The Turkish economy board is implementing targeted measures to reduce reliance on so-called "carry trade" inflows, a strategy where investors borrow in low-interest-rate currencies and invest in high-yielding Turkish assets, Treasury and Finance Minister Mehmet Simsek told lawmakers on Monday during budget discussions at Parliament.

Addressing criticism over the rise in carry trade volumes, Simsek dismissed opposition claims that the improvement in the Central Bank of the Republic of Türkiye’s (CBRT) reserves was primarily driven by speculative capital inflows. He explained that although Türkiye does not impose significant restrictions on capital flows, the central bank introduced a series of macroprudential measures in 2025 to mitigate risks associated with speculative short-term inflows.

"Financing needs should not be met through carry trades. We do not favor such a path," Simsek said.

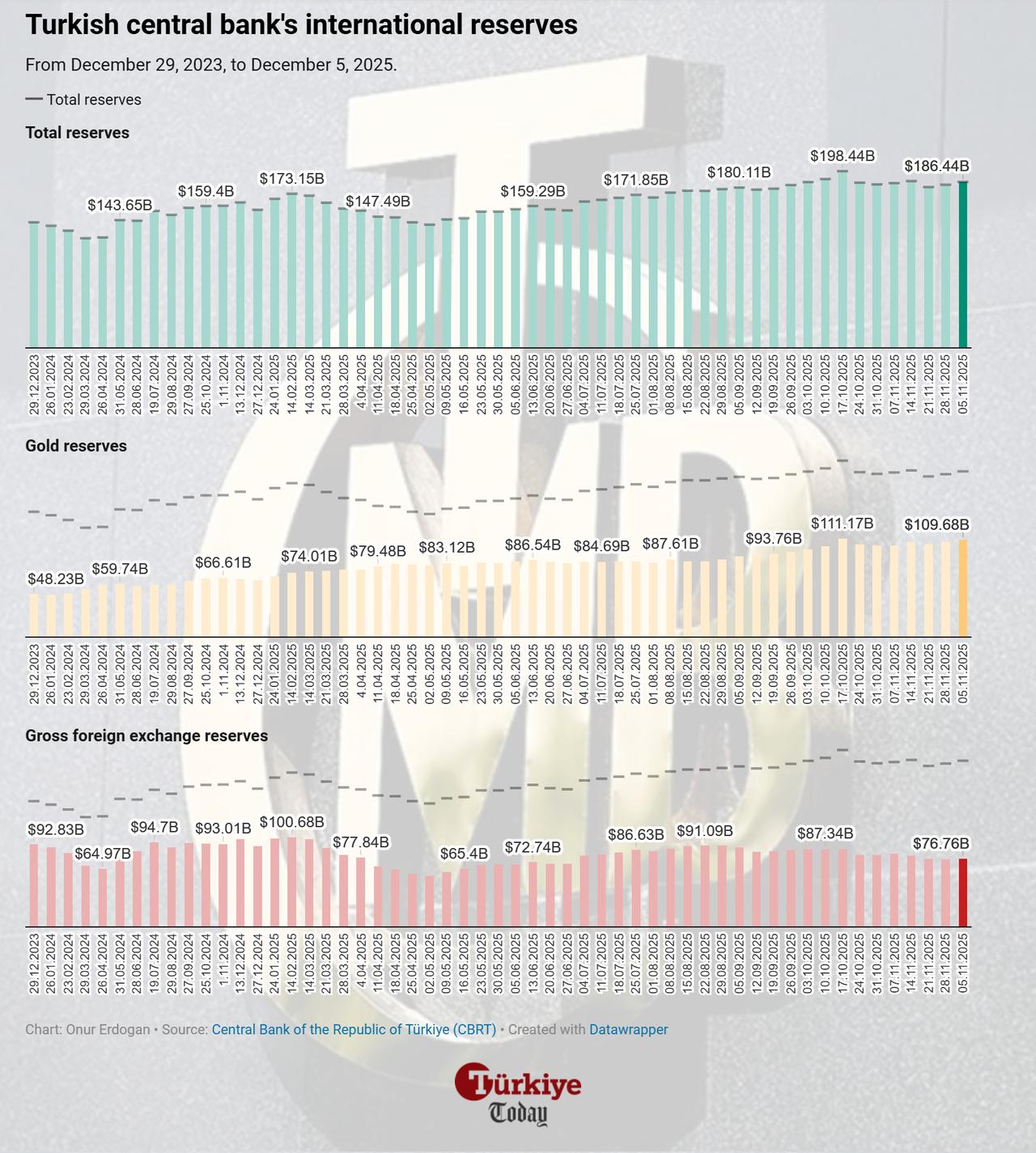

As of the last available data published by the Turkish central bank covering the week ending Dec. 5, the bank's total international reserves rose to $186.44 billion, and net international reserves excluding swaps rose to $62 billion. On the other hand, the gross carry trade volume stood at $51.76 billion for the same period, based on calculations using data from the Banking Regulation and Supervision Agency (BRSA) and the CBRT.

On the other hand, the Turkish Lira Overnight Reference Rate (TLREF), one of the key indicators of local funding costs and a benchmark closely watched in carry trade strategies, continued its downward trend, falling to 37.74% as of Tuesday.

Detailing the macroprudential measures introduced by the central bank, Simsek noted that reserve requirements on banks’ external liabilities have been raised to curb carry trade activity. The ratio of foreign bank deposits was increased from 8% to 12%, while funding obtained through external repo transactions and foreign loans now faces reserve requirements ranging from 12% to 18%, depending on maturity. He also made clear that both domestic and foreign investors are subject to a 17.5% withholding tax on gross income from deposits and investment funds, with no inflation adjustment applied.

Simsek highlighted that since May, the central bank’s gross reserves have increased by $88 billion, while net reserves—excluding currency swaps—have risen by approximately $123 billion.

