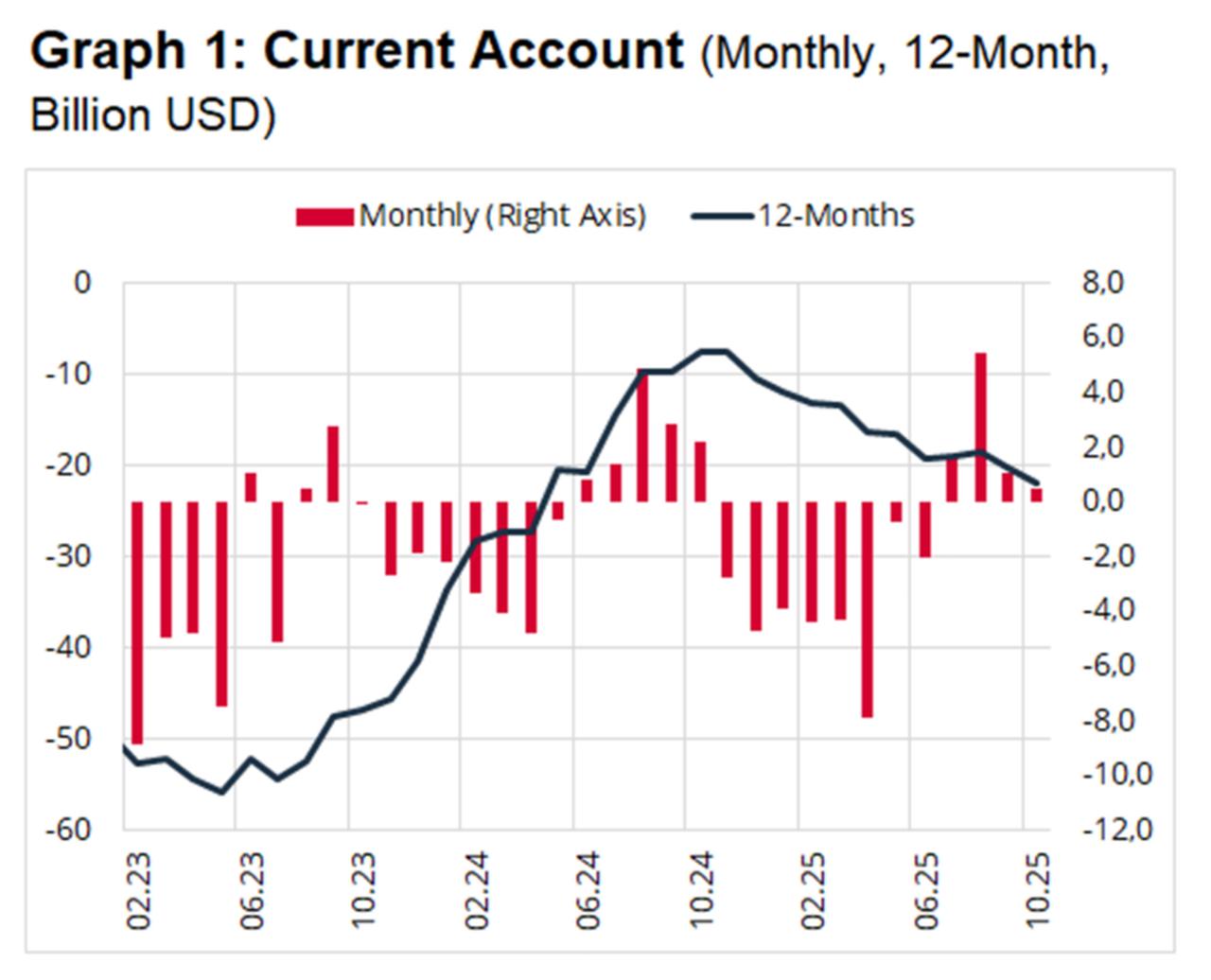

Türkiye’s current account posted a $457 million surplus in October, marking the fourth consecutive monthly surplus, while the gold- and energy-excluded balance recorded a $7.03 billion surplus, the Central Bank of the Republic of Türkiye (CBRT) reported.

In previous months, the current account showed surpluses of $1.73 billion in July, a record $5.4 billion in August, and $1.07 billion in September.

While the current account deficit slightly narrowed to $22 billion on an annualized basis, the balance of payments-defined trade deficit was $5.96 billion in October and $67.3 billion on a 12-month rolling basis.

The services balance generated net inflows of $7.59 billion in October, with transportation services contributing $2.46 billion and tourism-related travel income reaching $5.86 billion.

On a rolling 12‑month basis, the services balance posted a $63.2 billion surplus, helping to offset the merchandise trade gap and income-related outflows. The primary income balance, which includes cross-border payments such as investment income, interest, and wages, recorded a $17.6 billion deficit, while the secondary income balance, covering transfers such as remittances and grants, showed a smaller deficit of $328 million.

Türkiye financed the annual current account gap through $5.2 billion in net direct investment, $200 million in net portfolio flows, $26.9 billion in loans, and $800 million in trade credits. In contrast, net cash and deposit outflows exerted a $3.9 billion drag.

Real estate investment data showed that foreign residents purchased $240 million in property in Türkiye in the January–October period, while Turkish residents acquired $225 million worth of real estate abroad.

Foreign direct investment (FDI) inflows reached $128 million in September, raising the 10-month total to $11.58 billion and the annualized figure to $14.68 billion. However, outbound direct investment by residents also totaled $966 million in September and amounted to $9.49 billion on a rolling 12-month basis.

Commenting on the figures via social media, Treasury and Finance Minister Mehmet Simsek said the annual current account deficit remained at sustainable levels and underlined the government’s commitment to long-term fiscal discipline.

"The favorable outlook in energy prices and our export performance are expected to support the current account balance. We will continue to implement structural reforms decisively to make these gains permanent," the minister said.

Trade Minister Omer Bolat echoed a similar sentiment, highlighting steady improvement in Türkiye’s foreign trade dynamics. He said increases in both goods and services exports—particularly from tourism and transportation—have supported the trend toward a current account surplus.

"Despite weak global demand conditions, trade tensions, and regional risks, Türkiye’s economy is presenting a profile that reduces external financing needs and reinforces macroeconomic stability," Bolat added.

Following the release of the figures, analysts at Dutch lender ING stated that the current account surplus recorded in October was broadly in line with expectations. However, they noted that the capital account continued to exhibit signs of strain, as resident-led financial activity drove persistent outflows.

"Further analysis reveals that resident activities generated an outflow of $5.5 billion, mainly due to an increase in deposits held by domestic banks abroad, outward FDI investments, extension of trade credits and acquisition of financial assets abroad," the analysts said.

ING noted that while the headline balance showed a widening trend on the surplus side, the capital account did not show a corresponding improvement and remained under pressure following large outflows recorded in the previous month.

The report also noted that preliminary customs data from the Trade Ministry pointed to a mild deterioration in the November current account balance, with the trade deficit widening by approximately $300 million compared to the same period last year.

"A combination of external risks – including developments in global trade and geopolitical tensions – as well as ongoing weakness in domestic demand, is expected to shape the path of the current account balance in the coming months," ING said.

According to central bank figures, Türkiye’s current account shortfall equaled 1.32% of GDP in the third quarter of 2025.