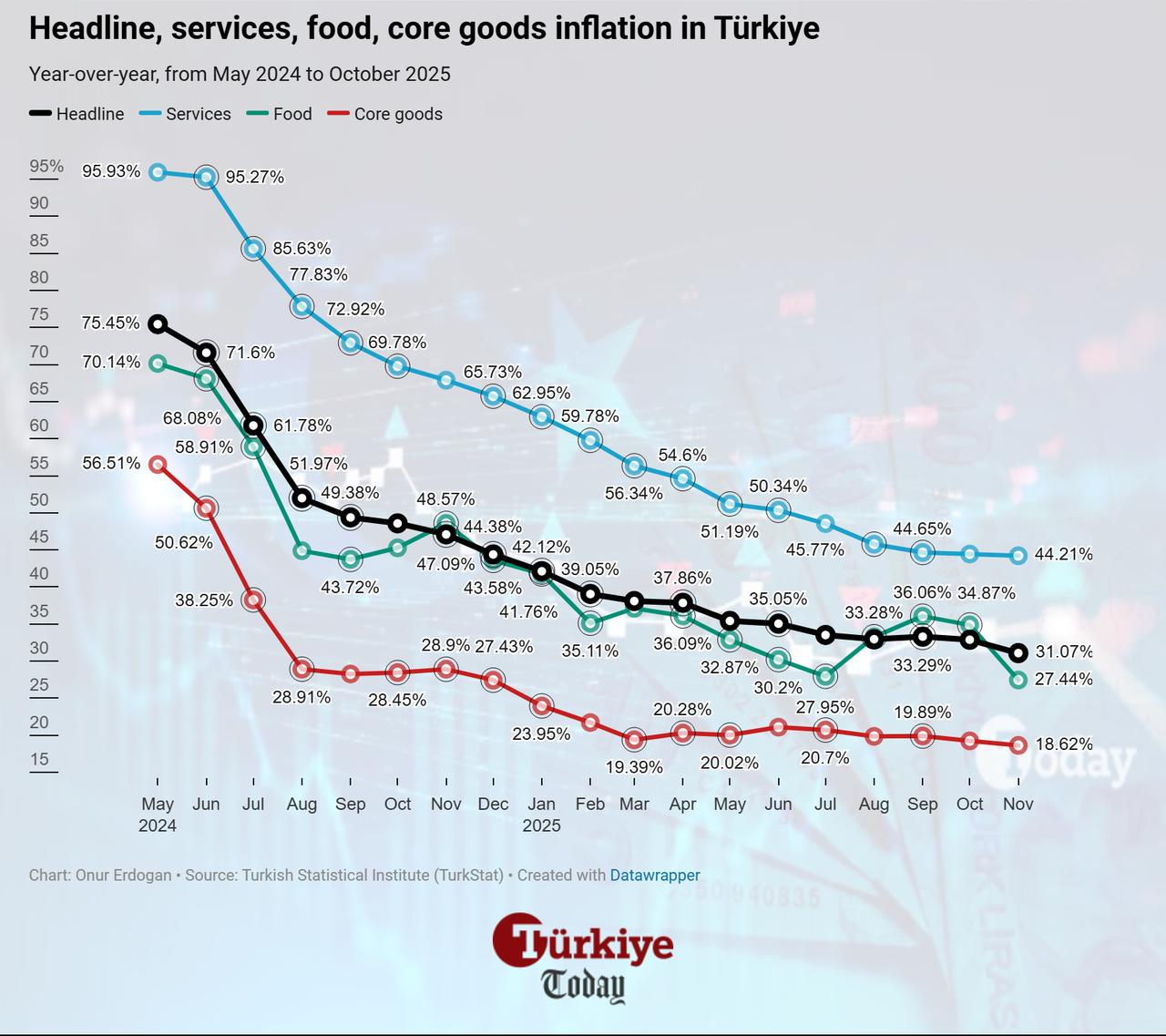

Simsek stated that headline inflation has moderated noticeably since the launch of the government’s economic program. Year-end inflation, which hovered around 64%–65% in 2022 and 2023, dropped to 44.4% last year and further declined to 31.1% as of November 2025. "The improvement is visible, though still slightly above our targets," he said.

He explained that the elevated headline figure largely reflects persistent inflation in the services sector, which has been slower to adjust to disinflation measures. "In Türkiye, service inflation has proven rigid due to backward indexation practices," he explained. "In particular, rent and education prices have been increasing at nearly twice the pace of headline inflation over the past two years."

To contain these pressures, Simsek said the government is implementing structural policies, including a large-scale public housing campaign and the completion of post-earthquake reconstruction, which are expected to increase supply and curb rent growth.

Simsek emphasized that Türkiye’s broader economic program, centered on restoring fiscal discipline, lowering inflation, and reducing external imbalances, has already yielded tangible results, including a marked decline in the country’s risk premium.

"Our risk premium, which had climbed to 700 basis points before the program, has now fallen to 216 basis points," he said, as Türkiye’s credit default swap (CDS) level is now at its lowest since May 2018. "This improvement directly supports lower external borrowing costs." As a result, the yield on Türkiye’s five-year U.S. dollar-denominated bond has dropped from 11.3% in May 2023 to around 5.5% today. Simsek stressed that the improved risk perception has made it easier for private firms and banks to access international financing.

Türkiye has recorded meaningful gains in its current account balance, long seen as a key macroeconomic vulnerability, with the deficit narrowing from over 5% of gross domestic product (GDP) in 2022 to just 0.8% by the end of 2024, the minister underscored. "If we exclude gold imports—primarily a portfolio preference—we actually recorded a $3.2 billion surplus last year," he said. "This represents a clear shift in our external balance dynamics."

The narrowing deficit has contributed to a decline in Türkiye’s gross external financing need, which fell from 23% of GDP to below 17% in 2025, with projections suggesting it could drop further to 13%–14% by the end of the program period, Simsek added.